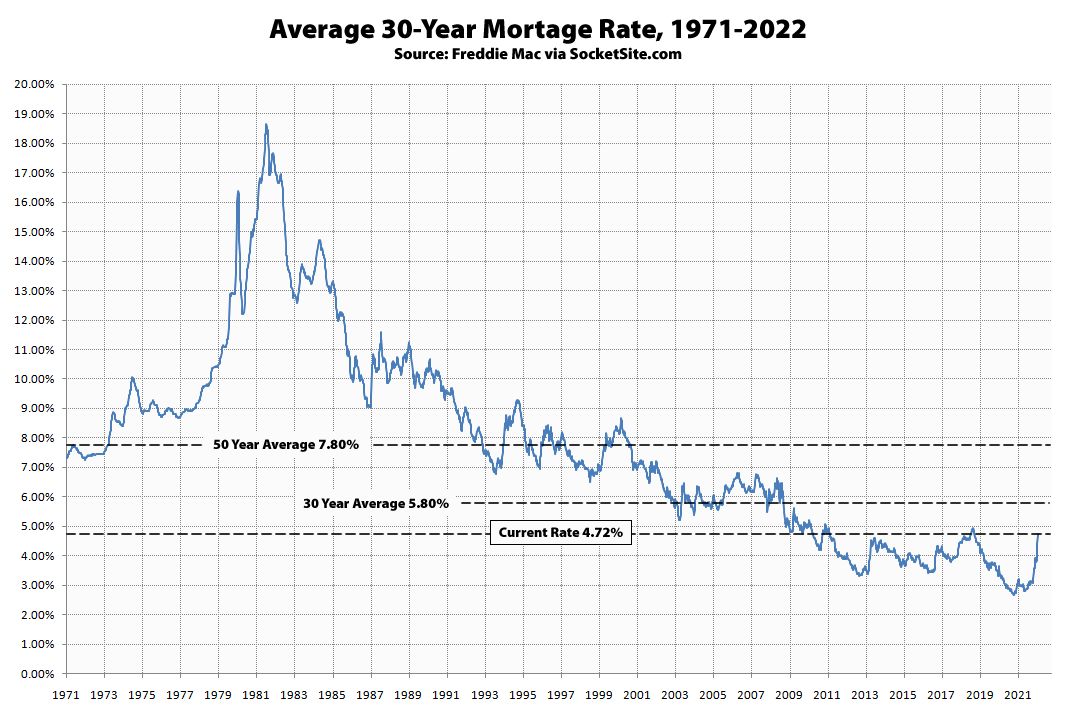

The average rate for a benchmark 30-year mortgage ticked up another 5 basis points (0.05 percentage points) over the past week to 4.72 percent, which is 159 basis points, or 51 percent, higher than at the same time last year.

As such, the 30-year rate is now within 23 basis points of an eleven-year high, having rocketed over two (2) full percentage points (207 basis points) since January of last year with the probability of the Federal Reserve raising interest rates by another two (2) full percentage points by the end of the year having jumped as well, which should translate into even higher mortgage rates, less purchasing power for buyers and downward pressure on home values. Or in the words of Freddie Mac this morning: “The increase in mortgage rates has softened purchase activity such that the monthly payment for those looking to buy a home has risen by at least 20 percent from a year ago,” none of which should catch any plugged-in readers by surprise.

Half of America wasn’t even born yet when rates were 10%.

Boy-o-boy, are Folks gonna whine.

On the other hand all interest was tax deductible then too. So there is that.

Everybody is already whining. They should just accept inflation, shut up, get to work, and get over it.

And a $20K MM acct would draw more than $1.83/annum….that might be more meaningful to old-fashioned sorts who actually like to save. (Altho, as noted, savings rates have played the tortoise to borrowing rate’s hare)

Well that didn’t take long. Yesterday 30yr fixed closed the day at 5.25%. Making this the highest rate increase since 2009. For those too young to remember, 30yr fixed rates today are still a bargain compared to the 1980’s when rates were running in the double digits, 16~18%.

Next up slow down in the refinance space so expect to see layoffs in the mortgage banking sector soon.

Still largely negative real interest rates compared to Consumer Price Index numbers….