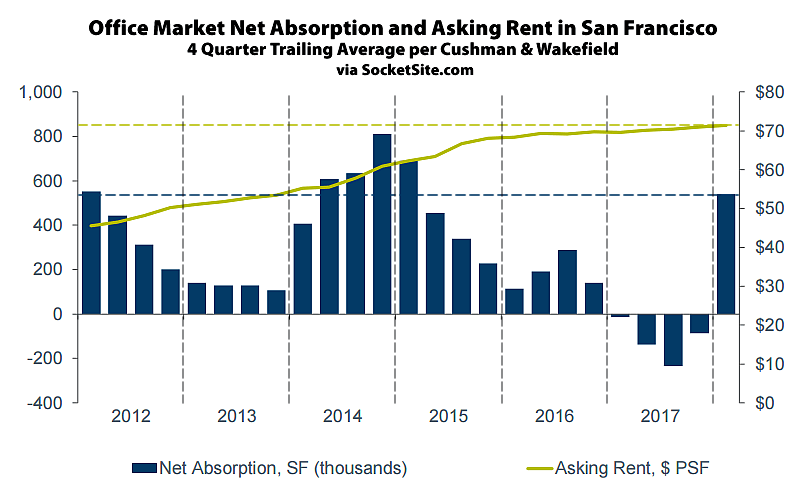

The average asking rent for office space in San Francisco inched up 0.5 percent in the first quarter of 2018 to an all-time high of $71.40 per square foot per year, which is 2.5 percent above the mark at the same time last year.

And the net absorption of occupied space was a record 2.25 million square feet in the quarter, driven by the delivery of Salesforce Tower (415 Mission Street) and 350 Bush Street, which together total over 1.8 million square feet and were delivered 97 percent pre-leased, according to Cushman & Wakefield.

As such, the overall office vacancy rate in San Francisco dropped 100 basis points to 7.6 percent (5.2 million square feet), which is 1.4 percentage points below the historical average of 9.0 percent and 1.1 percentage points lower than at the same time last year, but equal in terms of the vacant square footage, not accounting for 871,000 square feet of space which is technically leased but available for sublet.

At the same time, the average asking rent for older Class B space, which dropped 2.8 percent in 2017 to $63.25 per square foot, ticked up 2.1 percent to $64.56 which is 1.1 percent higher versus the same time last year.

And while the overall need of all tenants actively seeking office space in San Francisco ticked up 6.7 percent to 4.8 million square feet in the first quarter of 2018, it’s down 12.5 percent on a year-over-year basis with 4.7 million square feet of office space under construction, 1.9 million square feet of which is slated to be ready for occupancy in the second quarter but 100 percent of which is pre-leased, including the office space component of the tower at 181 Fremont Street which has been leased by Facebook.

This is a great example of people giving the ‘negative net absorption rate’ a higher predictive weight than the fact that large tech companies were (and still are) grabbing as much office space in SF as they can. Tech companies have ‘skin in the game’ when it comes to office space, so I trust their actions (expressed by new leases, price per square foot etc.) more than the flux of net absorption rate.

Further, the ‘yes, but what about Class B office space’ narrative seems to be falling apart too. Class B office space can be converted to class A office space given sufficient time and demand (e.g. see WeWork grabbing the former Union Bank building at 400 California street).

The missing variable is the number of companies which are effectively trading up and/or consolidating into the newer developments and their strategies to either manage or shed the various spaces which they currently occupy.

Expect to soon hear of a couple of big spaces, if not buildings, that should be available to sublet by the end of the year.

This would be the case if you assume that companies are simply trading up with a fixed demand for office space. I’m quite certain tech companies (Facebook, AirBnB, Dropbox) are still expanding, rather than staying the same in size.

We’re not assuming anything, we’re basing it on knowledge of the actual leasing strategies and space requirements, which include projected growth, at hand.

Yes, like touting the net absorption rate as the primary indicator for a commercial real estate slowdown in SF.

No, like knowing the actual leases in comparison to specific projected needs (while being able to process more than one metric at a time and understanding the implications of each one, both individually and collectively as a whole).

Speaking of which, “Salesforce said Tuesday that it is subleasing its offices at Rincon Center at 101 Spear Street in San Francisco, as it consolidates its staff into three high-rises near the Transbay Terminal.”

Who could have seen that coming! And yes, there are more to come…

And that is the point. There are few moves of workers to SF. Most of these leases (such as the DropBox lease last year) are shifts of workers within SF to better digs in SF.

It will take several quarters to see to what degree Salesforce and DropBox put up old space for sublease. It won’t be one for one but it should be significant and at some point relatively soon there will be a large negative absorption to balance out this positive absorption.

Last year saw a net negative absorption and this year, while it may not be negative, will IMO see just a small positive absorption. Not near as robust office absorption as some other cities.

That sounds pretty good. Not too much new construction without tenants is coming online over the next 2-4 years. Office rents should stay at a premium barring an external economic event.

What happened to all of the extra sub-let space that signaled a slowdown?

The slowdown is happening next quarter.

Or at least that’s been the schedule for the last few years.

Actually, it really depends upon how you’re defining or measuring a real slowdown.

As we first noted in early 2016, while asking rents had hit a record high, a slowdown was underway, after which the annual increase was 1.8 percent in 2017, down from a 2.4 percent in 2016, a 15 percent gain in 2015 and an average annual increase of nearly 20 percent over the previous six years.

And once again, current absorption and vacancy rate trends are being driven by the delivery of pre-leased new buildings, trends which shouldn’t catch any plugged-in readers by surprise.

If prices are still increasing, I don’t think most people would call that a slowdown.

If by “most” you mean those who don’t understand basic derivatives and can’t understand how markets transition from up to down, and excluding all those in the industry responsible for tracking pro forma rents, then we agree!

Derivates are so hard! Can you please explain them? Use small words, though, if you’re going to be condescending.

An economic slowdown means that the numbers are dropping. People have been predicting the coming economic collapse for years here. Remember when the bubble was about to burst? This is a real concern because it would really affect real estate prices. But it’s never happened. People have been wrong for years about it. SF’s economy remains strong.

Its all about the trend. Accelerating, or decelerating. Up or down, and how fast. A slowdonw is simply a change in previous trend, even if the general trend is still up. All the model monkeys have to adjust thier inputs down, even is still up overall….causing more caution…..more hesitancy to invest or invest as much. Its about the pychology on the trend. How is that for simple?

If ‘slowdown’ now means ‘growth’, I’ll take it!

That’s our mistake. We had assumed you had a basic understanding of the terms at hand, such as how a “slow down” doesn’t preclude growth (as opposed to a contraction or decline). And now back to the topic at hand…