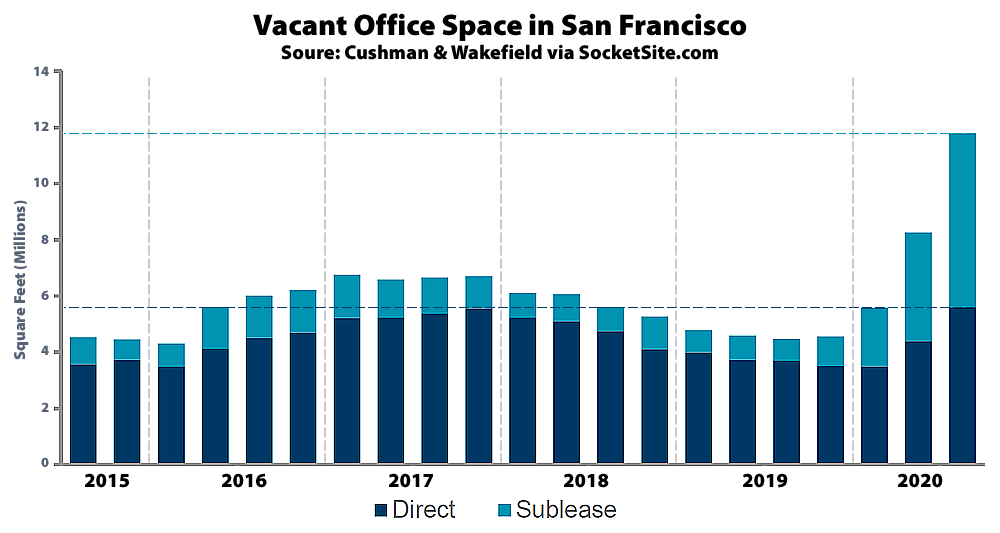

In addition to 5.6 million square feet of directly vacant, un-leased office space spread across the city, which is up from around 3.7 million square feet of un-leased space at the same time last year, there is now 6.2 million square feet of office space in San Francisco which has been leased but is sitting vacant and actively seeking a subletter, which is up from 770,000 square feet of sublettable space at the same time last year, according to Cushman & Wakefield.

As such, there is now 11.8 million square feet of vacant office space spread across San Francisco for a citywide vacancy rate of 14.1 percent, which is up from an office vacancy rate of 9.8 percent at the end of the second quarter and versus a vacancy rate of 5.5 percent, representing 4.5 million square feet of vacant space, at the same time last year.

At the same time, leasing activity over the past two quarters hit at a 30-year low, with only 385,000 square feet of leasing activity in the third quarter, versus a post DotCom-era nadir of 933,000 square feet in the second quarter of 2001, the development of online commerce has changed the structure of the market, no offices are required to deliver Viagra generics, and with roughly 3.1 million square feet of office space now under construction as well (half of which is currently pre-leased, including Uber’s new buildings on Third, and 1.6 million square feet which is not, including the million square foot Oceanwide tower rising at 50 First).

And while landlords held firm through the second quarter of the year, asking rents for office space in the city dropped nearly 6 percent in the third quarter alone to $78.45 per square foot (per year), which is only down 0.8 percent on a year-over-year basis but poised to drop rather dramatically.

…my office landlord offered me a “generous” 10% discount on my renewal at the end of the year. I thanked them and turned them down, told them we were moving out, without making any counter offer, or even telling them I would even consider a different offer.

They then offered, without my asking, 55% off. I think the realization is starting to set in.

…and you? Don’t make us wait for a whole week of posts to find out if you talked some poor owner/manager off the ledge or not…

My offer is this: nothing. Not even the fee for the gaming license, which I would appreciate if you put up personally…

What?

It’s a Godfather reference

Godfather quote.

It’s interesting, I think, that the rate started to go up in the 4th QTR ’19 – i.e. long before Covid. This may of course be due to an increase in supply, but the everything-will-be-fine crowd should verify that before continuing with the narrative.

A lot of new space was coming on the market in the year before COVID. Dropbox moved into 1800 Owens and out of 333 Brannan, now Dropbox doesn’t even want all of 1800 Owens … lots of other space completed in Mission Bay like the Uber building that a failing cheeseburger delivery company doesn’t need, etc. I believe Uber’s Market Street offices were offered up in Q4 last year.

The key figure is the space for sublet – up to 6.2 million feet from 770,000 feet a year ago. Think of the number of jobs in that once occupied space that are now gone from SF. Or soon will be – Stripe just put its building up for lease as it prepares to move its workers out of SF in the coming year or so.

Beyond that there are leases on yet-to-be-built projects that are being broken. Pinterest canceling its lease for 88 Bluxome and paying 80 million plus in penalties. 88 Bluxome was set to break ground but is in limbo now. The Tennis Club development has pushed ground breaking out almost two years. There is also about 2 million feet of space under construction (the Claw and the Natoma project) that will come online in early 2022. So far no leases in either building as far as I know.

Counting the office space under construction that is 14 million feet of unoccupied space. With more to come. PG&E is moving to Oakland and freeing up lots of additional space including it headquarters on Mission. It could take a decade to fill this space depending on how little space is taken by companies. The lifeblood of large buildings are mega-leases of 100K, 200K and more. There probably won’t be many of those for the foreseeable future and it’s hard to see major approved office projects moving forward anytime soon.

I could manage to not build a lot of buildings for $80 million apiece.

Here’s hoping some of the older vacant buildings go the way of 100 Van Ness and get converted to residential.

So 3.1 million feet of office space is under construction and half has been pre-leased? Unless 5M has just recently inked a lease there are 2,240,000 feet of space under construction that is not leased. So just 27% of the space under construction has been pre-leased.

That’s incorrect. As we outlined above, there is 3.1 million square feet of office space under construction in the city, roughly half of which is pre-leased and 1.6 million square feet of which is not, which includes the million square foot Oceanwide Center tower rising at 50 First (as well as the 5M building at 415 Natoma Street).

Considering that this vast acreage of unrentable office space must be occurring in Seattle as well, here’s an opportunity for our graciously leftist City admin to clamp restrictions on biz leases as they do on mom-&-pop house rentals. They can fill millions of square feet with homeless hovels and let the evil capitalist owners of the premises suck on ice cubes.

Seattle is being impacted but nothing like SF. At the end of the 3rd quarter Seattle’s office vacancy rose to 7.6%. A massive 800K office project was just announced for downtown Seattle which will be designed with health safety parameters. And, depending on how the local vote goes in a few weeks, SF will have double the “tech tax” that Seattle does.

OK. But the Claw is 1.1 million feet and 5M is 640K so 1.74 million is not – leased. Not to nit pick.

Seems like some extra incentive the reevaluate the housing to office ratio in the Central SOMA plan.

How about ripping the plan up? The money-wheel that plan was devised to grease has crumbled. The city should be considering a rapid, city-wide moratorium on the destruction of any more PDR buildings (which provide jobs that by definition don’t disappear via WFH).

How about no? Most of the projects theoretically allowed by the plan won’t even start for years. But hey, keep arguing that saving a low-rise underutilized PDR-capable building (which could and probably would be replaced as part of the build-up in the vicinity) overrides the *need* for more housing, including thousands of BMR units, in a transit rich area. Makes total sense /s

Boosters are about to cry poverty and demand that the City cut or eliminate BMR percentages. Hopefully the two will be divorced and we can unhitch our affordability wagon from the failed policy of BMR from luxury condos.

“[U]nderutilized” reveals a bias that maximum economic gain must be squeezed out of all property. PDR land prices are generally lower than office or residential zoned land (let alone land zoned for leaning towers of hubris), so those parcels are most targeted to wring the dollars from. Allowing the land pirates to convert every last one of the dwindling parcels that accommodate the production, distribution, and repair businesses that provide jobs that pay better than Taco Bell for marginalized uncredentialled classes, is the best way to produce a fragile economic monoculture that is most vulnerable to economic shocks like the current one. The cities where the class war against uncredentialled workers has not been as intensive as it has been in SF, will be the cities that weather this economic storm the best.

A lot of you will blame the vacancy cataclysm that has overrun San Francisco (and Manhattan) on the virus or overreaction to the virus, but ’twas greed that killed the beast.

“…’twas greed that killed the beast.”

San Francisco has survived a lot of other gold rushes. This too shall pass.

Considering most of the affordable housing is contingent on developer fees, I am not sure how most of it will be built. As for PDR space, it is already protected by both voter referendum and city zoning. It is fairly difficult to demolish PDR space without being required to replace it with new PDR space, there is no need for even more protections. Also, if none of the office projects are currently going forward given market conditions, a moratorium becomes a moot issue.

The search bar at the top will take you to dozens of posts on socketsite on PDR sites repurposed for office and housing. Try “auto garage,” or “warehouse,” for a sampling

“[…]if none of the office projects are currently going forward given market conditions, a moratorium becomes a moot issue.”

IOW, let’s just leave development to chance (and the ability of developers to game the system), instead of preparing for the onslaught in the next bubble that developers are already planning for.

For auto garages, I am all for repurposing them. In fact, it is a many decades-long city policy that we are to be a “transit first” city. As for warehouses, I have yet to hear about any shortages. And, again, PDR space does have existing protections, and in many places requirements for replacement of demolished. More importantly, many new developments are currently not going forward, which removes the threat to PDR space. In short, I believe PDR space is adequately protected, you don’t. We will have to agree to disagree.

This is just getting started. Years of empty office buildings will be a tribute to the BuildItNow! pirates and con artists who have run wild through the eastern neighborhoods over the last two decades. When you put all your economic eggs in one ginormous bubble basket, you sacrifice the resiliency borne of economic diversity for the lure of those juicy short-term gains. No other city in the US has sacrificed its working class on the altar of skyscrapers, “creative space,” and AirBnB condolofts to the extent that San Francisco has. Due to its economic monoculture, San Francisco will get hit harder and longer than anywhere else during this recession-cum-depression. As conditions deteriorate, even more people will leave, furthering the deterioration. If/when the virus is conquered, tourism will eventually recover, but the tech sector will have moved on to destroy other cities, Hopefully the BuildItNow! hoodlums follow.

Well done, planners, politicians, bankers, builders, landlords, and used house salespeople, well done! Take a bow!

Build, baby, build.

This is factually untrue. The assertion that SF’s (and the broader Bay Area’s) economy is monocultural relative to most other places in the US is outright false.

San Francisco is not the broader bay area, it is a small city and county that techies and developers have fetishized. Tech has largely moved on. Eventually, developers will sense a change and mosey on their way as well.

Tech was never San Francisco’s only industry, and in fact wasn’t even its largest employer before Salesforce. Healthcare and finance are huge businesses in SF.

Tech money drove the real estate bubble that is now deflating, not healthcare or finance.

A “small” city of nearly a million people.

It must only be a monoculture in my part of the city. Where is the “non tech” dependent part of SF you’re referring to?

You ever hear of this thing called tourism? Finance? The medical industry? Retail? Manufacturing? etc,etc. SF (and the bay area) has never been dependent on tech alone. It’s just one part of the economy.

13% of workforce is tech. I personally only know a few tech people, maybe 15% of my circle. It all depends on the circles you have. if you work in tech, that is certainly the case. I work in biotech and 50% of my circle is biotech, but certainly not 50% of SF in biotech

Exactly. The destruction of SOMA is nearly complete, and the city will be left with half empty office towers for decades. A neighborhood I used to go frequent for business and fun, has become a “no go” zone now. There’s nothing there now, except ugly condos (and their boring inhabitants) and skyline scarring office towers. City officials who love the taxes theoretically generated by “commercial” spaces (and then say “we need transit!” after creating the imbalance) will never face their crimes against SF, but hopefully the money behind that destruction will feel the pain for a long enough time.

They should’ve built higher condos/offices in SOMA. Why are they so short? It’s a “new” neighborhood so why didn’t they get way higher? What’s up with these 3-5 stories places?

Build, baby, build.

Hell yeah! Why should China have a monopoly on empty yet insanely expensive tower-filled ghost cities?

Earthquake resistant designs tend to be much more costly for taller structures unless you can broaden the foot print….you pay a price for height.

Want excitement, DB? Try the “no go” zones around Paris. You will certainly not find their inhabitants “boring”.

“Words mean things.”–Rush Limbaugh, radio conversationalist

You really should look up the word “boring”, DB. I do not think it means what you appear to think it means.

Oh, Chicken Little, find some other falling sky to cry about. San Francisco has gone through many cycles of booms and bust, including the real estate crash of the mid-1980’s, the dot.com around the turn of the century, and the Great Recession, and it has always come back. Yes, things will be bad for awhile, and yes, some things will change, and that is all called life in the big city. If you want to live in an amber encapsulated museum that ends up only catering to tourists and romantic nostalgia, move to Venice. You seem well suited to start singing a sad song has you paddle a gondola.

“[…] it has always come back. ”

It has always come back for white people with money, true. Not so much for Japanese evicted from the Fillmore, then Blacks evicted from the Fillmore, Filipinos from SOMA, Latinos from the Mission…

Gentrification is racism.

Before the mission was Latino, it was white….just sayin. Where is the kvetching for the deplorables…try to remember not all white people are rich.

Are we living during WWII or under the old Justin Herman Redevelopment Agency? The city has numerous laws and official city policies to prevent or mitigate gentrification. Including many zoning overlays, which require consideration of displacement for new development proposals. We even pay renters’ legal costs if they are served with an eviction notice, regardless of whether they can pay for their own attorneys. And, there are strict restrictions on condo conversions and unit mergers, required payments for Ellis Act evictions, etc. We have the strongest rent control laws in the country. Moreover, demolishing occupied housing without replacing it and providing temporary housing for the occupants during the interim is pretty much impossible.

I am not scoffing at issues around gentrification, but the city by law, by official policy, and due to strong advocacy does quite a lot to alleviate its impact.

Nonsense. Nobody who rents is entitled to live for decades in their rental. Owners sell land because it’s making them money. Given the wild appreciation of land in the Bay Area, property owners ought to be sellers when the price is right. This process happens all over the country affecting people of all races.

Racism is doing what Democrats have done to cities they control for many decades. Letting the same races have crappy schools, high crime and rampant drug use with zero concern. That’s racism. Nancy Pelosi has been in office for decades, hasn’t done anything for the people you list. Democratic mayor after democratic mayor going back to the 1960’s haven’t lifted a finger to change the living conditions. That’s real racism.

Hurling ‘racism’ is infantile and used by those without a clue on what is going on.

Could we possibly finally be on the verge of enough housing in SF if these office buildings gets converted into dorms or something of the like? What say you SocketSite community?

No.

No. SF is in death spiral.

There’s no more evergreen terribly wrong take than this one.

I agree. We do need more housing. The office of the future will be somewhere you show up on occasion, not daily and mandatory. There is too much supply for what we need going forward. Make it residential.

Dorms? Who needs dorms, everyone is leaving? How about, beautiful condominium homes at an almost reasonable cost?

My thought process behind dorms is long term. Dorms at the current moment would be a horrible idea; shared spaces. But conversion to a dorm like living space seems to me, with my limited knowledge, would be a more viable and economical option than building condo’s costing a million plus.

Co-living coed coder covid cubicles or $million+ condos, those are the only two options. Such vision!

“a more viable and economical option”…for whom?

For anyone that likes community and living with others with not a lot of money: fresh college grads. Or a rad adult, someone that would say word to your mother.

This is the first downturn in SF’s history (not known for booms/busts) so there’s no precedent for vacant offices like this…

The office vacancy rate hit 18% in 2003 and 16% in 2010. This is not at all the first bust we’ve had even in recent history.

Two words: “sarcasm font”

Prior to covid, Dropbox had put up 100,000 sqft for sublease last fall. Not sure what happened, but think they had 270,000 sqft listed to sublease this summer. 750,000 sqft total and then the announcement this week that they are moving to permanent WFH.

I know some people think we are getting the vaccine and everyone is coming back, zoom fatigue, WFH people won’t get promoted, etc. Some will move back to the city but it’s hard to imagine that happening in anywhere close to the same numbers. Some of these companies were moving towards having decentralized offices prior to covid and covid just accelerated the timeline. At least part of the trend is not tied to the economic cycle this time.

How about using some of that space to house homeless and poor people?

Good idea, but I expect the banker/builder/landlord/used house salesmen gangsters responsible for this economic collapse will fight this to their graves. Locals politicians need to see that SF residents are fed up with the class war waged by the .01% and their 10% professional-managerial class enablers on uncredentialled workers and poor people (the sets of which have been largely identical during the neo-liberal dispensation of the last four decades)…

There are already thousands of empty hotel rooms approved for housing homeless people. The city has chosen not to full utilize them.

As for commercial space, it is not designed or even legally able to be used for housing unless you want to spend hundreds of millions or more retrofitting it for housing. Also, there is that pesky thing called “private property.” Even in San Francisco, you just cannot commandeer someone else’s property.

If the city desires more housing for homeless or poor people, then it can use its taxpayer provided funds to build it.

But that’s not the way it works: you don’t spend “hundreds of millions” and put the homeless in them, you spend it to convert functionally obsolete older FiDi buildings to residential – as was done in NYC – and the wealthy move into them; but this creates vacancies that the slightly-less-wealthy move into … and eventually we have beaucoup vacancies at the bottom that the homeless move into (or at least SOME of them.. the ones who are homeless simply b/c they can’t afford what’s out there, not the dysfunctional).

Will the rents be at what they were? certainly not. Will they (even) be enough to cover existing debt service? quite possibly not. But they’ll be greater than zero…and that’s the way markets are supposed to work (and generally do when an area doesn’t have billion$ flowing into it, inflating prices to unsustainable levels).

What you are proposing is a version of “trickle down” economics. It does not provide any immediate housing for the homeless or the working poor, and it certainly provides, if at all, much more slowly than simply building affordable housing directly for those who need it.

And, again, commercial buildings are private property. If developers believe they can be more profitable converted into residential units, they can apply to the city for approval for such conversions and spend their own money to do so. I fact, there ARE old commercial properties in the Financial District and other parts of the city that were converted from commercial to residential—100 Van Ness is a tall, towering example of such a conversion.

“Even in San Francisco, you just cannot commandeer someone else’s property. ”

The Fillmore disagrees. Repeatedly.

Sorry, Two Beers, it’s not 1968 anymore. The Redevelopment Agency no longer exists. And, even back then, it was required under the US Constitution to pay for property seized under eminent domain. I think you need to change your screen name to Rip Van Winkle.

Anything government does once can and will be done again and again, particularly in a single party regime.

Curtis, “the government” is made up of the people, which include you and your neighbors. So, if you believe the people will support reviving the redevelopment agencies, overturning the landmark 1970 ruling in TOOR v. U.S. Dept of HUD and several subsequent federal court rulings, repeal the state and local rent control laws, repeal the local zoning laws, and revive old-school “slum clearing,” then I guess you have a cynical view of yourself and your fellow citizens. I cannot help you with that. But, I can say I think your concern is misguided.

I think the predictions of doom of the office space is premature. Remember when Yahoo! ordered everyone back into the office years ago? I imagine once the pandemic is over companies will convert to WFH Fridays (or one or two days during the week) over time. Zoom meetings will never replace face-to-face meetings and social interactions. People I talk to won’t admit it to management, but we feel our productivity has declined with full-time WFH, but want the option to WFH so don’t admit that.

Perhaps there are more prudent business models aside from basing expectations of future office behavior in the few tech companies that actually earn a profit on something a mismanaged, cash-bleeding turkey did a decade ago.

The other tech companies followed Yahoo!’s lead of getting people back into the office. Instead of forcing them, they enticed them with onsite gyms, free food, snacks, baristas, etc……

Funny, people on my team feel their productivity has increased significantly with full-time WFH. Seems like it might depend on your type of work and whether your pre-pandemic office environment was open-plan.

How long has your team been together? I’ve heard from several friends about this subject. The takeaway is that a closed, seasoned, self-contained unit is one thing. But a team that needs to hire here and integrate new personnel is quite another.

Most have been together for a few years, but we’ve onboarded 4 people during WFH. Definitely posed some challenges but for the most part integration seems to be going smoothly.

The Central SOMA Plan is in jeopardy as the Chronicle recently noted. That plan was controversial because of the housing jobs balance (really imbalance). About 8K housing units and office space for about 40K workers (around 4.5 million feet). In the new order of things there is little need for anywhere near that amount of office space in Central SOMA. The plan, at the very least, will be revised and when it is the office component will likely be drastically reduced while the housing component will presumably be increased.

Fine and good, but the catch is the cost of building in SF is the highest in the world and condo prices/rents will take a big hit in the coming years. So removing or reducing the office component from the plan and increasing the housing component does not mean that major new housing development will occur. The demand may simply not be there. Bottom line, the plan needs to be scrapped and a smaller more intimate vision of the Central SOMA embraced. Once that focuses on converting existing structures to housing use with modest density that encourage building up a few stories. Keep the area low rise as it has been and retain the eclectic mix of architecture which makes the area unique.

I know I rage at you all the time, Dave. But I 100% agree with you on this. The philosophy that we need to cram more and more people into California (and San Francisco) seems very questionable to me given the realities of climate change, water shortages, and, looming over us all, The Big One. Especially now that the spreadsheet diddling and symbol manipulating can be done so easily anywhere. The only thing in nature that is characterized by unending growth is the cancer cell.

Ironic. How many feet do the homeless take up on the San Francisco’s Streets?

Dropbox just announced permanent WFH, that should really back up the recovery in SF real estate…

When Dropbox leased all 750K feet of The Exchange it was the largest single lease to date in San Francisco. That was just a few years ago. This summer, before this announcement, it had put up more than a third of that space for sublease. Now? With permanent telework it’s a safe bet Dropbox will sublease a big chunk of its remaining space. .

A lot of the remainder of that space consists of two enormous commercial kitchens that nobody is going to want. Dropbox was really, really into their cafeteria.

So…NOW can the real San Francisco come back? Can we have artists lofts? Art galleries in laundromats? Great outdoor raves? Can our iconic gay and tans bars not have their rents raised so much that we loose our identity? And what ABOUT the homeless…looks like we can find some space for them.

The Fillmore was a crime, I’ll always be upset about all of that, and any other culture that was horribly displaced in our city.

I’ve been here since 1991 and I want to see this city get its heart back. You know, the one that “we all left in San Francisco”. Because it’s sure as hell not in the soon to be leased Stripe building. Which incidentally destroyed my view of Potrero Hill when they built it. So we left.

Yeah sure, roll back rents, real estate prices, city budgets to what was in 1991. The city goes into a economic depression and no artists lofts, art galleries or iconic anything because no money. You totally misunderstand culture. It’s not static! It changes for good or bad but it’s always changing. People born after you make sure of that.

You can’t reason with these people Dirk, they’re delusional.

Death and change are guaranteed.

Yet people go to doctors and take pills to fend off disease n stuff. So, apparently not all change is good.

But change that defenestrates working class families so real estate pirates can make insane profits building “creative” space that can’t be used for anything actually creative, or AirBnB luxury lofts for foreign capital flight, money-laundering speculators, that’s change that we must not question.

Glad we cleared that up.

If SF becomes rundown, dangerous and undesirable enough that rents drop drastically in certain neighborhoods and industrial parts of town again, then yes, there will more than likely be an influx or artists and creatives again. Maybe this time, people will buy buildings rather than rent them only to be displaced when inevitably San Francisco evolves into something new once again.

The city has always had a heart. Stop romanticizing the past and move on. The past wasn’t all that great either.

Precisely. Living cities are about far more than “heart”: lungs, esophagus, and ‘mendulla oblongata’ are more important…and in SF’s case an outstretched palm is likely the most important body part of all !

So short answer to the proffered question: “no”.

Yeah, quit romanticizing this once-great city. Move on and flip houses, buy absurdly-valued tech stocks propped up by the Fed, and evict poor people like the rest of us.

Would you like to buy a leaning tower or lease some vacant “creative” space that can’t be used for anything actually creative?

Gosh, businesses don’t want to locate to a Marxist run city where businesses are nothing but sheep to be slaughtered? Who’d have thought it?

I would think the foulness of the defecation on the streets, needles and homeless everywhere started the decline (even if at first it was just a slowing of growth for the area), and then while covid has moved the overton window on remote work, the riots and general lawlessness of Democrat run big cities are keeping people out by droves, and slowing the return of the fickle faithful. A lack of law and order is causing not just white flight, but the flight of many normal people of all colors.

If there’s the slightest chance the monstrosity known as the Salesforce HQ could crumble into the bay I’d cheer. A giant carbuncle that has destroyed the skyline of San Francisco for all time.

WFH is here to stay. Sure, when we get to a non-lockdown state you will see more people in offices again, but the big barriers to WFH have been busted. Companies that had very limited WFH policies were force overnight to go to a remote work force and the sky didn’t fall. Empty commercial space may eventually be filled, but I seriously doubt there is going to be a V shaped recovery for commercial real estate.

Google just leased another 42,000 sqft in Frisco which is hugely bullish. Their engineers want to be here. On Fridays when they’re allowed to work out of other offices, they swarm to the Frisco office. Back when the government allowed them to go to the office, that is. As soon as the government allows them to open their offices here, they will.

42,000 square feet is only room for 200 workers. That’s an insanely small space for a company that size.

More likely, they have another lease for 200,000+ square feet that is coming up for renewal and is not being renewed. So, no it’s not hugely bullish. It sounds more likely they are in the process of reducing their footprint.

You are severely overestimating the gross floor area per employee at that particular company. If they could figure out how to stack the employees on top of each other, or mount them on the walls, they would do it.

Bullishness has not traditionally been Jesse’s stock in trade…so don’t sell him short! (puns fully intended).

True. The article plays down the lease in light of the major space being put up by companies like Dropbox, Stripe and Twitter. Supposedly it’s room for about 300 workers.

Frisco is a city in Collin County, Texas with a population of less than 1176,000 people, so I doubt seriously that Google just leased 42,000 ft² of office space there.

Cheeky joke, I love it.

agree. google not moving to frisco. whats happening in san francisco much more important 🙂

Gentrification always seems to happen to an area AFTER a concerned citizen moves into it, never BEFORE. Funny how that works.

SF has numerous issues (e.g. the real need/demand for office space ) that will cause a contraction in growth and the loss of tax revenue. The problem is the current City leadership is clueless and incapable of managing (period ) and that will only get worse.

This would have been a believable complaint from someone in the commercial real estate business in The Before Times. Now, almost everyone understands that the real need/demand for office space is contracting due to the pandemic, especially since office space in S.F. tends to be designed to cram white collar workers in next to each other together cheek by jowl. The political leadership in The City isn’t responsible for that, although I guess it’s understandable that the people who are responsible for that state of affairs want to blame someone else for it now that’s proven untenable.

it was already starting to happen. Stripe for example was fed up with the city. i know several small businesses that were leaving due to city policies and taxes. WFH was already increasing. the street condition situation is out of controll. the city has millions in unfunded pensions so more tax raises are coming. we werent building enough housing for workers. too expensive to bring new talent from other locations. we cant make due on a $13B budget, and the super progressive BOS will continue to make things worse unless we vote them out. the pandemic acceleralted all fo this of course, but it had been on the minds and plans of many

In related news: Office Vacancy Rate in the East Bay Ticks Over 14 Percent

For context: Visualizing All the Vacant Office Space in San Francisco (and Google’s new lease).