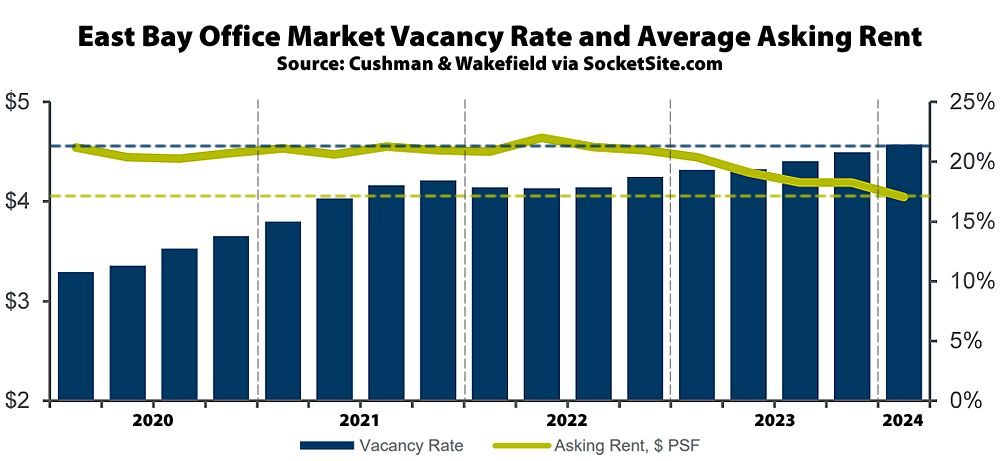

With the office vacancy rate in San Francisco having ticked over 33 percent last month, the effective office vacancy rate in the East Bay, not including Walnut Creek or further east, inched up another 70 basis points to 21.5 percent, including 4.9 million square feet of un-leased and non-revenue producing space, which is up from 4.8 million square feet of un-leased space at the end of 2023, and another 1.2 million square feet of space which has been leased but is effectively vacant and being offered for sublet, at discounted rates, according to Cushman & Wakefield.

That being said, leasing activity/demand, which dropped to a 28-year low at the end of last year, increased 22 percent over the past quarter to 260,000 square feet of space, versus a decline in San Francisco, with the office vacancy rate in Oakland’s Central Business District (CBD), which had nearly tripled over the past five years, holding at 29 percent.

And while “a wave of refinancing and sales activity in the years before Covid-19 left many landlords at a basis where they were unable to materially lower rates and still make their investments pencil or meet their loan covenants,” which should sound familiar, and East Bay landlords had been trying to hold firm on asking rents, the average asking rent for East Bay office space dropped a little over 3 percent last quarter to $4.05 per square foot per month and was down nearly 9 percent on a year-over-year basis, with properties starting to go back to lenders, “drastically lowering cost bases and creating the potential for rates to better adjust,” and the asking rate for office space in Oakland’s CBD having dropped 20 percent from its pre-pandemic high.

We’ll keep you posted and plugged-in.

995 Market St in SF just closed sale for $72/SqFt. At that $/SqFt does residential conversion make sense?

It’s next door to the recently hi-lighted 989 Market https://socketsite.com/archives/2024/04/over-21-salesforce-towers-worth-of-vacant-office-space-in-s-f.html, but unlike the dept store sized floor plates in that…well, former department store, this would seem to be well dimensioned for conversion.

Depends on the other variables, doesn’t it? This site has pointed out more than a few times over the past couple of years that while 100 Van Ness (the old AAA building) was a fairly recent office high rise to residential housing conversion, it was successful because the cost basis was under $200 per existing ft.², including an adjacent building which was then demolished to yield a “bonus” 429 units of housing.

You’re pointing out that underutilized office space can be had for < $100 per ft.², and that is clearly under $200 per existing ft.², but construction costs have risen, the cost of capital is a lot higher, and the expected yield from finished apartments or condos is substantially lower than when the 100 Van Ness conversion was initiated. In order to entice a private developer, the cost of the conversion has to be cheaper than building something from ground up on a (former) parking lot.

Even in best case scenario it would be 3 years out before any units were occupied.

Actually, I would argue a “best case” has little to do with what occupancy is finally developed but whether/not the facade is restored: much as with the Chronicle Building, hidden under the sheet metal cladding is – or at least was (and hopefully still “is”) an atractive design…the David Hewes Building. Spelndid Survivors, the architectural guide, felt it could become an “A” building again, assuming it’s mostly intact.

Historic restoration? Extend the timeline extra year or two.

I’m not sure it’s historic preservation, per se – tho that would presumably help with the financing – more along the lines of “undoing (cosmetic) damage”.

Sure, it would be years before any units were ready for occupancy, but an owner taking the conversion route would be betting on values being on the upswing when the completed residences were ready for market. If values were still on a downhill slide, then the developer might still underperform what they put into their pro forma for the lender.

Even if the numbers ‘penciled out’, I wouldn’t be surprised if the new owners of The David Hewes Building (995 Market St.) just did some cleaning, painting and minimal repairs and then try to lease the building as office space, perhaps at a marginally lower rate. Conversion to residential would require someone with cojones to actually build, and most of these so-called “players” in the S.F. real estate game only know how, or perhaps only want, to move money from pocket to pocket and make rips along the way.