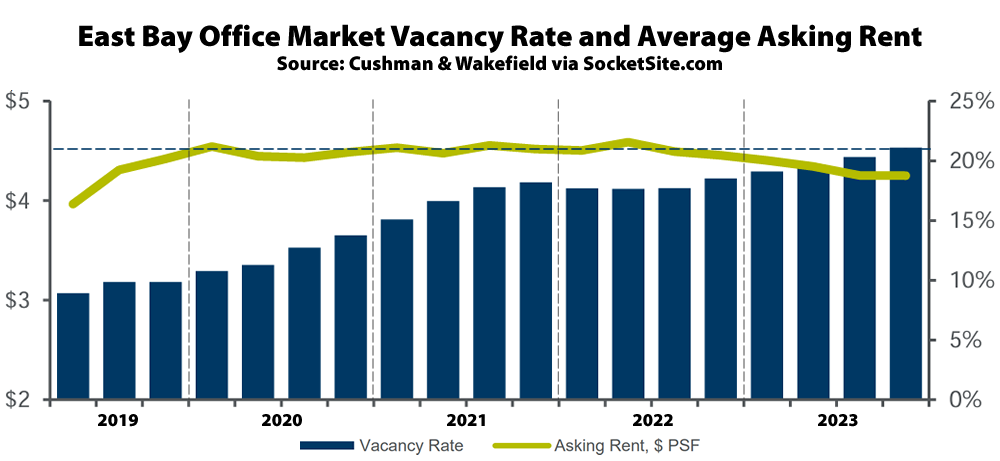

The effective office vacancy rate in the East Bay, not including Walnut Creek or further east, ticked over 21 percent at the end of December, with nearly 4.8 million square feet of un-leased and non-revenue producing space and another 1.2 million square feet of space which has been leased but is effectively vacant and being offered for sublet, at discounted rates, according to Cushman & Wakefield.

As such, the East Bay office vacancy rate has more than doubled over the past four years, with gross leasing activity/demand having dropped 40 percent from 2022 to 2023, representing the lowest level of annual activity since Cushman & Wakefield began tracking the market in 1995 and the office vacancy rate in Oakland’s City Center Core nearing 40 percent.

At the same time, East Bay landlords are still trying to hold firm on asking rents, with the average asking rent having held at $4.25 per square foot per month over the past quarter, which is only 4.9 percent lower than at the same time last year, despite a second straight quarter with over 200,000 square feet of negative net absorption, a sixth straight quarter with over 100,000 square feet of negative net absorption, and “looming loan maturities” (with the cost of capital having jumped).

I wonder if PG&E still intends to close on 300 Lakeside for a billion dollars under these conditions.

Has much changed in the past few mos?

“a second straight quarter with over 200,000 square feet of negative net absorption” which follows from “a sixth straight quarter with over 100,000 square feet of negative net absorption”

My question pertained to PG&E’s plans – there was a link, since deleted – not to the market in general.

(And what the link said – or claimed – was that at least as of October, their plans were unchanged)