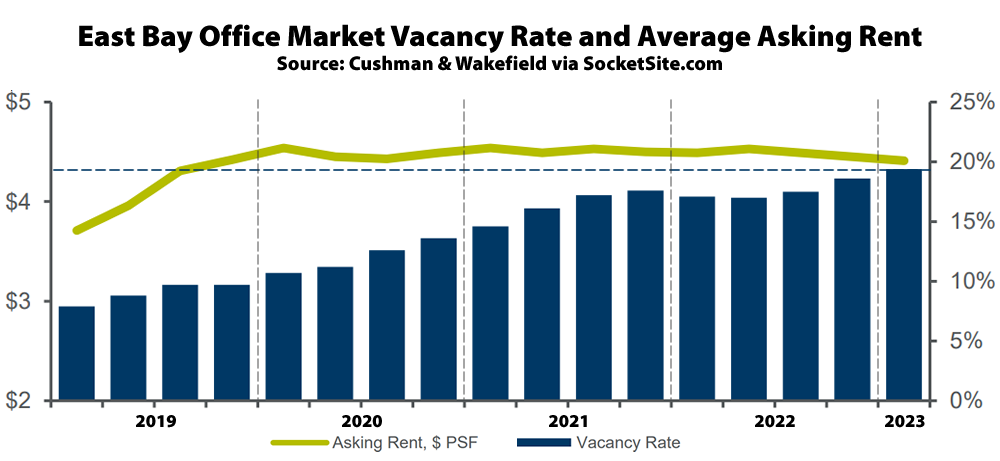

The office vacancy rate in the East Bay, not including Walnut Creek or further east, nor life science/lab space, which is a methodological change, ticked up 80 basis points in the first quarter of 2023 to 19.4 percent, which is roughly double the vacancy rate prior to the pandemic, with 4.5 million square feet of un-leased space and an additional 1.1 million square feet of space which is has been leased but is actively being offered for sublet, and an office vacancy rate of nearly 35 percent in Oakland’s City Center Core, according to Cushman & Wakefield.

At the same time, the average asking rent for office space in the East Bay barely budged in the first quarter, inching down 4 cents to $4.41 per square foot per month, which is less than 2 percent lower than at the same time last year and only 3 percent below the market’s peak in the first quarter of 2020, as East Bay landlords continue to hold firm on asking rents while offering free rent and build out allowances to reduce effective rents without signaling a mass decline or downward spiral.

In addition, a “flight to quality” has continued to prop up the average new rent, with new tenants being drawn to the highest quality spaces, the availability of which has jumped. And as we highlighted last year, “refinancing and sale activity in the years before Covid-19 [has] left many landlords at a [cost] basis where they are unable to lower rates and still make their investments pencil,” or remain in good standing on their loans, as is the case across the bay.

All that being said, cracks are starting to emerge, with the average asking rent for Oakland’s Central Business District having now dropped around 11 percent from its pre-pandemic high; three straight quarter of negative net absorption across the East Bay; and an uptick in sublettable space, including nearly 80,000 square feet of space in Oakland’s Uptown Station which was subleased from Square in 2021 and is now being offered as a sub-sublease.