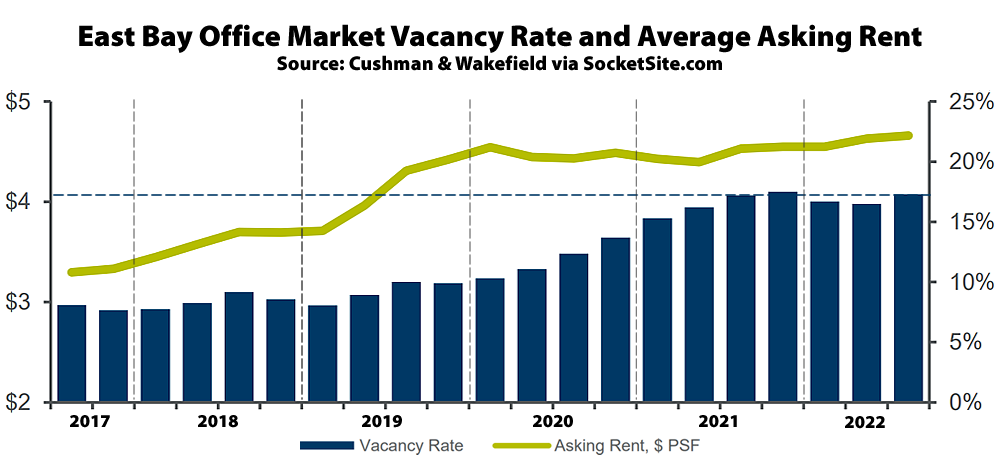

Having ticked down from 18.1 percent at the end of last year to 16.3 percent three months ago, the office vacancy rate in the East Bay, not including Walnut Creek or further east, has ticked back up to 17.3 percent, with net negative absorption of 269,000 square feet of space over the past quarter and versus a vacancy rate of closer to 8 percent in late 2019.

In addition to 4.7 million square feet of un-leased space, the current vacancy rate includes an additional (one) million square feet of space which has been leased but is actively being offered for sublet, according to Cushman & Wakefield, and an office vacancy rate which has just ticked over 33 percent in Oakland’s City Center Core. Across the Bay, the average office vacancy rate in San Francisco‘s Central Business District is currently running a little over 24 percent.

At the same time, the average asking rent for East Bay office space has actually inched up another seven (7) cents to $4.66 per square foot per month, with landlords holding firm on asking rents despite the marked increase in vacant space over the past two years but offering free rent and build out allowances to reduce effective rents without signaling a decline.

From Cushman & Wakefield:

“Given that vacancy in [Oakland’s Central Business District] has more than doubled…it is surprising that the pricing adjustment has not been more significant, particularly within the Class B and commodity Class A product types. The first factor holding up rents has been a notable flight to quality. To draw employees back to the office, tenants are drawn to the highest quality spaces, and as they often downsize their footprint, they become less price sensitive. The other is landlords’ inability or unwillingness to drop rates. A wave of refinancing and sale activity in the years before Covid-19 have left many landlords at a basis where they are unable to lower rates and still make their investments pencil, even in the face of rising vacancy.”

The aforementioned trends and landlord challenges aren’t limited to Oakland, as plugged-in people should be well aware. We’ll keep you posted and plugged-in.

Office landlord strategy: delay and pray.

I realize you’re just following CW’s lead, but it’s potentially misleading – at least to those more knowledgeable about The Town – to use “City Center (core)” interchangeably with DTO: City Center was the specific name for the 15 (later 12) block redevelopment project developed in the 60’s- thru 80’s.

SF office space will fare better than Oakland in a hybrid / remote work because it’s a more central, “trophy” office. It’s easier to access for more people, namely San Mateo and most of Santa Clara county.

Oakland could work for companies who want more in-person, 3+ days a week in the office, and are willing to go all-in on hiring mostly in Alameda and Contra Costa county. Oakland strikes me as high risk/high reward whereas as SF is the safe play.

Let’s check back on this forecast in a year. Nothing but dark clouds ahead.

East Bay (Oakland) emerged as its own separate office market long time ago. With so many employees living in the east bay, it just makes sense for some companies to move the offices closer to them. It might not be considered direct competitor for office tenants with SF.

Trophy office sounds nice in times of surplus, perhaps. Palo Alto/peninsula or Walnut Creek or even Marin could be more trophy though? 15 sales force towers for trophy offices a little unrealistic…

Also you would do layoffs first but hang on to a trophy office? Priorities may have changed quickly of late.