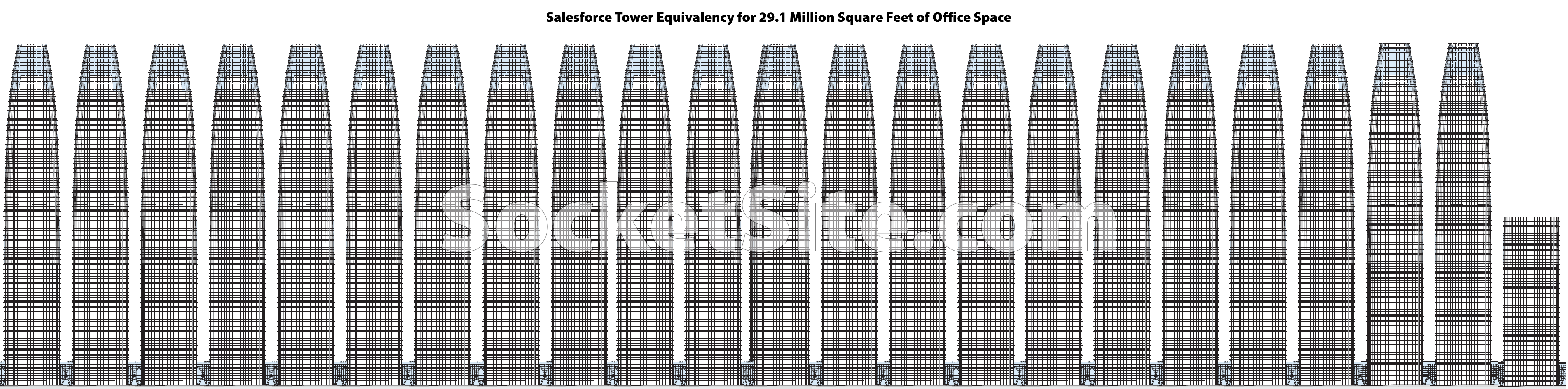

As we outlined yesterday, the amount of vacant office space in San Francisco now totals over 29 million square feet, having increased by over a million square feet in the first quarter of this year despite the “AI Boom!”

For context, the 1,070-foot-tall Salesforce/Transbay tower at First and Mission, which is the tallest building in San Francisco, contains 1.35 million square feet of office space spread across 59 floors.

And employing the framework we developed back in 2020 and others have since co-opted as their own, there is now 21.5 Salesforce Towers – or nearly 1,300 Salesforce Tower floors – worth of empty office space spread across San Francisco, which is roughly enough space to accommodate between 166,000 full-time employees, based on pre-Covid office density ratios, or up to 223,000 part-time or former twitter/X-esque worker bees.

For additional context, that’s roughly 692 times Google’s headline lease of 42,000 square feet of additional office space in the city, which was billed as a bullish sign of a major player “bucking the trend” three years ago, when there was over 50 percent less vacant office space in San Francisco, or over 1,700 times the headlined “full floor leases!” at 350 California Street last year.

At the same time, there are now over 16,000 fewer San Francisco residents with a job than there were are the same time last year, with over 39,000 fewer employed people in San Francisco than there were at the end of 2019, prior to the pandemic, and over 30,000 fewer people in the local labor force, with Bay Area employment nearing 2015 levels.

Time for capitulation?

ASB Real Estate Investments has listed a 117,200-square-foot office building in San Francisco’s Mid-Market for a reported $12 million — or 80 percent less than it traded for a decade ago.

The property – 989 Market (The original flagship of Hale Bros before they moved to 5th Market)- is being marketed @ ~$100/gsf; IIRC isn’t that around the magical number where residential conversion might start to make sense ?? And if not for “the overwhelming majority of commercial property in SF” maybe a somewhat more whelming segment than formerly? Of course plugged-in readers will recognize that conversions have never been impossible per se, since they’ve seen a number of them in these pages over the years – it just might seem like it.

At 97,512 square feet, 989 Market Street would represent a whelming 0.3 percent of the vacant office space in San Francisco.

Which, of course, isn’t even underwhelming (microwhelming?) No: I was suggesting that this might be a new threshold for properties in general…at least to the extent that one can generalize about 30Mgsf. (And this property is probably the weirdest of all: altho the build date of 1907 is generally correct, I believe the facade actually prdates the Fire…having been preserved by a unique process that required supprting it with guywires during reconstruction)

Recent Class B sales in San Francisco, including short-sales, have been averaging closer to $260 per square foot.

Well, sure. This site has pointed out a few times over the past couple of years that while 100 Van Ness (the old AAA building) was a successful recent office high rise to residential high rise conversion, it was successful because the cost basis was under $200 per existing ft.², including an adjacent building which was then demolished to yield a “bonus” 429 units of housing.

The listing I saw for 989 Market Street (a 6-story) indicates the building class is “B”. That classification is probably due to the building having been built in 1907, you wouldn’t think that looking at the interior finishes (it’s been remodeled).

“B” would seem generous, given the age – and environs – of the building, tho I confess I know nothing of what shape it’s in, or what upgrades it may have had.

Do we have a comparable metric for vacant retail space? How about one with …oh…bloomingdales as the unit. Come March, the city’s vacant retail space will be increasing by exactly one bloomingdales

Ordinance 52-19 requires San Francisco commercial landlords to annually register all vacant buildings (including retail spaces).

If San Francisco commercial landlords actually obeyed the law, then The City would have the retail space vacancy data at hand and could make available a dashboard like the one they’ve had up for office space for a while showing total vacancy for retail.

As you know, most recently from the imbroglio around 2022’s Proposition M (the Residential Vacancy Tax), many San Francisco landlords chose to skirt or outright ignore local laws that attempt to impair their ability to engage in Ayn Randian “strikes” against tenants by just sitting on vacant property in lieu of lowering rents to market-clearing levels.

According to a story datelined June 15, 2023 and written by Wendy Thurm (“SF’s Empty Storefront Tax, After a Year’s Delay, Has Little Effect”), as of that Summer over a year ago, the tax has been ignored by hundreds, if not thousands, of property owners and lessees who have failed to submit the required tax filings, according to data from the city treasurer. Since the Residential Vacancy Tax was struck down in court, I expect the landlords to start legal attacks against the Empty Storefront Tax if and when The City attempt to actually start levying penalties.

Um, OK….tho I believe the data always cited here comes – came – from the CBRE reports, so I’m not sure the law – ignored or not – really has much to do with it.

Now back to our story: DTSF’s “revival”…or not.

Yes, I was aware that usually this site reports data based on CBRE reports, but I assume you have to be a subscriber to get it. There’s no standard for retail vacancy rate, which is why I think The City’s data, if it were available, should be considered authoritative, but of course it would depend on the compliance of the local landlord class, cooperation which is not forthcoming (According to therealdeal.com the summer before last, only 2.6 percent of retail landlords with vacant space paid the vacancy tax). The SF Business Times reports numbers from some other brokerage.

According to to Cushman & Wakefield’s “San Francisco MarketBeat Reports” (RETAIL Q4 2024, bylined by SOANY GUNAWAN, Senior Research Analyst):

The same report the previous quarter said “The San Francisco retail market’s vacancy rate has been steadily rising and reached another record high at 7.9 percent in the third quarter of 2024.” So presumably when Bloomingdales vacancy gets taken into account in a future quarter, the net absorption will go back into the red, and that will be true regardless of whose numbers and methodology we’re discussing.

No the CBRE has always been available on their site gratis (presumably they want people to use it and give them credit)

As for retail vacancy(-ies): IMHO the number, far more than office – is a phantasy….even Oakland has a rate of only 10 or 20% or whatever, when one can plainly see it’s likely most space. The reason is simply enough: space has to be actively marketed to be considerd “vacant”; so all that acreage in Oakland or SOMA – or increasingly, now, DTSF – that’s emptier than the Bates Motel, but doesn’t have a “for lease” sign on the window, doesn’t get included.

Not sure who is operating this site now. Previously SS used the office vacancy data from CushWake (Cushman Wakefield). I would sometimes question that data saying it was too conservative, the real vacancy numbers for office are higher on CBRE. That kind of comment got deleted by the mods, or countered by mods saying CushWake data is more reliable. Its not worth getting into a pissing match over that. All the commercial real estate brokerage firms acknowledge that there is no standardized data for office vacancy rate.

Retail data is tracked different from office.