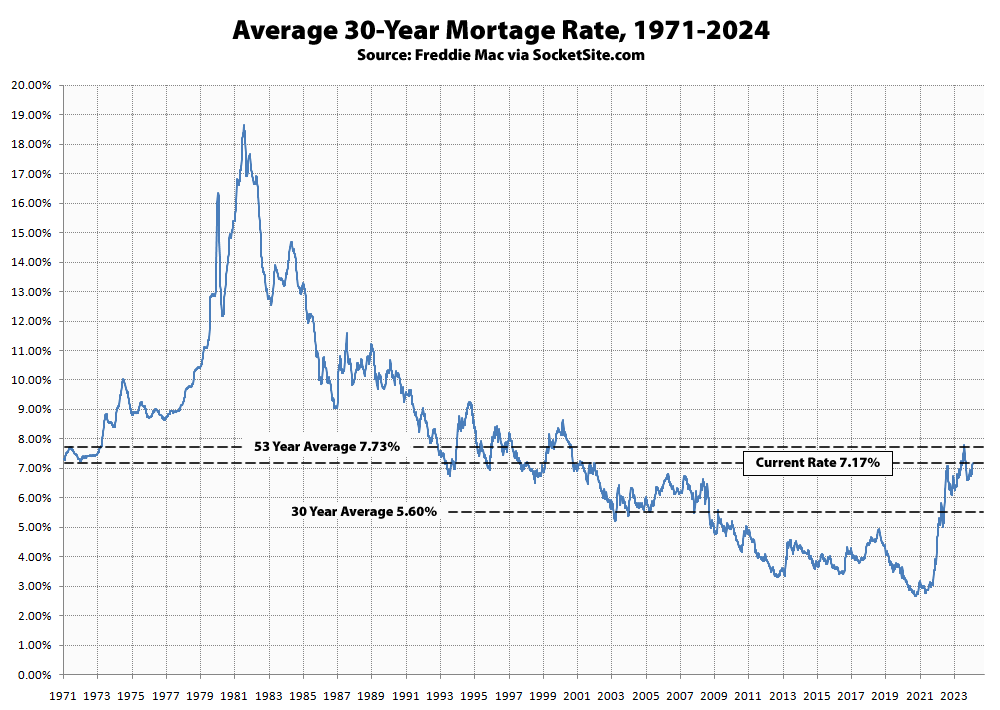

Having leapt back over 7 percent last week, the average rate for a benchmark 30-year mortgage has since ticked up another 7 basis points (0.07 percentage points) to 7.17 percent, which is 74 basis points higher than at the same time last year and over 450 basis points, or 170 percent, higher than its all-time low rate of 2.65 percent in January of 2021 but still 56 basis points below its long-term average of 7.73 percent, with the average rate for a 30-year Jumbo up to 7.45 percent and the expected value of the Fed’s rate cuts over the next eight months having tumbled, as we first outlined over two months ago, none of which should catch any plugged-in readers, other than the most obstinate or easily mislead, by surprise.

At the same time, the number of homes for sale in San Francisco (a.k.a. inventory), which hit a 13-year seasonal high last month, continues to climb, with asking prices and apples-to-apples returns on the decline. We’ll keep you posted and plugged-in.