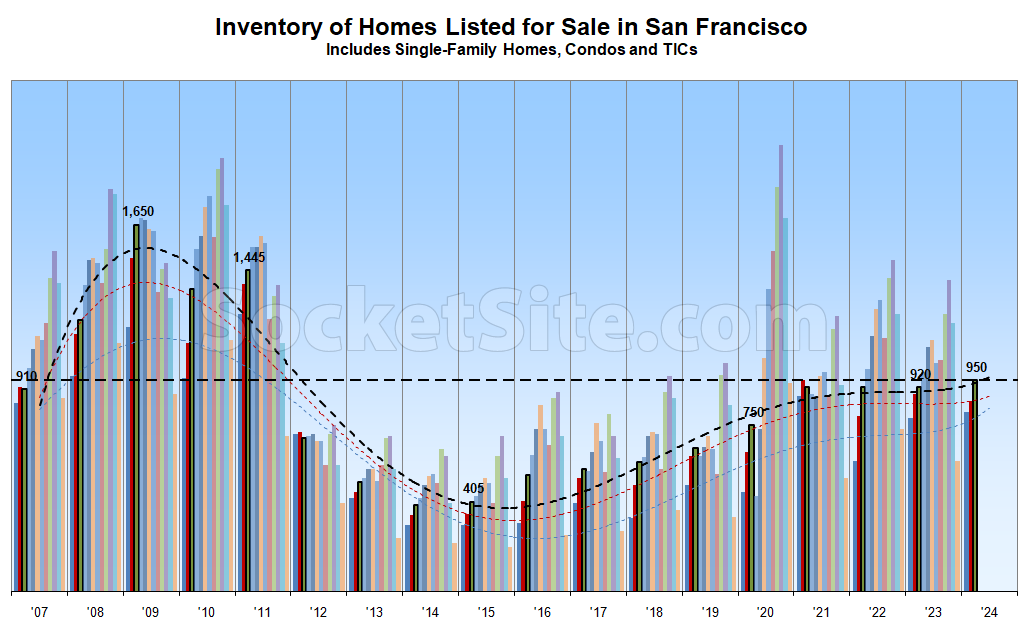

Well, our model was off by a week. But with the net number of single-family homes and condos on the market having ticked up another 3 percent, there are now 4 percent more homes on the market than there were at the same time last year and trending up, marking the first year-over-year increase in the number of homes on the market in 12 months.

And despite continued misreports of “low inventory” levels and related misanalyses elsewhere, listed inventory levels in San Francisco just hit a 13-year high for this time of the year, with 25 percent more inventory on the market than prior to the pandemic, 40 percent more inventory on the market than average for this time of the year, and over twice as many homes on the market than there were in March of 2015.

At the same time, the average asking price per square foot of the homes on the market in San Francisco remains lower than at the same time last year, not higher, and 10 percent below peak, none of which should catch any plugged-in readers, other than the most obstinate, by surprise.

I do get a sense there are fewer transactions as whole this year compared to prior years. Who knows when mortgage rates get down below 5% and if that will encourage more transactions.

Although not directly related to this post, I am curious if Socketsite or its users have any comments on this interesting new court case NAR settlement about the 6% commission for buying/ selling homes. What does it mean for people buying and selling in the future? I was born in Melbourne, now live in SF and always thought the 6% fee (3.5% seller, 2.5% buyer) was WAY to expensive, especially when homes regularly trade in SF for upward of 1 million.

What real estate agents will tell you is that the commission for buying/ selling homes, in California at least, was always subject to negotiation, and therefore no one was ever forcing you to pay 6 percent. That doesn’t mean [an established agent] is going to work on your behalf for 4 percent, however.

Yes, [an agent] submitting or receiving an offer and writing some fluff about whatever house s/he’s flogging is somehow more special than whatever ChatGPT could come up with in nanoseconds so she really earns that extra basis point.

Thankfully the days of real estate agents being personalities is over.

I’m curious if you were ever a buyer of property in Melbourne, John? Because I’m half Aussie and my family has traded quite a bit of real estate (full disclosure I’m a 30 year agent in SF and Reno/Tahoe now), some they did without agents some they did in the auction system and there is no buyer representative. It’s buyer beware and horrific disclosures – I was horrified watching what my cousin went through buying her strata home and she absolutely got shafted by the system there.

Sydney has some of the highest real estate prices in the world so it certainly hasn’t reduced pricing. I was so relieved they have buyer representation here and now….well, be careful what you ask for is all I have to say.

I’ve heard a lot of things but the headlines are also click bait. People always could use an attorney to represent them, they always could pay a single use broker to just put photos on the MLS, and there are plenty of FSBO’s For Sale By Owners (including famously Elon Musk – who ended up using a broker in the end…).

Cheer up, bubbleheads. RE is getting hit even harder in Austin. Clearly, the real estate market in Austin is falling due to the number of homeless people in San Francisco, and not due to following the same policies as SF in encouraging gentrification and speculation that led to overbuilding high-end supply, defenestrating a large number oif locally-rooted working class families, and putting all our economic eggs in one volatile “tech” basket, all facilitated by an unprecedented long run of historically-low interest rates and monetary stimulus. Nope, it’s those tents in SOMA and the Mission that are softening Austin’s real estate market. Ergo, logically, San Francisco’s rekindled romance with the police state should lead to a real estate rebound in Austin, as well as SF, right?

Do you really think that Austin, one of the more rapidly growing cities in the country, and a major educationnal and government center – both the UofT and state capitol are located there – “put all it’s eggs in one basket” ??

You’re right! Austin, while increasingly tech-heavy, is still more diversified economically than SF. SF is waaaay more screwed than Austin…

“put all it’s eggs in one basket” – yes, the inflation was a direct result of QE. We are in the value destruction phase of the business cycle. And American technical competitiveness is being challenged like never before. America still holds the lead in intensive innovation. But where extensive innovation at scale is concerned, the game has shifted elsewhere. Which is to say, how US will retain and exceed previous of levels of productivity is a question worth pondering.

Part of the “Tech Valuation” in the Bay Area is also because of global opportunity for software to replace repetitive and inefficient analog processes. This global opportunity was very carefully curated by our 3-Letter agencies. And even more so, in the Unipolar world – from 1991 thru 2021. That Unipolarity is ending. This ending is a consequence of multiple factors. Predominant among them are Fiscal & Monetary indiscipline and excesses in the West and growth of economies/re-assertion of Geographic destines (China, India, South East Asia, Africa..). As a result, global markets are fragmenting and with that the opportunity for scale is too. Couple of stark examples: Cisco vs Huawei in networking. Apple vs Huawei and others for mobile edge devices, the AI race etc.,

Smart juicers! Meal kits! VR headsets!

Just because digital technology can be thrown at something doesn’t make it a good use of capital. Just because an old technology can be outsourced or digitized, doesn’t make it a sustainable move. Never before has so much capital (in both relative and absolute terms) been thrown at pointless, wasteful, and often socially and environmentally destructive “technology.” Crypto, NFTs, and AI are exciting ways to blow mid-sized industrial nation-level amounts of carbon into the atmosphere.

Let’s talk ride-hailing robot cars. You replace one low-paid livery driver with 1.5 highly-paid tech monitors per vehicle. You replace one owner-provided relatively low-cost vehicle with a company-owned vehicle loaded down with or 6- or 7-figure computers and sensors, backloaded with billions of dollars and years of R&D that need to be recovered by extremely low margin transactions. While that’s great for class war on the lower income classes and for transfering wealth upwards, it doesn’t do anything to help improve the standard of living for the vast majority of people, let alone make the world a more livable place.

Under the ruse of doing everything “smart”(sic), we’ve gutted our industrial base and lost irreplacable technological capabilites. Even our last industrial stronghold – weapons manufacturing – has become a joke (which, from the point of view of brown people in exotic places getting bombs dropped on their heads, is a good thing!).

What you describe as “value destruction” might just be a repeating stage in ongoing social destruction.

Well said, two beers! You next beer is on me!

None of this is surprising. SalesForce is biggest office tenant in most desirable office building in SF, and they have now given back 45% of their office space. Having SF address isn’t as important as it was pre-pandemic.