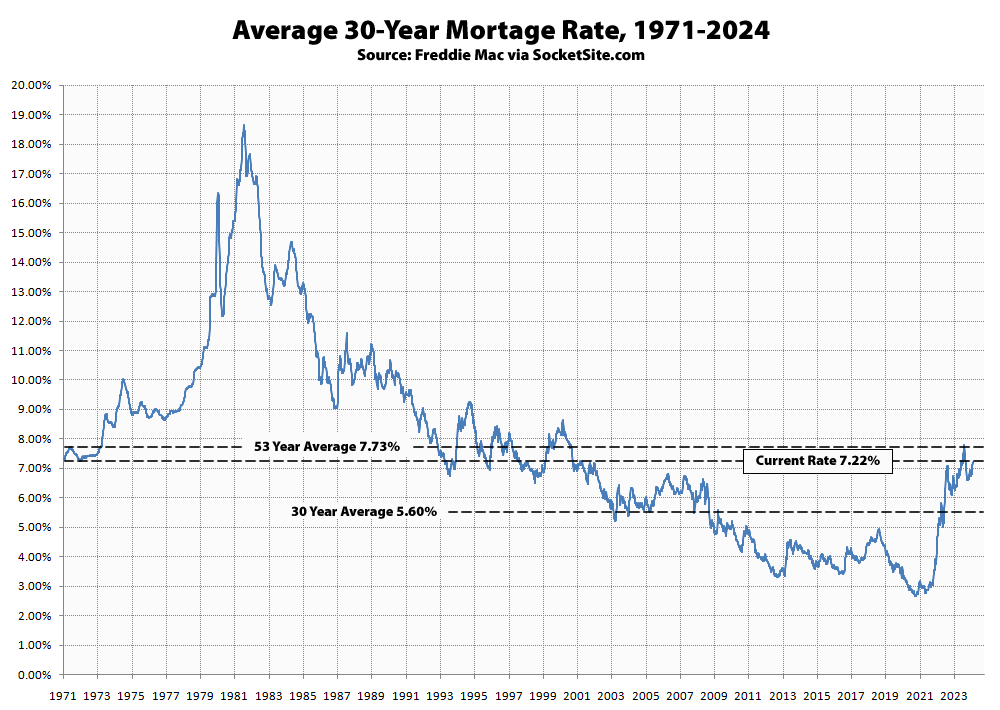

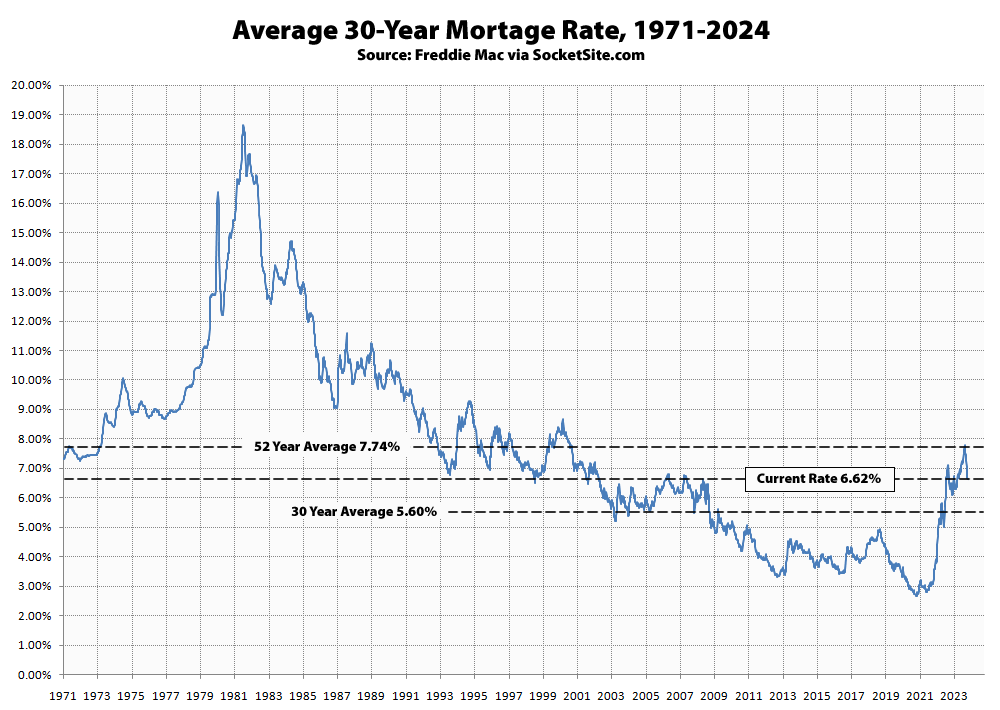

Benchmark Mortgage Rate Ticks Over 7.2 Percent, Poised to Moderate

Measured prior to yesterday’s affirmation from the Fed, the average rate for a benchmark 30-year mortgage had already ticked up another 5 basis points (0.05 percentage points) to 7.22 percent,…