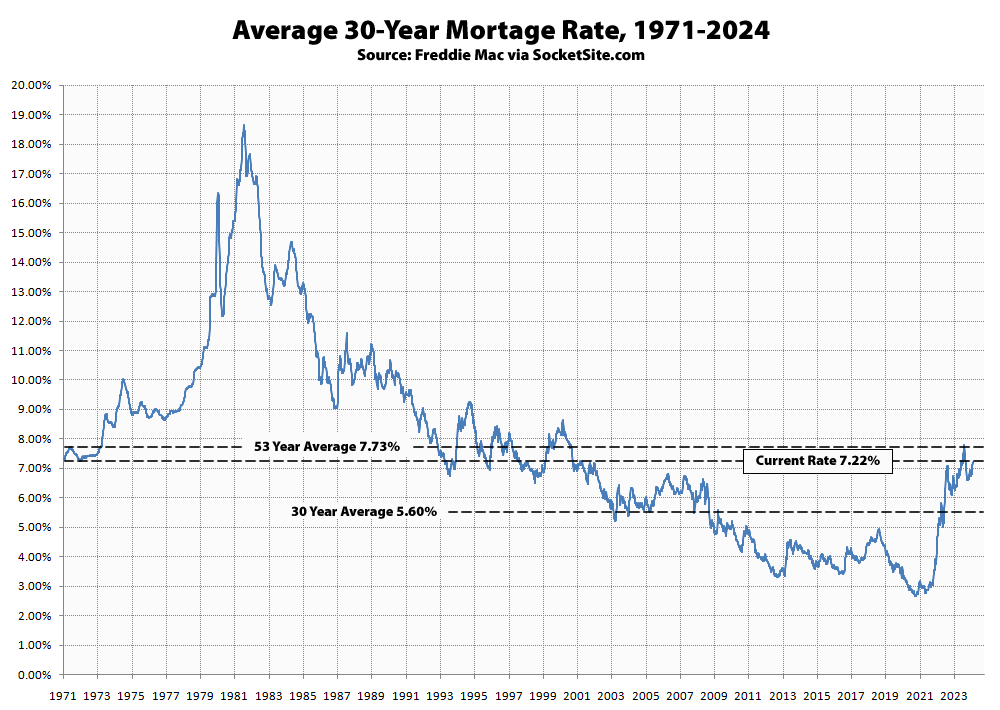

Measured prior to yesterday’s affirmation from the Fed, the average rate for a benchmark 30-year mortgage had already ticked up another 5 basis points (0.05 percentage points) to 7.22 percent, which is 83 basis points higher than at the same time last year and over 450 basis points, or 170 percent, higher than its all-time low rate of 2.65 percent in January of 2021.

That being said, the current average rate is still 51 basis points below its long-term average of 7.73 percent and not “historically high,” with the average rate for a 30-year Jumbo having inched down to 7.39 percent and the yield on the 10-year treasury, which drives 30-year mortgage rates, having inched down a few basis points over the past day. We’ll keep you posted and plugged-in.

UPDATE: As projected, the average rate for a benchmark 30-year mortgage moderated over the past week, ticking down 13 basis points to 7.09 percent, which is 64 basis points below its long-term average of 7.73 percent and not “historically high” but 74 basis points higher than at the same time last year and over 440 basis points, or nearly 170 percent, higher than its all-time low of 2.65 percent in January of 2021.