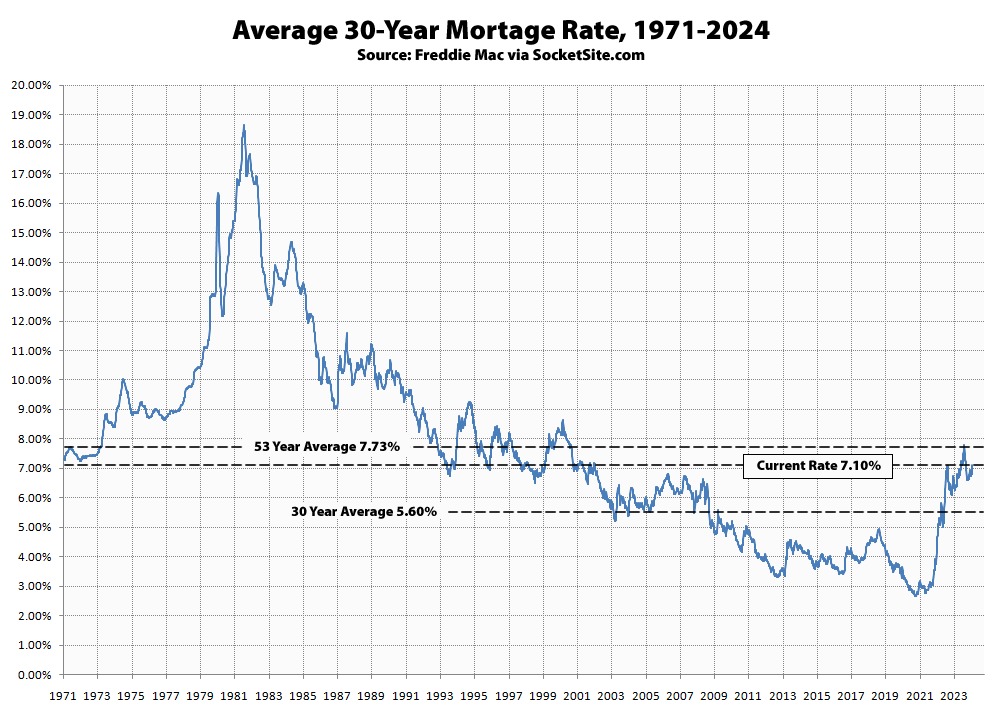

The average rate for a benchmark 30 year mortgage jumped 22 basis points (0.22 percentage points) over the past week to 7.10 percent, which is 71 basis points higher than at the same time last year and 445 basis points, or nearly 170 percent, higher than its all-time low rate of 2.65 percent in January of 2021 but still 63 basis points below its long-term average of 7.73 percent, with the average rate for a 30-year Jumbo having jumped to 7.40 percent and expectations for the Fed’s rate cuts over the next eight months having tanked, as we first outlined over two months ago, none of which should catch any plugged-in readers, other than the most obstinate or easily mislead, by surprise.

At the same time, the number of homes for sale in San Francisco (a.k.a. inventory), which hit a 13-year seasonal high last month, continues to climb, with asking prices and apples-to-apples returns on the decline. Again, none of which should catch any plugged-in readers by surprise. We’ll keep you posted and plugged-in.

This soft “landing” apparently won’t reach the ground any time soon.

UPDATE: Expected Value of Rate Cuts Tumbles, Again