In a move that shouldn’t catch any plugged-in readers by surprise, the probability of a rate cut this quarter, based on movements in the futures market, has dropped to under 20 percent and the total expected value of the Fed’s interest rate cuts this year has now tumbled 40 basis points since the end of 2023.

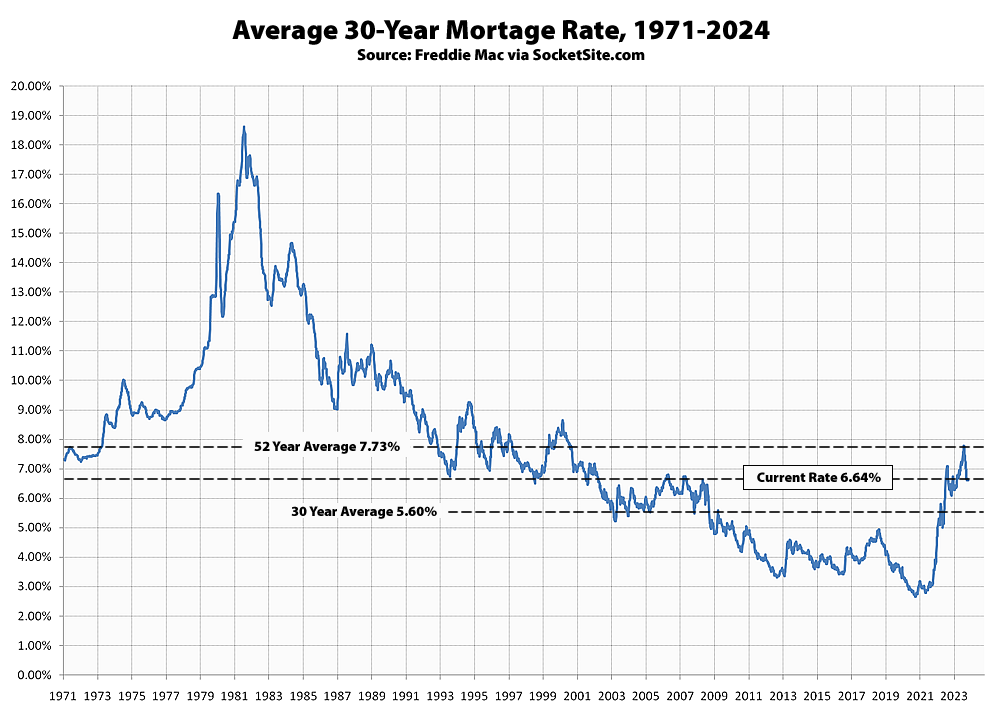

At the same time, the average rate for a benchmark 30-year mortgage inched up a basis point (0.01 percentage points) over the past week to 6.64 percent, which is over a full percentage point below its long-term average 7.73 percent, with mid-six percent rates suddenly being normalized as “stable” (rather than mischaracterized as “historically high and certain to drop back into the fours,” as they were by many last year).

UPDATE: Benchmark Mortgage Rate Ticks Up to 6.77 Percent