As we outlined last week, prior to a market shock that appears to have caught some by surprise, the expected value of the Fed’s interest rate cuts this year was tumbling and has now dropped 50 basis points over the past two weeks alone.

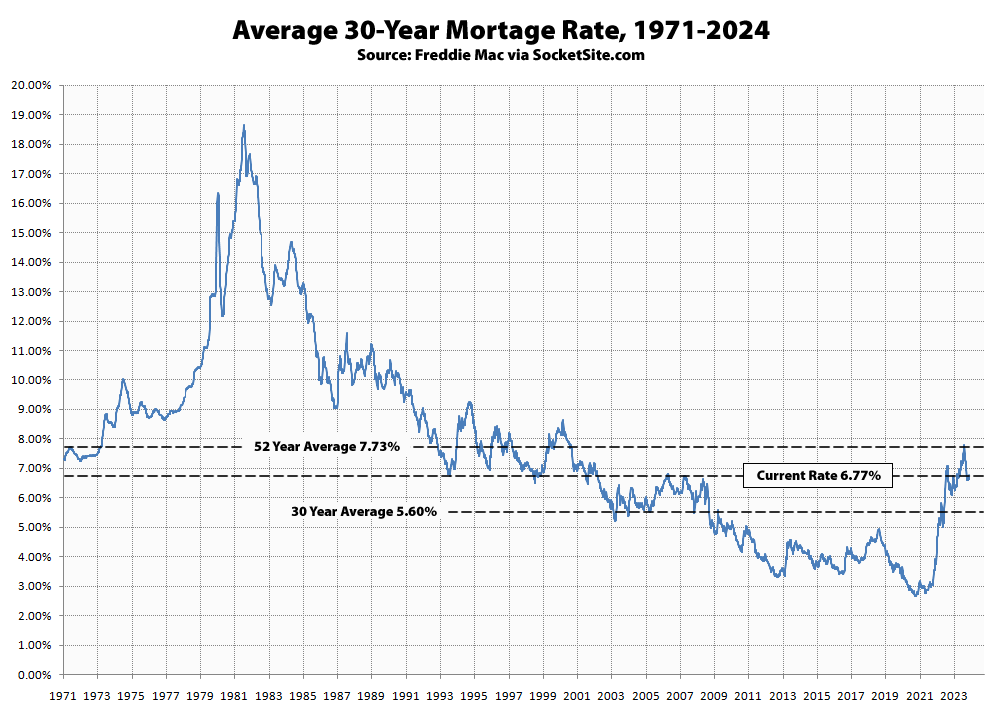

And having been dangerously mischaracterized as “historically high and certain to drop back into the fours” by others over the past two years, the average rate for a benchmark 30-year mortgage ticked up another 13 basis points (0.13 percentage points) over the past week to 6.77 percent, which is 45 basis points higher than at the same time last year but 96 basis points lower than its long-term average 7.73 percent, with mid-six percent rates suddenly being normalized and continuing to put downward pressure on both sales and property values, none of which should catch any plugged-in readers, other than the most obstinate, by surprise.