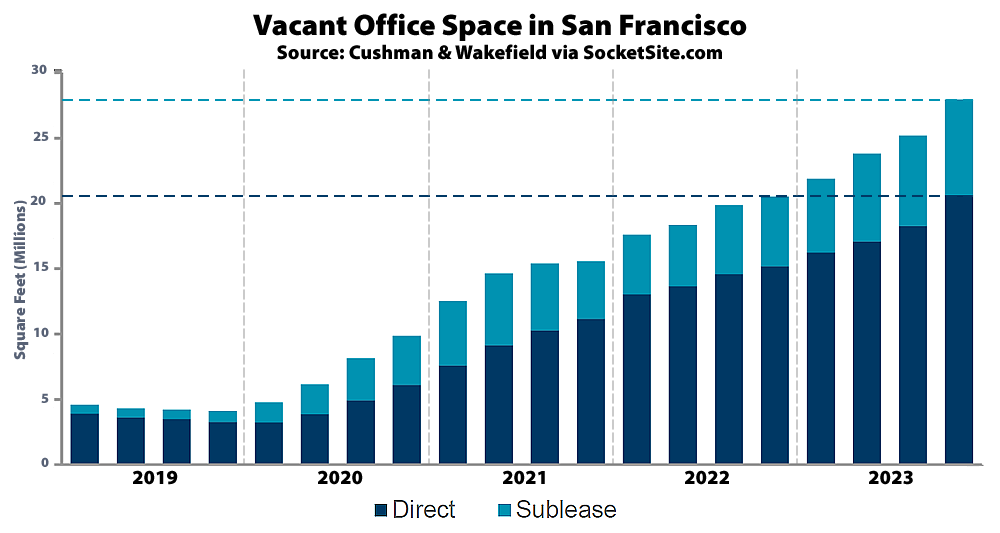

As we noted this past October, at which point there was “only” 26 million square feet of vacant space spread across San Francisco, there was “another 2 million square feet of leased, revenue producing space slated to come off lease” by the end of 2023, despite the over-hyped “AI Boom!”

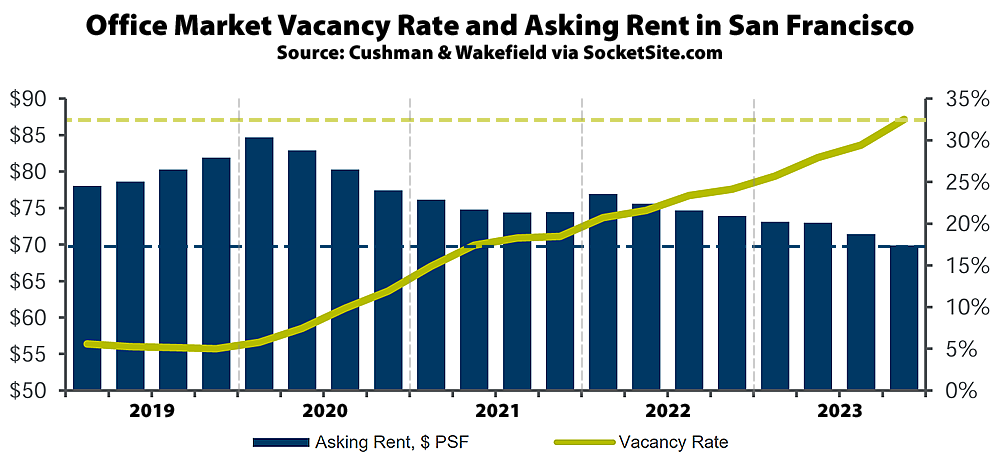

And in fact, the office vacancy rate in San Francisco ticked over 32 percent at the end of 2023, representing nearly 28 million square feet of vacant office space, with 20.6 million square feet of un-leased and non-revenue producing space, which is up from 15.2 million square feet of non-revenue producing space at the end of 2022, and over 7 million square feet of space which is technically leased but unused and being offered for sublet, according to data from Cushman & Wakefield.

For context, there was less than 5 million square feet of vacant office space in San Francisco prior to the pandemic and the office vacancy rate in San Francisco has averaged closer to 12 percent over the long term, with a much smaller base of buildings.

While gross leasing activity did increase from 1.3 million square feet in the third quarter of 2023 to 1.7 million square feet of space in the fourth, said activity was driven by renewals versus new demand and the estimated active demand for office space in San Francisco dropped by over 5 percent to a total of 5 million square feet, compared to over 7 million square feet of active demand in the market prior to the pandemic, at which point there was over 80 percent less vacant space as today. In other words, there’s nearly 6x more supply than demand.

At the same time, the average asking rent for office space in San Francisco only ticked down another percent in the fourth quarter of 2023 to $69.87 per square foot, which is only 5.1 percent lower than at the end of 2022 and roughly 16 percent below its 2020-era peak, with landlords’ still fighting, or obligated, to keep asking rents up and another shoe still poised to drop.

As we’ve outlined for over a year and others have finally started to figure out, “while it’s tempting to see, promote or editorialize an opportunity to convert all the vacant office space in San Francisco into housing, the conversion of existing office space to residential use still makes absolutely no economic sense for the vast majority of San Francisco buildings, due to the relative value of each use and the costs of conversion.”

And yes, there are higher vacancy rate numbers still making the rounds, but it’s the consistency of the data set and context going back over a couple of decades, as our numbers do, that matters, with an escalation of poor reporting and cross analysis between data sets in the press and splattered across X.

What is the average sale price / appraisal price for A quality office buildings over the past 5 years?

It seems like $1k psf down to $350psf is about right.

What’s interesting – and it’s hard to find interest when something like 1583 of 1605 (or whatever) words are exactly the same as they’ve been every quarter for years – is that it looks like the increase in the vacancy rate is actually accelerating (’23vs’23:+5M vs +2.5M)

Yelp wants to know if it’s not too late to add another 18,000 sq ft to the data set, and bezos, faceborg, and goggle all want to get in on the action with their latest layoffs, too.

Certainly not to find fault with the contention, strongly maintained here on SS, that office conversion is NOT a plausible “solution”, but might I then ask where the errors are, in the premises and/or conclusions, from [SPUR’s report at the end of last year]?

I ask for my own education purposes. Mainly, I might have thought that the article’s authors *should* have a decent grasp on the factors involved, and were citing some pretty legit data sources — unless, that is, they’re “too close” to the situation to see why conversion couldn’t work. I also noted they did not expressly say why incentivized conversion seemed to work in NYC (which they appear to be hinting), but why it wouldn’t (necessarily) in SF.

It’s time to put a moratorium on building permits for any new office space.

Doesn’t – or rather hasn’t – the “market” take(n) care of that?? How much office space is being built right now?

It’s not just a matter of brand new construction. Consider a post from this very site, almost a year ago but well into the period when it was obvious to even the most casual observer that S.F. had a surplus of office space: Market Street Conversion on the Boards!:

Sure, that’s just one example, and you might argue that those plans won’t actually come to fruition in terms of proceeding with construction this year. The point is that not all developers have heeded “the market’s” message.

That is the wrong approach. Companies are right sizing and buying places that fit their needs and then outfitting them as they prefer. Playing games with permits will only make things worse for those who are actually trying to move forward in this environment. Old buildings that have lost their value will be repurposed or taken down as always.

AI Boom will use AI to avoid spending on office space. First software ate the world. Now, AI will eat software.

It’s worth mentioning here that the Book Concern Building at 83 McAllister St we were discussing here last week was converted from office space in 2007. Sure, that’s just one building (add it to our running list).

The reason that it’s worth mentioning in this thread is that the repeated refrain of “the conversion of existing office space to residential use still makes absolutely no economic sense for the vast majority of San Francisco buildings” is likely to get translated by the already reticent local developer community into “the conversion of existing office space to residential use makes no economic sense for any San Francisco buildings” and used as political rhetoric to avoid going to work on the buildings where it does make “economic sense”. So, given the state’s goal to force The City to build 82,000 housing units over the next seven years, that would be a harmful narrative to take hold, even if the editor here would get a lot of gratification (“others have finally started to figure out”) from hearing others parrot it with a similar frequency.

According to the research report that SPUR put out with ULI San Francisco in partnership with Gensler and HR&A Advisors, From Workspace to Homebase: Exploring the viability of office-to-residential conversion in San Francisco’s changing real estate market (released Oct 2023), about one-third of the vacant office space is in Class B and C buildings, which they say are less competitive for office tenants than Class A buildings as vacancies rise. The City can and should be encouraging the conversion of the bottom tier Class B and C buildings — buildings like 25 Taylor St — that are vacant to residential use even if that isn’t a silver bullet solution for “the vast majority of buildings.”

Brahma / Gang,

There’s an even more recent SPUR report on the very topic (Dec., 2023), to which I had tried to post a link, but was probably in violation of SS policy. (My bad, no finger-pointing.) The newer one also specifically distinguishes between the Class A vs. Class B/C feasibility / economics / “penciling” etc.

One thing I couldn’t quite grasp from the Dec. report was an statement regarding conversion success in NYC, which left this reader hanging on the (unmade?) conclusion: why is it that whatever “worked” in NYC would not work in SF. Awaiting analysis by sharper minds…

I haven’t seen the December version you’re referring to, but in the report that was released in The Fall, it was pretty obvious.

Simply put: New York was able to put into place a few well-designed “property tax abatements” to get conversions subsidized and thus incentivize private sector developers to proceed with them.

That kind of thing isn’t within the realm of possibility in San Francisco because of the third rail of California politics. To change it, you’d need voters statewide to approve a ballot initiative with a supermajority vote.

Brahma,

Thank you. I was curious, and it was beyond my ability to pick up on my own.

Not just working in NYC. Also being encouraged by local governments in Los Angeles, Chicago, and Dallas. Canada, too (name link). San Francisco government seems to be slow off the line on this one.

36% office vacancy is only one part of the doom loop for San Francisco.

The “other shoe” IMO, to quote the SF Standard: San Francisco Commercial Property Owners Have Billions in Debt Coming Due. What’s Next?” ..”San Francisco has the fourth-highest number of commercial loans—18—up for refinancing this year among major U.S. cities, according to Bloomberg data.” Those are commercial mortgage backed security debt, (CBMS) loans tied to vacant office buildings. Saying Its difficult to recast a CMBS loan without revenue generating tenants is a understatement.

Then there is this from Well Fargo CFO Mike Santomassimo regarding the FED’s QE plans: “…the San Francisco bank isn’t holding out much hope that the prospect of lower interest rates this year will provide much relief to troubled commercial mortgage borrowers. (CMBS)” “We’re dealing with what is a structural change in the demand for real estate in some parts of the country, so you’ve got to work through that,” Santomassimo said. “On the margin, lower rates are helpful, but the bigger issue needs to get worked through first.”

Which make me wonder how many of the 18 CMBS debt secured buildings will go south by the end of the year. Maybe then the conversion from office building to residential will begin make economic sense.

Or as we outlined over 8 months ago: As Office Vacancy Rate Climbs, Another Shoe Is Poised to Drop.

The “Convert to residential” argument has some serious problems, aside from fire code, cost etc:

Even if by some miracle you can go through the huge process and costs of converting commercial to residential, you still would choose not too. Why? Because condos have dropped 30% easily in some areas and people still don’t want them!

How can you make the numbers work when condos are 2014 prices and people still don’t want them?

Not to mention, if you keep adding more condos to the market it will make your numbers make less sense.

Because there is still demand for housing; people just want it at a price that is affordable. And for too long over the past twenty-five plus years, housing has only been made available to those in the top parts of the wealth distribution, and those who move here from elsewhere (in many cases foreign countries) to take jobs at tech companies and wind up overpaying for housing due to asymmetric information. Even if we concede that condos have dropped 30 percent in some areas of San Francisco, there is still demand that will make the market clear once the price level declines sufficiently.

But for a vacant office building? I would argue that the value is negative, because an empty office building still must be maintained and kept secure while unoccupied. They are almost always leveraged up to the gills, so ongoing mortgage payments must be made against the property.

After the so-called 2008 financial crisis 140 New Montgomery, just to take one example that comes to mind immediately, sat empty for nearly six years. And this time, the office space market isn’t going to come back because WFH has permanently destroyed a substantial amount of demand.

There may be demand, but the numbers don’t pencil out when it come cost to build and risk of selling them. SF is too expensive. e.g. We built a home in Atherton and one in the sunset. (The permit fees alone in SF was $33k, in atherton, a home worth 3 times more cost $3k.) Atherton per sq ft is double the value to sell than SF, why would I ever want to invest in SF?

Builders have stopped building condos altogether since they’re in freefall. (and they don’t have to pay for retrofitting)

Nobody wants to build condos with these numbers, let alone retrofitting them.

Multiple other local news outlets are reporting that infamous local flipper and building industry impresario Angus McCarthy has submitted preliminary documents City Planning to demolish the 116-year old building at 1088 Sansome St that was formerly a PDR building that was converted to office space in 2016. He wants to replace it with a 17-story building with 112 dwelling units and about 15,000 ft.² of retail on the ground floor.

Of course, submitting a proposal is cheap, we’ll have to see if he follows through. But if it were obvious that condos “don’t pencil out when it come cost to build and risk of selling them”, he wouldn’t even have gone that far.

That’s incorrect (re: “…if it were obvious that condos “don’t pencil out when it come cost to build and risk of selling them”, he wouldn’t even have gone that far”). As we outlined last month:

“With values dropping, the cost of capital having jumped, sales down, and developers getting squeezed or even foreclosed upon, the number of net new units of housing under construction across San Francisco has dropped to around 5,000, representing the fewest units of housing under construction in the city in nearly a decade.

That being said, there are still over 70,000 units of housing in various stages of development…including fully approved and permitted plans for 5,000 units of housing which have yet to break ground; another 12,000 units of housing which have been approved by Planning and applications to secure building permits have been filed; and over 33,000 units of housing which have already been approved by Planning but for which the permitting process has yet to be initiated.

In addition, plans for another 14,000 units have been drafted and proposed, representing over 60 percent more newly proposed units than there were at the same time last year, over 10 percent more newly proposed units than average over the past decade, and over twice as many newly proposed units in the pipeline than there were in early 2012.”

The chief difference between the aggregates that the editor is repeating and the proposal from Mr. McCarthy is that the latter is extremely recent, and was submitted well into the stage when it was abundantly clear that — to use ‘thattechguy’ phrasing — condo prices were in free fall.

It’s not at all clear that those “70,000 units of housing in various stages of development” haven’t been in that state for years, and some for decades. But I’d be willing to read about the average and median number of months those units of housing have been in the pipeline if the editor wants to share them.

In the absence of hard data, I’d be willing to guess the overwhelming majority of those projects were proposed before the pandemic, and that includes the bulk of the “around 5,000 net new units of housing under construction”.

That’s right, it takes time for a project to go from proposed, to entitled, to built and marketed – from “years [to] decades,” in fact. Which is exactly why the overhyped import of the “extremely recent” proposal for entitling the future redevelopment of 1088 Sansome is relatively meaningless, at least in terms of trying to counter the fact that “the conversion of existing office space to residential use still makes absolutely no economic sense for the vast majority of San Francisco buildings, due to the relative value of each use and the costs of conversion,” as we first wrote over a year ago. But it is a great time to try to ride the political wave and entitle projects that otherwise might not fly, particularly ones with low cost bases that can be banked.

At the same time, construction is slowing and the pipeline of already entitled projects is growing, which speaks directly to the state of the market and projected economics, at least currently and in the near-term. Which brings us back to the data and trends at hand…

You’re failing to make your point, SocketSite. There may be 70k units in development in various stages, but most are on hold or just on paper. The 70k in the pipe additionally scares away developers.

Show me the development costs of retrofitting a major downtown building and what you *think* you can get for each unit and show me the profit. I certainly can, because we have 6 projects currently ongoing. Show me the real costs and profits – not some public data you pull.

Regular folks just don’t have the on the ground numbers and and scream “convert to affordable housing!” SF reminds me of teenagers with all the right ideology but no way to execute and lacking all the actual knowledge.

Just to be clear, SocketSite isn’t attempting to say that there are 70k units in development that are retrofits of major downtown buildings. Or trying to say that retrofits of major downtown buildings are viable at current selling prices of completed units. Quite the opposite, in fact.

Regarding the Angus McCarthy-proposed project at 1088 Sansome St. I brought up earlier in this thread, it looks like the project is not, in fact, moving forward toward breaking ground.

The Chronicle’s Laura Waxmann had a piece datelined Oct 17th (“Controversial Telegraph Hill housing tower backed by S.F. billionaire is dead”) saying that “the preliminary application filed in January for the tower was automatically canceled because the developer did not submit a full application within the required 180-day timeframe”. Planning Chief of Staff Dan Sider had not heard from the project team about why they missed the deadline and said team did not respond to messages from The Chronicle’s Real Estate reporter seeking comment. So it appears that thus far, all of the legislation enacted recently to entice developers into converting office space isn’t having much of an effect on actual conversions.

Good points. I can’t say this with authority, but I suspect that condo buyers as a group are more likely to be single, elderly, or pied-a-terre owners. In comparison to single family or 1-2 unit apartments, marriage, job changes, and aging make the market more volatile, and less influenced by sentimental attachment to a building, neighborhood, or city.

This type of housing is both necessary and desirable, but the segment is a volatile, thin reed on which to base a large, long term investment. Some pre WW II office buildings might lend themselves to conversion, but modern skyscrapers don’t. They’d be great for mini storage, however, with no shortage of demand in SF. There’d have to be a major price reset for the buildings, but that’s likely to happen anyway.

“I suspect that condo buyers as a group are more likely to be single, elderly, or pied-a-terre owners.”

What about non-organic demand? This broad category includes speculators, REITs, private equity, mom ‘n pop landlords, flippers, foreign capital flight, and short-term rental maggots. Layoffs and the move to full or partial work-from-home is only one aspect of the collapse in demand. If, as real estate wonks tell us, real estate prices “move at the margin,” the “margin” has become a massive and growing sinkhole.

The data suggests that (even in real estate) when demand drops and supply remains constant, prices fall.

Responding to Californio.

San Francisco Business Times (The CMBS debt wave)….”Nearly $40 billion worth of commercial mortgage-backed securities loans tied to Bay Area real estate is set to come due over the next 18 months.”

“Those loans are only a portion of the commercial-mortgage debt weighing on the market, since they don’t include direct bank loans. But they suggest that a large group of owners across a range of property types may soon be forced to make difficult decisions about the future of their portfolios.”

San Francisco sees job losses in December 2023. Numbers of homes on the market continues to rise. Homes on the market continue to see price reductions.

On a long enough timeline the survival rate for real estate drops to zero.

“On a long enough timeline the survival rate for real estate drops to zero.”

What is that supposed to mean?? On a long-enough timeline, the survival rate all of us commenting here drops to zero. San Francisco has been through two major earthquakes a dot-com collapse and now the rise of remote/hybrid work. Unless you are writing off major cities/cultural centers, San Francisco will likely be an important place for any relevant timeline. But it might be somewhat less expensive. It also might not be less expensive.

Technology has a big effect on the value of real estate here. This most recent episode shows that humans, even supposed geniuses, are not very good at predicting where technology will take us.

The crime situation isn’t great but is unlikely to persist.

It’s a quote from the 1999 movie Fight Club (and presumably the book by Chuck Palahniuk). I think you understand it.

UPDATE: Office Vacancy Rate in San Francisco Hits a New High, Leasing Drops

Did SF mayor breed get herself fired??

If you think that having someone with no previous public sector experience as a manager or an elected official in office as Mayor is going to meaningfully improve the value trajectory of downtown CRE and the knock-on effects from not having as many people commuting in to downtown offices every day on The City’s budget situation over the next four-years, I am pretty sure you are going to be disappointed. That is outside of The Mayor’s control. Remote work is here to stay, and begging or cajoling corporate execs to impose return-to-office mandates isn’t going to work to restore things to pre-pandemic levels anywhere except in the fever dreams of local folks whose livelihoods revolve around the commercial real estate “game”.

OTH – or is it “furthermore”…well, whatever… – I understand SF’s expected Federal money to complete the Downtown Extension for Caltrain just got repurposed as footing for the Border Wall (perhaps they’ll be allowed to pick which segment they want, but I wouldn’t count on it)

That’s not surprising and it’s probably just an opener. The City Controller’s Office put out a report fairly recently that said at least $400 million of San Francisco’s annual budget comes from the federal government. Maybe the new President will feel class affinity for the new Mayor and go easy on the fiscal retribution.

More apropos to the subject of this thread, future reality-based economists will have a great time in the future publishing papers showing how S.F.’s real estate market disproves that markets are self-correcting and that private sector actors left to their own devices will produce desirable outcomes.

With well over 21 Salesforce Towers worth of empty office space spread across San Francisco, there was a hearing scheduled for the Board of Supervisors last week to approve a proposal from Candlestick’s redevelopment lead FivePoint asking for permission to move forward with a new plan, one that would