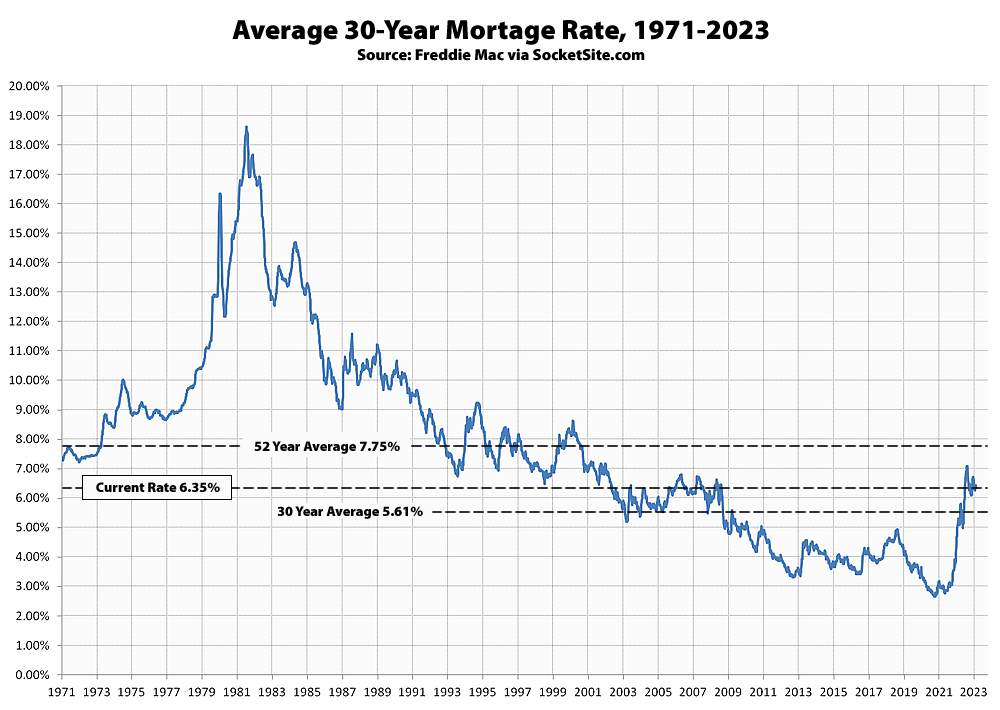

As projected, the average rate for a benchmark 30-year mortgage inched down another 4 basis points (0.04 percentage point) over the past week to 6.35 percent but remains 20 percent (105 basis points) higher than at the same time last year, with significantly tighter lending standards and the average jumbo-conforming spread having dropped.

At the same time, the probability of an easing by the fed has slipped and the odds of another rate hike, which had been hovering around nil, has ticked up to over 10 percent. We’ll keep you posted and plugged-in.

SF biggest residential landlord Veritas facing $1B in mortgage defaults now.

No one other than the odd gentrification cheerleader should have any sympathy for Veritas Investments. Their “business model” has been pretty flawed for a while now and it’s been clear it only looked reasonable because they purchased many of their buildings at a discount in the immediate aftermath of the 2008 financial crisis.

The buildings won’t go away; they’ll end up with folks with stronger hands at lower valuations and note holders will probably take haircuts. The city-mandated soft-story retrofit at their building in the Mission District that Veritas has been avoiding might even get started in the near future if there is a change in ownership.

It’s probably too much to hope that some of the principals at Veritas Investments signed personal guarantees for some of these loans so they can have their lifestyle(s) negatively impacted.

With rents holding steady, why would they face default?

They don’t say explicitly, but my read is that they’re over leveraged.

Interest rates have risen since the buildings involved were last financed, and they aren’t getting the residential rent increases necessary to make replacement loans work. From The Chronicle’s story earlier this week, sixth ‘graph:

Emphasis mine. Perhaps rents have been declining in the buildings that Veritas owns more than the market average. But I still think that they are just over leveraged.

Their business model of financing improvements in rent-controlled buildings and then using those capital improvements to pass on rent increases as a back door way to force out long-tenured tenants and raise the rent on existing units backfired, and now they have to pay the piper.

As Warren Buffet famously said, “Only when the tide goes out do you learn who has been swimming naked.”

Variable rate mortgage terms, and rising interest rates most likely. But CA residential landlords also took huge hit during pandemic when they weren’t allowed to evict deadbeat tenants.

Apropos commercial mortgages, Portola Valley-based investor Pollock Financial Group, which has been in arrears on the four-story 62,300 ft.² office building at 340 Bryant St. in South of Market, will soon hand its keys back to the lender, according to multiple local real estate media outlets. The current balance is $30.3 million and the loans have been delinquent for more than 90 days.

WeWork once leased space at the site but moved out and didn’t pay rent for all of 2021, according to the report to bondholders. Logitech occupies 14,597 ft.² with a lease set to expire in April.

340 Bryant was one of those conversions from light industrial to office that never should have happened. It doesn’t have enough parking to support the office workers, and nobody wants roof deck next to freeway. OTH if it had remained as light industrial facility it would have blown up in value during pandemic lock down. Now the building is awkward class “B” office space that has lost all its original industrial characteristics. Maybe demo and rebuild as biotech lab space?

I agree with all of this. Even if the financing was available, converting to residential use so close to the freeway would be a bad idea.

Whoever ends up with the building is going to try for a higher-revenue use, and biotech lab space is pretty much the only viable option there, assuming that the lab space takes up enough floor area to reduce the amount remaining available to workers such that the parking available becomes adequate for them. Whether or not they actually get a tenant at a profitable lease rate will remain a question mark.