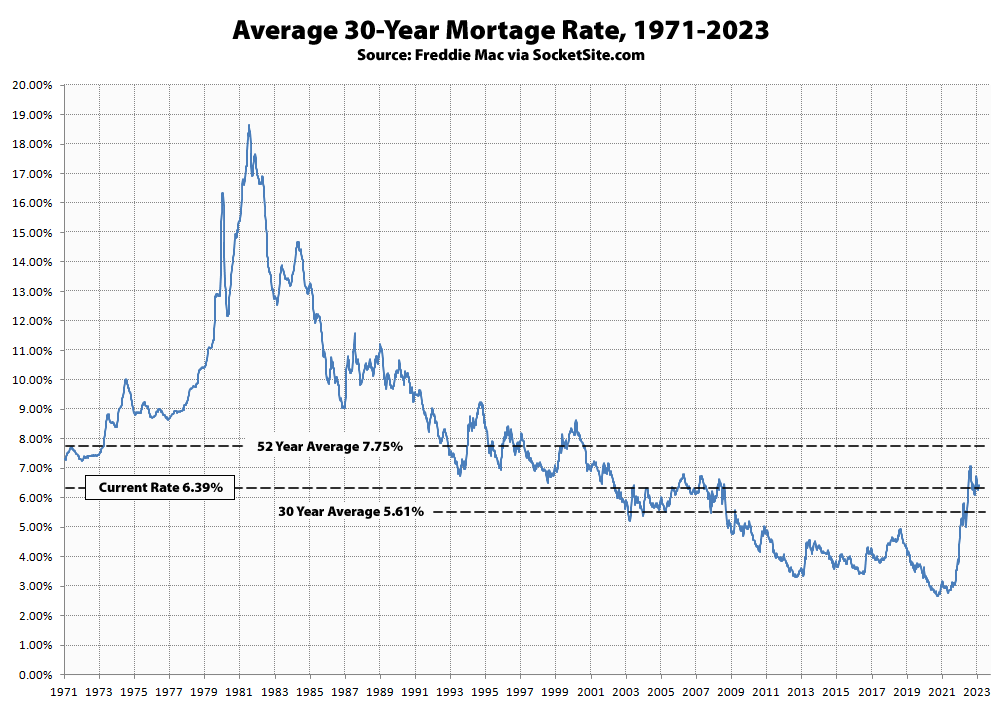

Measured prior to yesterday’s quarter point hike by the fed, the average rate for a benchmark 30-year mortgage had inched back down 4 basis points (0.04 percentage point) over the past week to 6.39 percent, offsetting the 4 basis point rise the week prior.

As such, the average 30-year rate was 112 basis points, or 21 percent, higher than at the same time last year over the past week and 374 basis points, or over 140 percent, higher than its all-time low of 2.65 percent in early 2021, but still 136 basis points below its long-term average of 7.75 percent.

And with yesterday’s hike having been projected and effectively priced-in, and the fed hinting that they’re done hiking rates, the yield on the 10-year treasury has since dropped around 20 basis points, which should translated into slightly lower mortgage rates over the next week as well, but with a muted impact on jumbo rates, as banks continue to tighten lending standards and narrow the average spread between jumbo and conforming loans, and the possibility of an easing by the fed now projected to be at least a few months away.

Banking Crisis Incoming. Big Credit Squeeze ahead.

Slowly .. then suddenly.

The good news is that our biggest problem is an inflationary spiral, an economy running too hot.

Credit squeezes and the commercial real estate distress we are observing are hugely deflationary as is the regional bank crisis. This should accelerate the stall-out of the economy and put the Fed back in a position to cut rates.

Save your pennies and buy stuff cheap.

Given the rate at which SF downtown is being deserted by businesses and people alike – I am not sure front running the Fed this time is going to be possible in the near term (1-2 years).

SFBT: 350 California sold for $60 million to $67.5 million — 75% below the $250 million sought when the building hit the market in 2020.

And they still overpaid

Cue up the violin music! If the owners thought they could get anywhere near $250 million, then they should have sold in 2020.

Nowadays interest rates are much higher, credit availability has contracted and all office buildings are worth less even if white collar workers were streaming into downtown five days a week. Which they aren’t.

SF Gate says it sold to SKS Partners, developers of 181 Fremont and others (per their website). I think this is great news for the city. The building going to an experienced firm. I would stand by my wild guess that if they pay 65mm for the building and another 85-100mm in rehab, they’ve got a basis of 150-170mm on 297k sf of $600ish per foot for rehabbed office in a Class A location.

I don’t think anything close could be built so inexpensively (though I am admittedly no expert in this space).

As re the urban doom loop, this too shall pass.

SFBT: In yet another major blow to downtown San Francisco’s retail scene, Coco Republic announced it’s pulling out of its massive 53,000-square-foot flagship bet at 55 Stockton St. less than seven months after it opened.