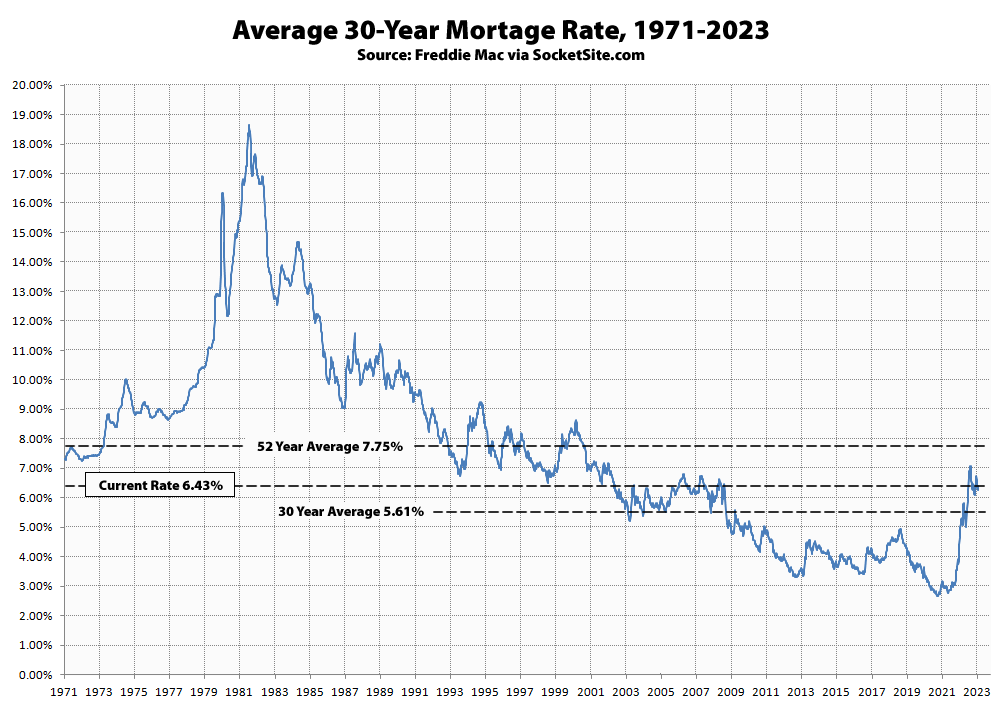

The average rate for a benchmark 30-year mortgage inched up another 4 basis points (0.04 percentage point) over the past week to 6.43 percent, continuing a trend that shouldn’t catch any plugged-in readers, other than the most obstinate, by surprise.

As such, the average 30-year rate is 133 basis points, or 26 percent, higher than at the same time last year and 378 basis points, or over 140 percent, higher than its all-time low of 2.65 percent in early 2021 but 132 basis points below its long-term average of 7.75 percent.

At the same time, the odds of an easing by the Fed over the next quarter are have dropped to under 3 percent, with the probability of another quarter point hike over 70 percent.

Commercial RE going up in flames

350 California up for Sale

Thanks for sharing that link. Interesting reading. The authors kinda imply that 350 California is, or that the new owners will want it to be, a “top-quality building”, but the listing indicates that the building class is “B”.

Anyway, if it fails to trade, maybe the lender that gets it back will have to mark their loss to market.

I’m guessing that’s a typo: it’s (only) from 1976, and if age alone is the criteria, then surely most of DSF is class B…which of course it isn’t.

Also Union Bank is being acquired by USBank, which may explain why it’s up for sale in the first place.(And yes, another HQ going away)

Yes, probably a mistake. 350 California was a SOM building, designed by Chuck Bassett for the Bank of Tokyo. Composed of a favorite SOM material at the time, precast concrete panels incorporating crushed white granite. It replaced the Alaska Commercial Bank and some token bits of ornament (a row of Walrus heads) were incorporated as mitigation for the lost of the historical structure. The lobby was recently remodeled to accommodate the Union Bank of California’s teller operations, a significant, almost comic, downscaling from its grand office across the street. / Interesting fact from the WSJ article: that it costs $25 per square foot just to heat and light a big office building.

FYI, this specific building’s status was raised here three days ago by soccermom. From the article pointed to above by cave dwller, 22nd ‘graph:

Emphasis mine.

If the owner doesn’t have any debt attached, as soccer mom suggested, then I don’t why see the property will actually trade at a fire sale price. Why would they sell when they can just wait out the downturn?

Why would they sell when they can just wait out the downturn? (emphasis mine)

For the first part: (see above) … this may be unrelated to market conditions; for the second part: what if – just “if” – this in’t a downturn – which implies a (timely) recovery – but rather a long decline ??

In Brahma’s world they don’t have insurance, taxes, maintenance, market risk or any of that stuff, you just sit around and wait for the market to save you. Also there are unicorns.

Good use of sarcasm with that. As far as taxes, it’s not unusual for landlords to ask for revisions to their tax bills in an economic downturn, as the implied value of their buildings get re-rated.

I think it’ll be interesting to see what happens to the office building at 25 Taylor St. as well as this one. After WeWork moved out, the building was and reportedly still is 97 percent vacant and also up for sale. Local media outlets are reporting that they have defaulted on their 2021 property tax bill for it.

Who knows, maybe a unicorn will come out of the enchanted forest, fall in love with the “creative finishes with exposed brick and beam ceilings” and conjure up the money to purchase it.

I suggest 297,642 sf * $250psf = $74mm and change purchase price.

Spend $50mm to make the building sexy inside = $74mm + 50mm = $124mm after repair value

5.5% cap on rehabbed nice office space in DTSF $124mm total cost = $6.82mm per year in NOI

Assume (I dunno) op ex at 25% of rents = @8.5mm of gross rents

$8,500,000 annual rent / 297ksf = $28psf per year in rent is all you would need to charge.

This seems very cheap.

I will adjust my guess to a sale price of $100mm.

Looking back at real estate prices from 2010 it seems incomprehensible that properties ever traded so cheap.

Or wait, maybe THIS TIME IS DIFFERENT?!?!?!?!?!?

What are the implications for residential & secondary/shadow commercial real estate (Airbnb etc.,)? I have my thoughts – but maybe I don’t know much .. would like to read the regulars’ views.

Please avoid ‘because in past, so will in future’ and SF hyperbole ..

While I may not be schooled in business or real estate I’m going to guess about 60% of the office buildings downtown will eventually need to be torn down, or converted. This is the type of building that would be expensive to convert; no vent-able glazing, etc etc. The older, marginally attractive buildings will be converted to housing, but the demand is so low that could easily take decades. In the end SF will segue into a resort/hotel/air bnb/piet a terre/dorm town with just enough “low income” housing to keep the aforementioned functioning, and just enough offices for 1-2 days a week for the middle class/upper middle class lawyer/finance/medical/etc etc.

My guess is with all the drive-by crime and unhygienic conditions – SF may have lost its once charming tourist appeal. Or at least it isn’t as charming as it was once imagined to be.

Even if most of the commercial RE is converted or torn-down and rebuilt – where is the occupancy going to come from? What are the regional employment drivers that would drive the occupancy?

Except there’s not that much demand for hotel space in SF. SF really isn’t in the same league with other competing travel destinations like LA, LV, Honolulu. Like the office sector, the SF hotel industry has its own metrics for vacancy / occupancy. They don’t want to dump more hotel rooms on the market and be competing against themselves, and thereby forced to lower their room rates.

True, and SF is also losings its convention status as visitors see nothing but property crime, mental illness, drug use, and overall misery when they walk outside.

At some point it may get cheaper to tear down empty buildings than it is to keep them presentable, inhabitable, etc. So I can see tear downs. As far as who would want to live here these days I think SF can be great if one has a lot of money, salary, and or connections. Most businesses don’t need the place, gays don’t really need it, mostly it’s just the drug culture that needs to be here, which is great. Unless the drug dealers send money straight to City Hall I don’t see how long even the drug culture can survive here. It seems like they do but I can’t say.

Many downtown office buildings may indeed “need to be torn down, or converted”, but we won’t get anywhere close to that actually happening for 60 percent of even currently mostly vacant office buildings over the next — let’s say five — years. I would be surprised to see demolition or conversion of even 5 percent of currently vacant downtown office buildings during the next five years, for the same reason the editor keeps pointing out: it doesn’t make business sense for the owner to do so.

Demolishing a building isn’t as simple as the owner deciding that they want to stop paying property taxes on the improved land value and so they file with the city to replace a vacant building with a parking lot. The owner would most likely have to propose replacing the building with another, presumably taller one, which takes you right back to the issue that the replacement building and use won’t bring in enough revenue to cover the construction costs of both the replacement building and the demolition costs (owners of office buildings in built-up, heavily populated areas likely won’t be able to get away with just hiring a demolition contractor and imploding their buildings like you can on the Las Vegas Strip), which means they won’t get a construction loan.

If the State starts forcing ownership changes in office buildings via tax sale due to the owner’s delinquent property taxes, the numbers might pencil out for a new owner.