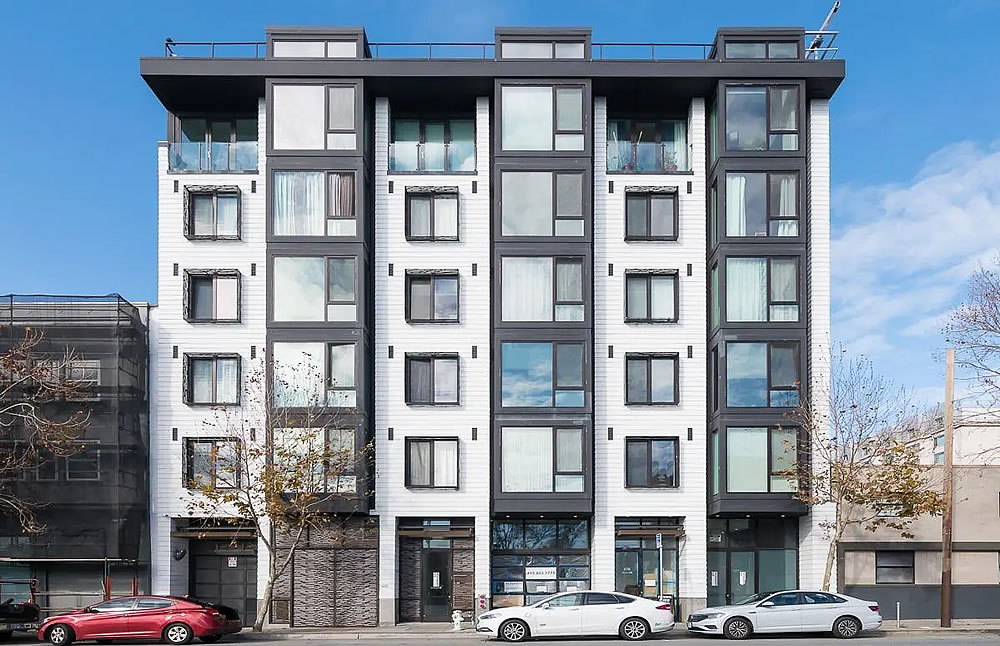

As we outlined last year, the 545-square-foot, contemporary one-bedroom unit #206 at 870 Harrison Street, which was built by JS Sullivan in 2015 and features “floor-to-ceiling windows with an open layout creating a modern and open living space,” along with a Bertazzoni range in the kitchen and “abundant closet spaces throughout,” returned to the market priced at $699,000 in September of 2021, a sale at which would have represented total appreciation of 7.5 percent since the first quarter of 2016 or 1.3 percent per year.

Reduced to $675,000 after a month on the market, the “well designed” unit was then listed anew for $675,000, reduced to $649,000, to $639,000, and then relisted anew for $629,000 last July, after which the one-bedroom, which comes with a monthly HOA fee of $697, was delisted and offered for rent at $2,899 per month.

Listed anew for $589,000 at the beginning of this year, a price which was reduced to $549,000 in February and then to $525,000 last month, 870 Harrison Street #206 is now in contract.

Keep in mind that a sale at $525,000 would be considered to be “at asking!” according to all industry stats and aggregate reports, despite the numerous reductions, but would also be 19.2 percent below the price which was paid for the one-bedroom condo in the first quarter of 2016 on an apples-to-apples basis, while the frequently misreported index for “San Francisco” condo values is “still up 13 percent” over the same period of time but dropping fast.

A 19% loss from 2016 to 2023. Wow. Particularly shocking to the buyer given the paper gains made from 2016 to 2020.

Q: What do you call a 20% decline in 7 years?

A: A good start.

Something like this should realistically be in the 200-300k range.

Agreed, for now. This area of SOMA is at least 50 years away. Unfortunately, there’s going to be a mass extinction event of auto-body shops due to electrification that’s going to impact businesses in the area. There’s so much residential infill of industrial uses that needs to happen. Once it’s filled in, it will be much more desirable.

Do electric cars not get in accidents and need body repairs?

More seriously – it seems that the pace of the residential infill is not currently capped by a lack of closed auto body shops, but by general market forces and projects “not penciling.”

Body repairs are one segment that will remain although self-driving tech will reduce fender benders. Tires will be fine, too, and maybe even increase. As a whole, though, it’s going to be really bad. I’m thinking an 80% reduction in spend by consumers. No oil changes. Massive reduction in brake pads. Pretty much 100% of engine related stuff.

To your second point, this area is somewhat capped in residential infill because it’s not as desirable, because of the auto body shops, street life, yada yada

Yeah no panhandle pro sounds confused. Use approvals for auto repair of any kind are highly coveted in SF. It greatly increases the value of the under-lying land. The properties typically draw multiple over-bids due to the scarcity of inventory supply. They are considered recession proof. They will retain their value for servicing the EV market. There are very long wait times to get EVs serviced.

You do realize that even in this electrified fantasy land you envision that California will power using unicorn farts that ice engines will be around for the rest of your life right? Or do you also believe in Santa Claus?

26% of cars sold in the first half of 2022 in SF were electric. That number is going to ramp up quickly in the next ten years as nearly every car company begins to sell a line of EVs.

Will ICE cars continue to be around for the rest of my life? Technically, yes. But they will be dwindling rapidly.

The future of auto body shops in SF is grim.

The future of SF is grim so I guess that trickles down to the auto shops.

PP- Sly ethnic and classist dog-whistle aside, auto body shops are the only in-demand use scenario for PDR-zoned land, amirite? If not, why the obsession?

Yes, there will be a few gas engines.

But in our lifetimes, virtually all vehicles will be electric. This is great for the world.

For those who haven’t been keeping up with the news, California won’t allow the sale of new gas-powered cars by 2035, although you’ll still be able to buy and sell them on the used market. Auto body shops will still be around for the rest of our lives and their owners will do well. Tesla, for one example, farms out auto body repairs to a network of locally-owned shops even though they do most other repair work in house at their own service centers.

What Panhandle Pro is talking about is other types of auto service businesses devoted to the internal combustion engine.

SFRealist, is it great for the world that burning coal is what generates the electricity to power those EVs? Or is the slave labor in Congo also good for the unrecyclable rare elements needed to build batteries that need replacing before being thrown into a landfill to ruin the same world? I don’t think you’ve thought this through, sort of like the politicians in CA, but sure, “great for the world”.

Ah, the newest Faux News talking point that even my old man is spouting… all the power that comes out or your outlet comes from burning coal. So easily disproved… but not to the Faux News patron.

The rare earth elements needed to build EV batteries are indeed recyclable, and there are several companies already doing it, including Li-Cycle, startups like Redwood Materials and SNT. I suspect from those earlier comments that SanFranSeeYa has investments in legacy automakers and is talking his book.

SFSY you are factually wrong. In 10-20 years, the electricity that powers EVs will be generated by solar or wing power, which are already cheaper than coal.

Like Brahma said, rare earth elements are recyclable, and we’re already mining them in California (look up the Mountain Pass mine).

I agree that one of us has not thought this through, but it’s not me.

Which brings us back to unit, numbers and real estate trends currently at hand…

According to the CPI Inflation Calculator on the Bureau of Labor Statistics’ website, the $650,000 that this was purchased for in March of 2016 has about the same buying power as $821,166 in today’s money. So much for real estate as an inflation hedge.

Given that SF has the highest construction costs in world and that materials/supplies are far more expensive than when this condo was built, would it pencil today – if all a one bedroom would command is 525K?

so many studio/1bdrm condos/apts empty right now. an a glut of ~5-10 year old family units. almost no 3bdrms in buildings that are <10 years old. people who inhabit studio/1bdrms are inherently more transitory. a market overloaded with 1-person dwellings will rise and fall with the tides. i personally wish there were more 3/2s for small families that want urban living. will san francisco or oakland ever build 3/2s in meaningful amounts? sigh.

So glad that the population of real estate professionals hanging around on this site also happen to be experts in autonomous driving, vehicle propulsion, fleet economics, power generation, and global human rigts! We really are a lucky bunch.p to be in such esteemed company.

There have been some corner gas stations in SF that have been redeveloped into small multi-family projects. But SF is never going to become city like Singapore where only 10% of the population owns cars.

Luckily we only have one person trying to figure out sarcasm and humor though, even though zhe is failing at it.

Oh, brahma, zero investment in legacy or ev auto makers, just commodities.

Yes the condo market is down, but since I only paid less than 200K for my modern 1 bedroom with windows on 3 sides ( even in the bathroom ) in 2011, I’m not upset, plus I have it rented for $2,500 a month to a good tenant. Even “affordable” one bedroom housing costs 800K to build now, so this buyer gets a great deal.

UPDATE: Contemporary Starter Condo Drops Over 20 Percent