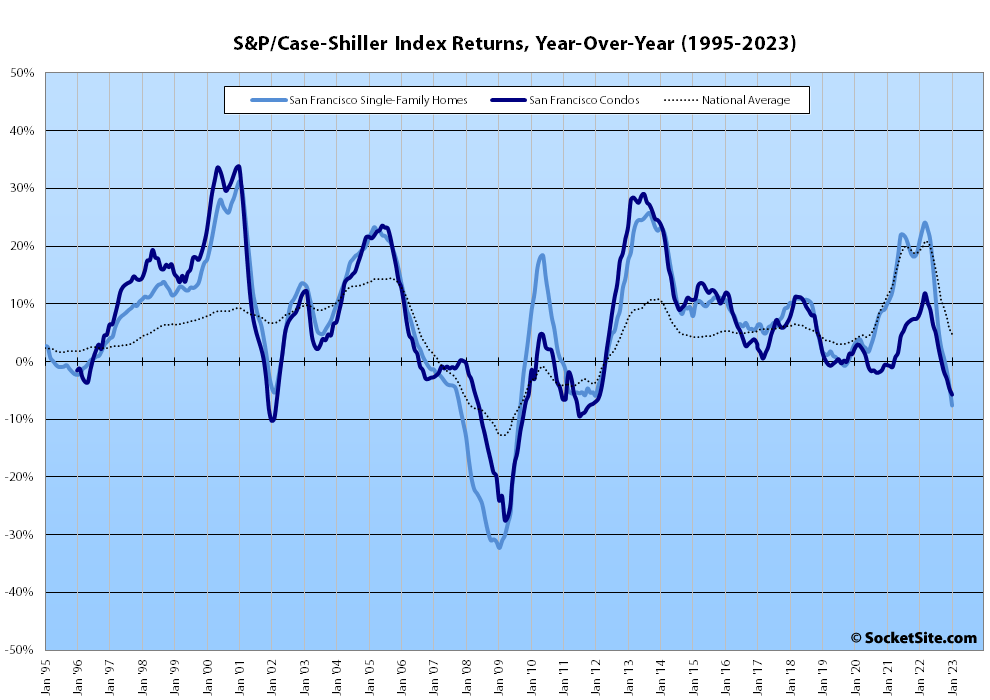

The S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – ticked down another 1.3 percent in January and is now 7.6 percent lower than at the start of last year, representing the largest year-over-year drop for the index over a decade.

In fact, the “San Francisco” index has actually dropped over 17 percent since last May and is on pace to drop at least 20 percent before all is said and done, none of which should catch any plugged-in readers, other than the most obstinate, by surprise.

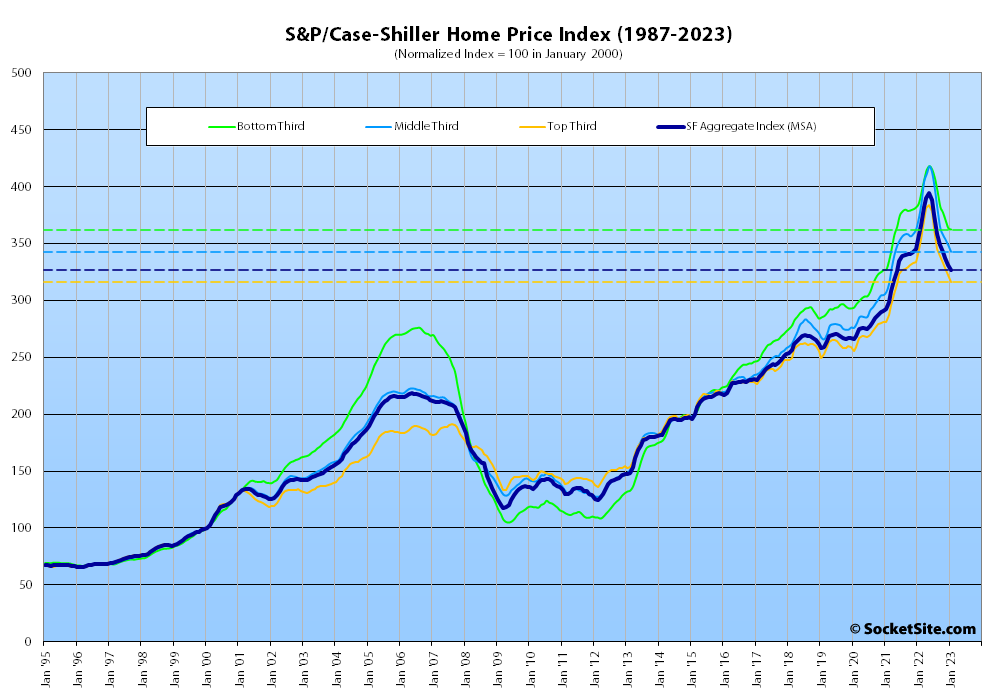

At a more granular level, the index for the least expensive third of the Bay Area market slipped 0.3 percent in January for a year-over-year decline of 5.9 percent; the index for the middle tier of the market ticked down 1.6 percent for a year-over-year drop of 7.8 percent; and the index for the top third of the market ticked down 1.9 percent for a year-over-year drop of 7.4 percent, as we had projected.

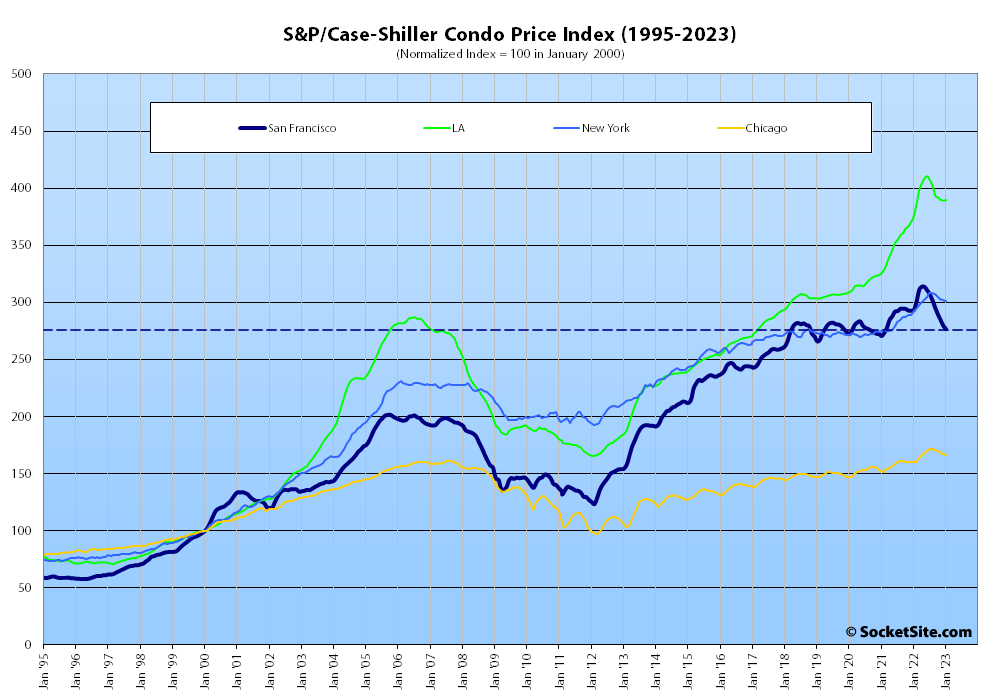

The index for Bay Area condo values, which remains a leading indicator for the market as a whole, ticked down another (1.0) percent in January and was 5.7 percent lower than at the same time last year, having dropped closer to 12 percent over the past eight months and versus “year-over-year gains” in Los Angeles, Chicago and New York to date.

At the same time, the national home price index only slipped 0.5 percent in January and remains “3.8 percent higher than at the same time last year,” with Miami, which remains 13.8 percent higher than at the same time last year, continuing to lead the way with respect to exuberantly indexed home price gains, followed by Tampa (up 10.5 percent) and Atlanta (up 8.4 percent), and the indexes for San Francisco, Seattle (down 5.1 percent) and now San Diego (down 1.4 percent) the only three major metropolitan areas having recorded year-over-year declines, at least so far, but with “broadly based” weakness and nearly every market now trending down.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).