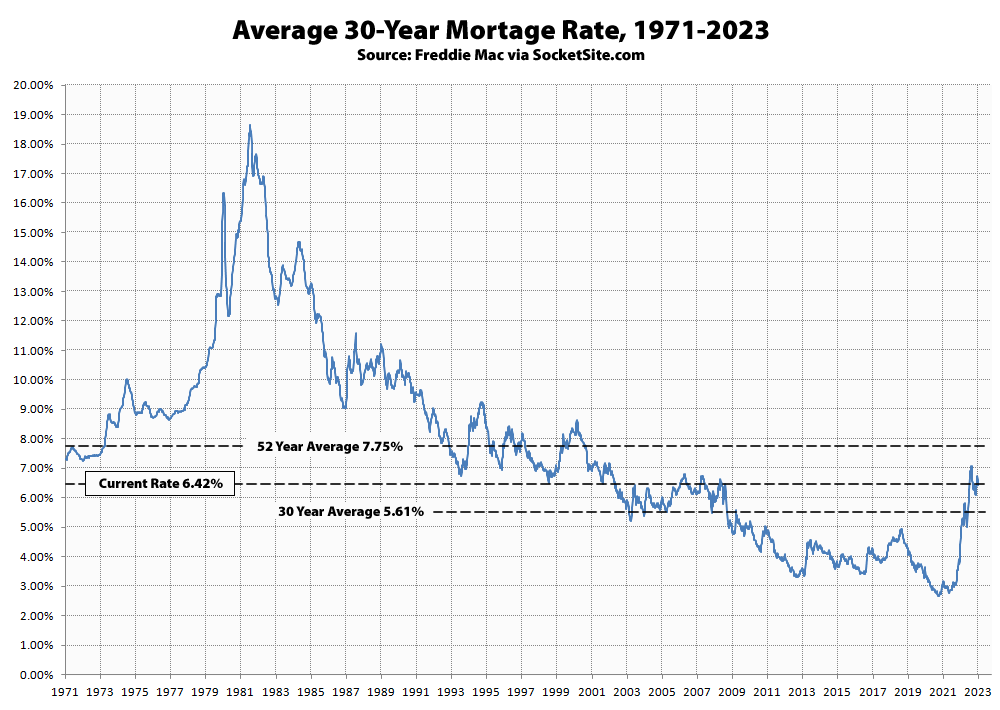

Measured prior to yesterday’s quarter-point rate hike by the Fed, the average rate for a benchmark 30-year mortgage had dropped another 18 basis points (0.18 percentage points) over the past week to 6.42 percent but remained 200 basis points, or roughly 45 percent, higher than at the same time last year and 377 basis points, or roughly 140 percent, higher than its all-time low of 2.65 percent in early 2021 with a dramatic drop in mortgage credit availability as well.

Absent another crisis, the average 30-year rate should drop around 10-20 basis points over the next week but remain over 6 percent, with the yield on the 10-year treasury having dropped around 15 basis points since the Fed’s announcement and the probability of another rate hike over the next quarter having dropped to 20 percent, with a slightly higher chance of an easing and effectively even odds that the Fed is done acting, at least for now.

The value of the US housing market shrunk by the most since the 2008 as the pandemic boom fizzled out.

After peaking at $47.7 trillion in June, the total value of US homes declined by $2.3 trillion, or 4.9%, in the second half of 2022, according to real estate brokerage Redfin. That’s the largest drop in percentage terms since the 2008 housing crisis, when home values slumped by 5.8% from June to December.

Or as we outlined two months ago, “the “San Francisco” index has dropped over 14 percent since last May. And as we projected, the index is now 1.6 percent lower than at the same time last year, representing the first year-over-year decline for the index since October of 2019 and the largest year-over-year drop in over a decade, and still trending down, none of which should catch any plugged-in readers by surprise.”

In fact, having since dropped another two points, “the “San Francisco” index is closing in on a 20 percent drop. Again, none of which should catch any plugged-in readers, other than the most obstinate, by surprise.

I have been going to open homes and decent condos/ tics (1 br, 2br) that are not crazy priced ( ie 2022 pricing) and have no major red flags are yet getting into contract fairly easily and quickly. I don’t see any significant correction in SF proper, simply as there is not much out there for sale in a City of 800,000 people. I think supply is restricted and folks will wait for interest rates to drop (2024) The current math ends up working out at $4500-$5000 for a 1 bedroom (when you factor in property tax, HOA etc on a 25% down condo for 850k), so not sure who thinks this is affordable. Renting is cheaper by a large margin-without the commitment/ headache of leaky roofs. This is anecdotal based on my own findings FWIW.

In terms of supply, inventory levels actually ticked up over the past week to an 11-year seasonal high in San Francisco, driven by listings for single-family homes and a further drop in pending sales (i.e., demand which is now down nearly 50 percent, year-over-year, which isn’t anecdotal).

If you are a tenant and the roof leaks you get one type of headache. If you are in a condo and not on the top floor you don’t get that headache and the HOA you paid into deals with it. So that isn’t one of the reasons to be a renter

UPDATE: As projected, Benchmark Mortgage Rate Ticks Down but Holding at Over 6%