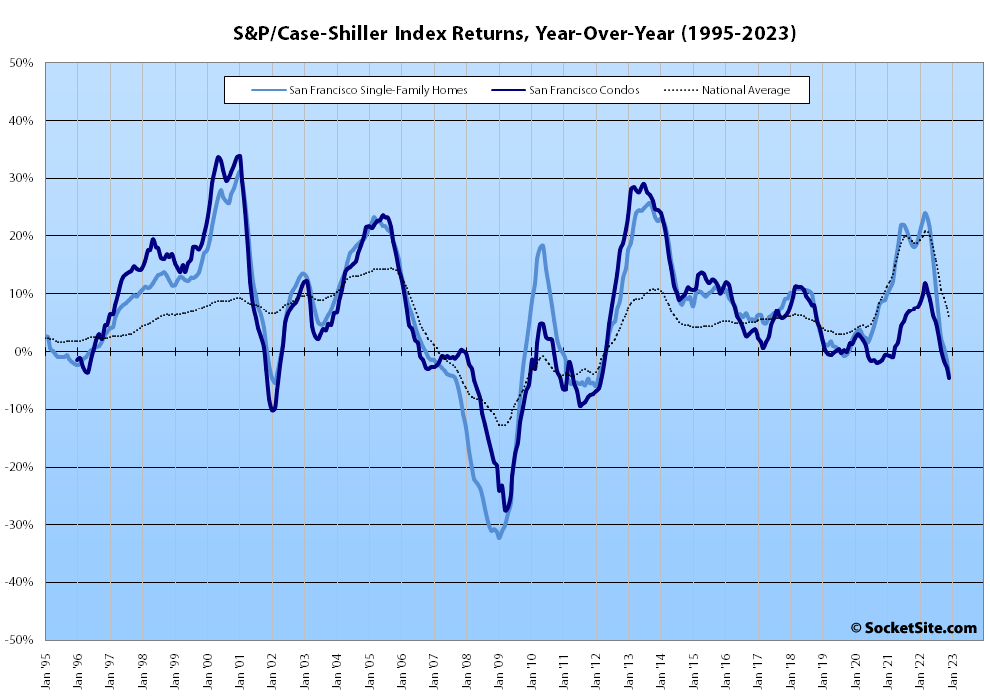

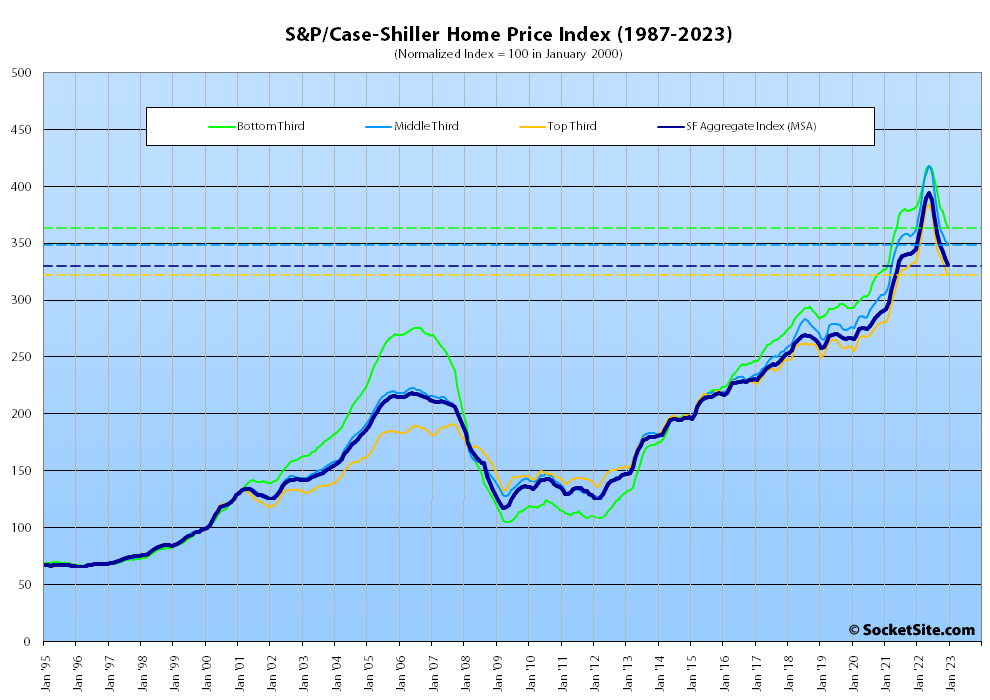

The S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – ticked down another 1.8 percent this past December and is now 4.2 percent lower than at the end of 2021, representing the largest year-over-year drop for the index over a decade. In fact, the “San Francisco” index has actually dropped over 16 percent since last May and the decline is accelerating, none of which should catch any plugged-in readers, other than the most obstinate, by surprise.

At a more granular level, the index for the least expensive third of the Bay Area market ticked down 1.8 percent in December for a year-over-year decline of 4.7 percent; the index for the middle tier of the market ticked down 1.4 percent for a year-over-year drop of 3.9 percent; and the index for the top third of the market ticked down 2.0 percent for a year-over-year drop of 3.6 percent, as we projected.

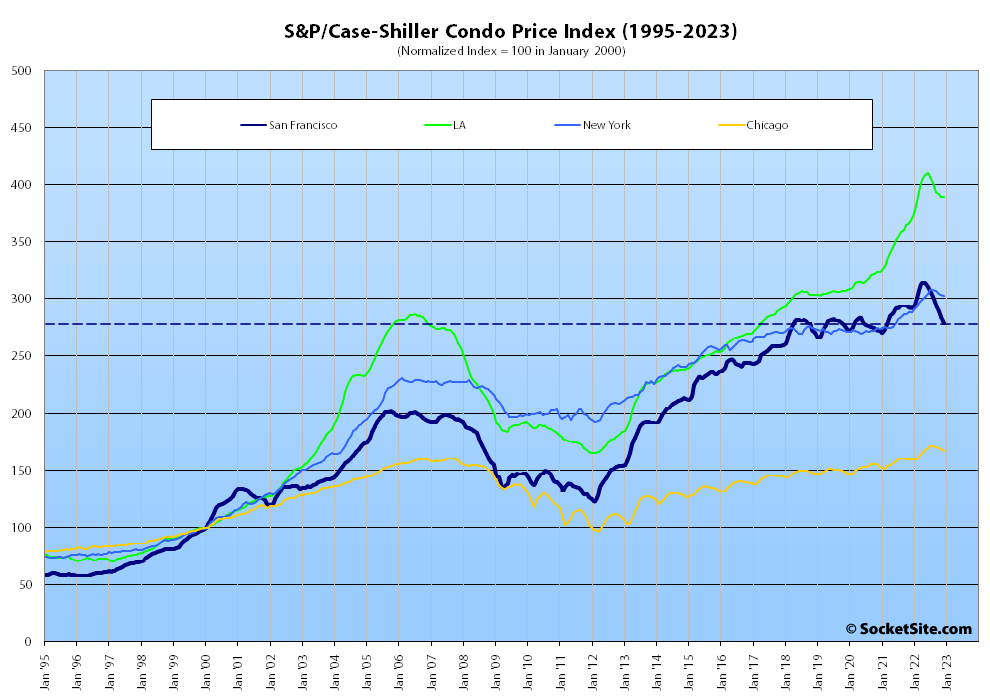

The index for Bay Area condo values, which remains a leading indicator for the market as a whole, ticked down another 1.7 percent in December and was 4.6 percent lower than at the same time last year, having dropped 11 percent over the past seven months, versus year-over-year gains of 5.0 percent, 4.4 percent and 4.8 percent in Los Angeles, Chicago and New York, respectively.

At the same time, the national home price index only slipped 0.8 percent in December and remains “5.8 percent higher than at the same time last year,” with Miami, which remains 15.9 percent higher than at the same time last year, continuing to lead the way with respect to exuberantly indexed home price gains, followed by Tampa (up 13.9 percent) and Atlanta (up 10.4 percent), and the indexes for San Francisco and Seattle (down 1.8 percent) the only two major metropolitan areas having recorded year-over-year declines, but with an understated “cooling” across the board.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

There is a lot of wealth in the valley that could support price levels ~ $800 sqft (avg) or ~ $1.9M/2400 Sqft home. The question could be one of yield – in real estate or where else? Or will it really be about being securely entrenched with whatever they have?

I think, those who currently own their homes outright (or have low debt levels) will weather the next few years better than those who are on mortgage.

Which “valley” are you referring to ??

Noe?

Silicon?

Central?

Great Rift ?

Uncanny

> I think, those who currently own their homes outright (or have low debt levels) will weather the next few years better than those who are on mortgage.

That’s a statement that’s literally always true. I too would love to own a home outright with no debt.

Simple common sense in hindsight (a simple truism really) – but risk perception/pricing has been altered to such an extent that society in general has practically forgotten the risk of carrying debt while have less than required productivity to service such debt. At a systemic level, price discovery is broken and Fed has been patch fixing it/hiding it with QE and making it worse.

SVB collapse is such an incident of risk misperception/mis-pricing. Now, the Fed can’t fix it. And if it does fix it (because rich people), it will only make the problem worse.

When you own an asset where the debt you took on to acquire it was fixed at about 3 percent for 30-years and the Feb 2023 CPI report indicates that the annual inflation rate is running at 6 percent, it’s certainly not “simple common sense in hindsight”, but many of the sophisticated folks in the S.F. real estate “game” would conclude that the balance of risks weighs toward carrying said debt.

If one chooses not to take on such debt, prices can run higher regardless of your personal risk balancing decision if there are enough other market participants who choose to do so. Some of those mortgagors will end up being landlords and their tenants will end up providing their landlord with the necessary income to service the debt, all the while the home appreciates (in the long term).

This is an example of the tyranny of markets and it doesn’t really have much to do with the actions of The Fed or whether society in general has practically forgotten about risk.

Lastly, there are plenty of wealthly unproductive people who can service mortgage debt. The heiress to the Stroh’s beer fortune, Frances Stroh, is an S.F. landlord who sits around in her copiuous free time writing books that very few people buy or read. It’s whether you have the wealth and income to service such debt that matters, not vague, ill-considered notions of “productivity”.

And again, the deep pockets will scoop up more Bay Area real estate in the trough, denying access to home ownership to those who truly need it. Then much of the profit will build more luxury condos that hardly anyone wants.

Did ChatGPT write this?

No, this is an example of a logical argument based on an understanding of political economy, human behavior, and history, as opposed to an easily-manipulated serial recursive probability distribution based on massive value-free data sets which are unreliable at best in discerning fact from propaganda (assuming that is even one of its programmed objectives).

that response from 2 beers was much more GPT like

The flipside of vacancy- and rent-maximizing algo “RealPage,” is the exciting new “RealTor” AI bot, which is not a privacy browser for you dark web aficionados, but rather a program to eliminate the increasingly superfluous human 3% + 3% property sales skim. It can coin hip new acronyms and names for old industrial neighborhoods, refer to a shoebox as “cozy,” and use Ring or Echo to monitor empty Tuesday afternoon open houses. On slow days in the virtual RE office – which are becoming alarmingly more frequent – it also directs tepid snark at people posting on their local real estate blog about the causes and effects of housing bubbles and busts.

So your solution to more affordability is higher prices??

Funny, I moved out of the bay area a few years ago to another big metro area in the US. Compared to SF, basically no one here says there needs to be more affordable housing. People simply understand that they need a longer commute to/from a cheaper residential area and suck it up.

Suck it up? That’s always been the existential crisis of the lie that is trickle down economics. Horrible for the environment as well.

Oh yes, the wonderful ‘drive till you qualify’ approach to housing, popularized by real estate agents, especially those who have arrived here from elsewhere to take advantage of so-called ‘tech workers’ willing to overpay for housing and plan to escape with their “winnings” to Texas or Florida.

Unfortunately, it doesn’t work. Traffic congestion and commute times in the Bay Area have actually become worse than most of S. California during my adult lifetime. And there are very few parts of the inner Bay Area affordable to most workers with median household incomes.

Really should have a second y-axis on that 1987 to present case-shiller chart of prices. Second axis should be Bay Area median income.

Would clearly illustrate that even with this recent correction we are on a unsustainable path for a decent society.