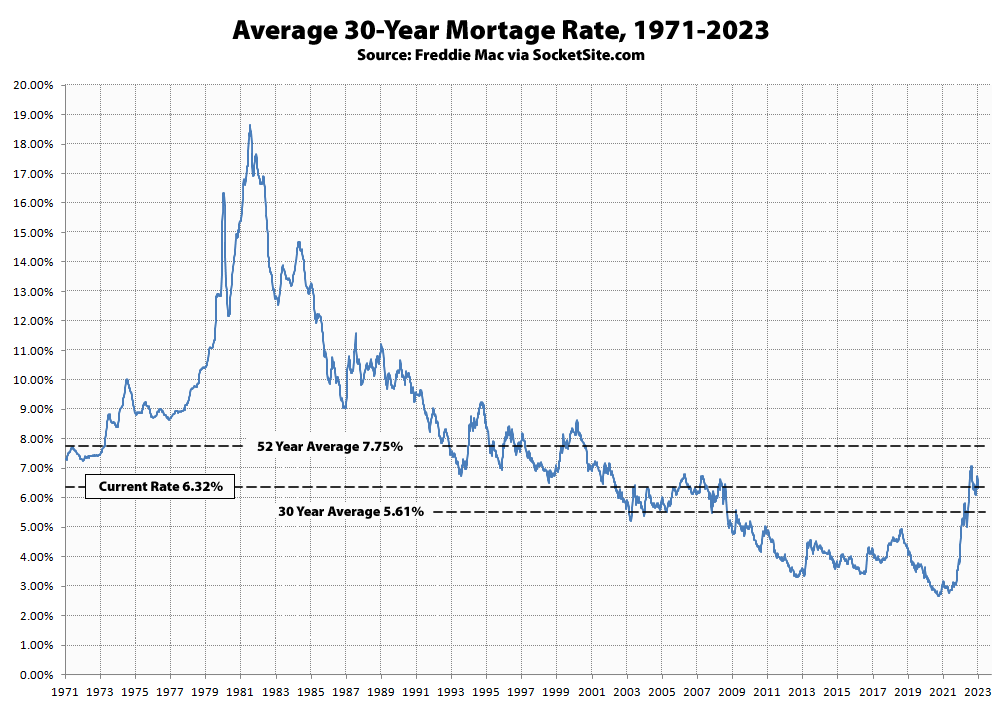

The average rate for a benchmark 30-year mortgage ticked down 10 basis points (0.10 percentage points) over the past week to 6.32 percent. Or as we outlined last week, “the average 30-year rate should drop around 10-20 basis points over the next week but remain over 6 percent.”

As such, the average 30-year rate is still 165 basis points, or roughly 35 percent, higher than at the same time last year and 367 basis points, or roughly 140 percent, higher than its all-time low of 2.65 percent in early 2021. And while purchase mortgage activity has inched up from a 28-year low, it’s still down 35 percent on a year-over-year basis, despite the recent drop in rates, with pending home sales in San Francisco proper currently down closer to 50 percent.

At the same time, the yield on the 10-year treasury is now holding, with the odds of another rate hike over the next quarter back to even and the probability of an easing having dropped to under 5 percent.

It’s all just charts and stats on here. Bring back the “do you think you know” or some name architect place or something. I’ll take a fight over a rear addition even

Bring back the old Fluj vs. LMRIM smackdowns. Those were always entertaining.

Yes agreed. But I think both those old curmudgeons have retired to Florida where they are from with their ill gotten real estate gains.

UPDATE: The average rate for a benchmark 30-year mortgage was effectively unchanged over the past week, inching down 4 basis points to 6.28 percent. At the same time, while the average 30-year rate has dropped by nearly 50 basis points over the past month, the volume of applications to secure a purchase mortgage loan for a home in the U.S. has suddenly dropped as well.