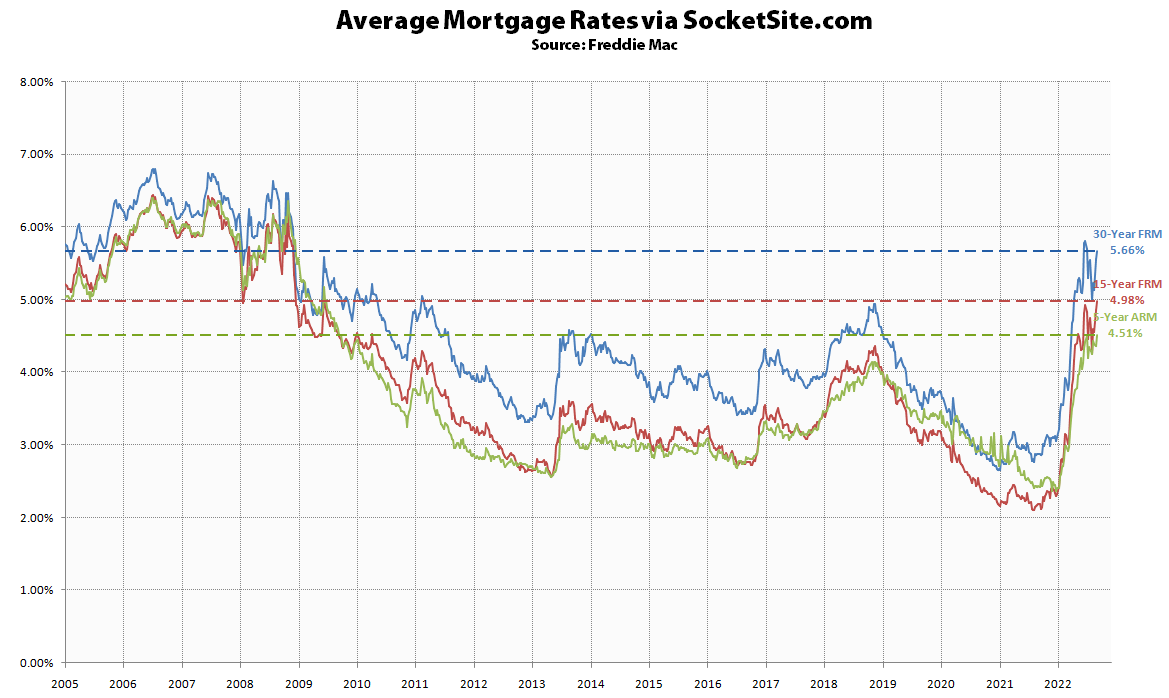

The average rate for a benchmark 30-year mortgage ticked up another 11 basis points (0.11 percentage points) over the past week to 5.66 percent, an average rate which is now 97 percent higher than at the same time last year and 114 percent higher than last year’s all-time low of 2.65 percent.

At the same time, the average rate for a 5-year adjustable rate mortgage (ARM) has ticked up to 4.51 percent, which is 86 percent higher than at the same time last year, 70 percent higher than the average 30-year rate at the beginning of last year and a 13-year high, with the probability of the Federal Reserve raising the federal funds (“interest”) rate by at least another full percentage point by the end of the year is now running at “100 percent” based on an analysis of the futures market and the pace of home sales continuing to decline, both nationally and locally and particularly for new home sales which have tanked.

In the euphemistic words of Freddie Mac this morning, “sellers are [now] recalibrating their pricing due to lower purchase demand, likely resulting in continued price growth deceleration,” none of which should catch any plugged-in readers, other than the most obstinate, by surprise. We’ll keep you posted and plugged-in to the leading indicators and trends rather than lagging the market by six months to a year.

I have a monthly adjustable mortgage ARM that was originally provided courtesy of WAMU (now Chase). It went up .75% for September which is the single biggest monthly increase since I’ve had the loan. I’m expecting another hit of the same magnitude in November. I’ve enjoyed years of ultra low interest rates so you take the good with the bad.

Not at all coincidentally, I’ve had (to put up with) years of CD rates of 1 or 2% (at best), now everyone and their non-binary sibling are tripping over each other to offer >3% (aka : almost “normal”). I guess you enjoy the bad with the good….well, other than there being no “good” in the former…at least for savers.

I Bonds are at 9.6%

I bonds are not a comp to CDs

For $10,000 savings or less (per year) they aren’t a comp, they’re far superior.

There is speculation they could go to 12% on the next reset in October.

Yesterdays close.

30 Yr. Fixed: 6.23%

$1,536 / mo @ a $250K loan amount

Is there even such a thing as a $250k loan in SF? $500k minimum, and that’s for a tiny condo. A 1,00sf+ house will require a $1M+ loan, even with 20% down.

@TBK Depends on how much cash you’re putting down.

My point is that a $250k loan amount is in the minority for Bay Area mortgages.

The conforming loan limit for a single-family home or condo in San Francisco (as well as Contra Costa, San Mateo and Santa Clara Counties) is $970,800. As such, roughly 50 percent of the homes on the market in San Francisco would qualify for a conforming loan, based on their current list prices and assuming 20 percent down, including 25 percent of the single-family homes. And the quoted “$250K” loan amount was likely provided as a marker for the relative payment amount(s).