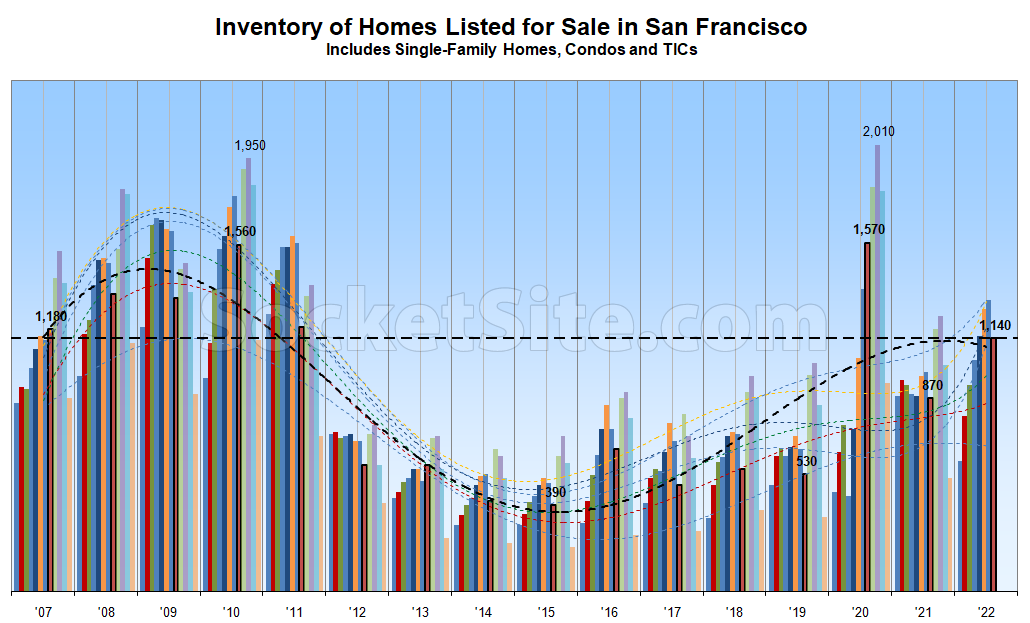

The net number of homes on the market in San Francisco (i.e., inventory) has effectively held at 1,140 over the past two weeks despite typically dropping over 10 percent at the end of August. And as such, inventory levels in San Francisco are still over 30 percent higher than at the same time last year, over 50 percent higher than average over the past decade, 125 percent higher than prior to the pandemic and 170 percent higher than in August of 2015, with the percentage of homes on the market in San Francisco for which the asking price has been reduced holding at 30 percent and the number of homes in contract down 36 percent on a year-over-year basis and dropping.

Expect inventory levels in San Francisco to jump in September and then continue to climb in October to an annual peak before trailing off through the end of the year but with an increase in reductions. As always, we’ll keep you posted and plugged-in.

Given that rents are yet incredibly high, and will continue to remain so. I think seller’s will simply ask for the sky while listing. If they do not get their asking price, they will de list it and rent it out for a year or two. I yet see TICs priced north of $1000/ sq ft selling in a few weeks.

With respect to said sky and the direction in which it’s moving, at least based on the facts, keep in mind that the averaging asking price of the home’s which are in contract has dropped 5 percent over the past quarter to roughly $950 per square foot and the average list price overall in the city has fallen around 7 percent from peak and is trending down.

will – will – will — a lot of wishful thinking there to remain bullish. Just based on the inventory and number of reductions those multiple wills are feeling quite unlikely, no? Actually, it’s hard to find a positive trend for you.