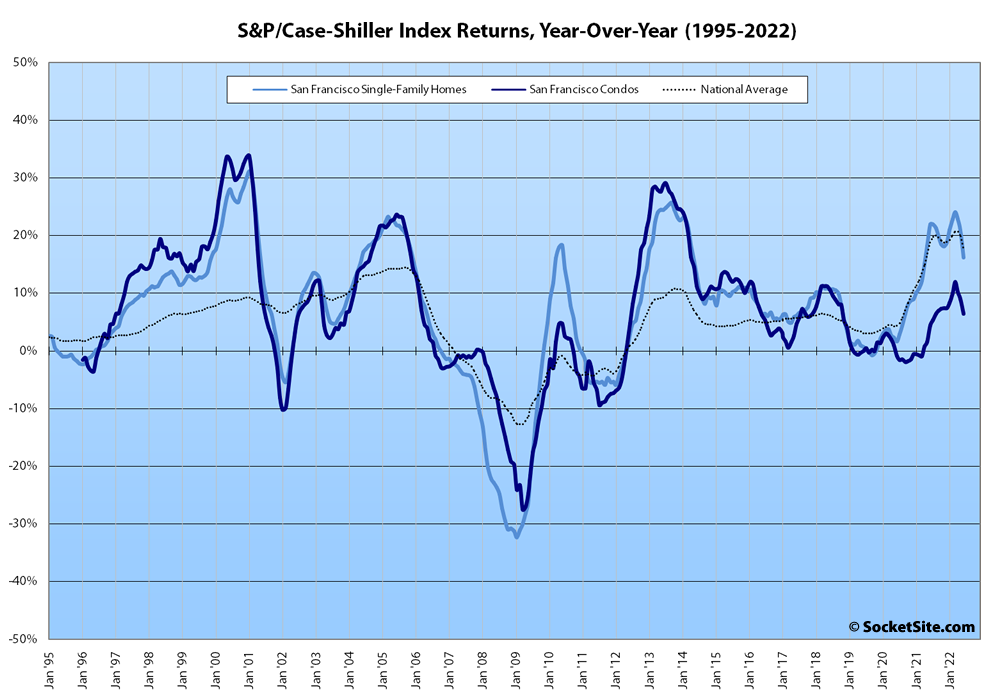

Having inched up 0.9 percent in May, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – dropped 1.3 percent in June, which was the largest month-over-month decline since the fourth quarter of 2018 but still 16.1 percent higher than at the same time last year with a rapid deceleration from a year-over-year gain of 24.1 percent in March.

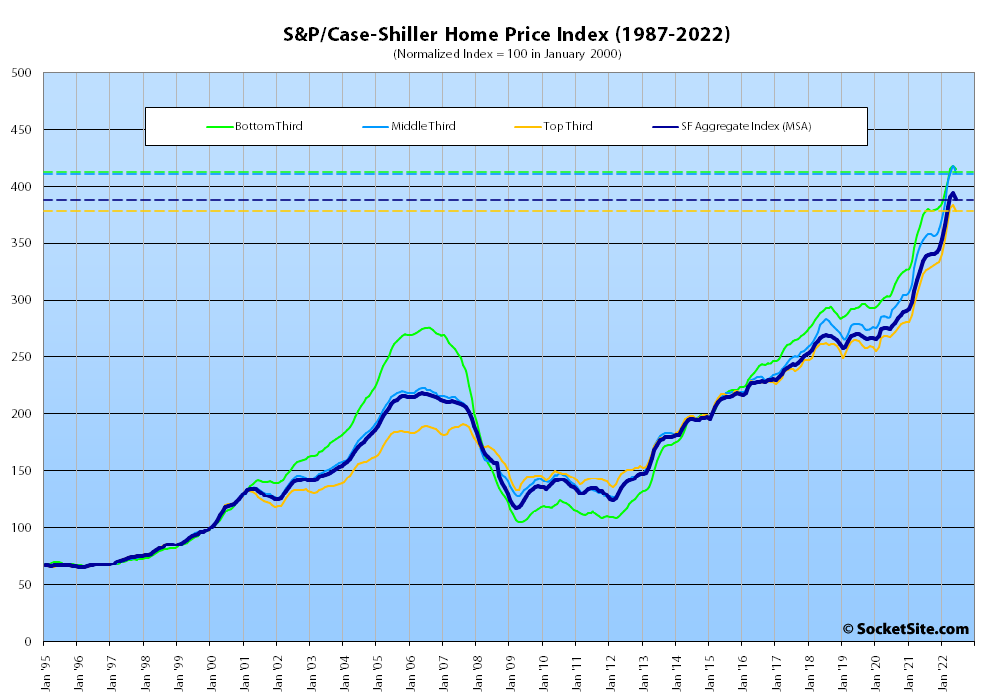

At a more granular level, the index for the least expensive third of the Bay Area market slipped 0.7 percent in June for a year-over-year gain of 10.9 percent; the index for the middle tier of the market dropped 1.4 percent for a year-over-year gain of 16.8 percent; and the index for the top third of the market dropped 1.4 percent as well, for a year-over-year gain of 17.0 percent, down from 25.1 percent in March.

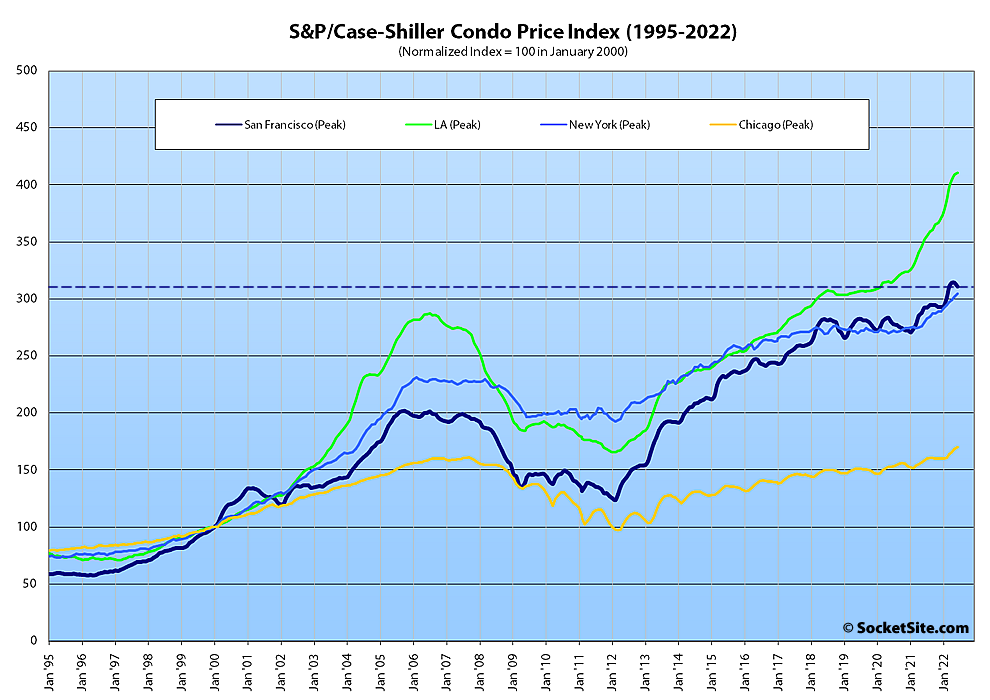

The index for Bay Area condo values, which remains a leading indicator for the market as a whole, dropped 1.0 percent in June for a year-over-year gain of 6.5 percent, which was down from a localized peak of 12.0 percent in March and versus year-over-year gains of 16.7 percent, 7.3 percent and 9.1 percent in Los Angeles, Chicago and New York respectively.

Nationally, Tampa once again led the way with respect to exuberantly indexed home price gains, up 35.0 percent on a year-over-year basis, followed by Miami (up 33.0 percent) and Dallas (up 28.2 percent) but with a continued “deceleration in U.S. housing prices” and a month-over-month gain of 0.6 percent overall.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

And so it begins. Any time you can’t maintain momentum through August, it’s a bad sign. The 1990 collapse began with a 0.45% drop in July (after a very slight increase in June).

After a bad May, the 2007 housing bust kicked into gear with a 0.67% drop in June. Ominous signs.

As a counterpoint, the shortlived 2001 Dot Com bust began in May and really got going with a 1.08% drop in June. One year later, though, the losses had been made up and it was off to the races. All of this is Case Shiller HPI for Ess Eff, of course.

I doubt it. This was a particular summer. Because everybody, their brother, sister, mom, dad, pooch, neighbor, went on vacation this summer at long last. Anecdotally, in terms of people I know, here is how many of them went on international vacations in July-August: all of them.

Fair enough. But bear in mind CS Index is a three month average, so April gains got wiped by a down June (and May?) It’s been bonkers on this side of the Bay, so I’m not sure where the losses have been centered. I heard the South Bay is starting to tank, but that’s not included in the index. YMMV.

Keep in mind that the Case-Shiller Index is a measure of values, not volumes.

So your hot take is that this isn’t about interest rates or a rapidly weakening tech sector and stock market, but …. too much summer vacay???

Lets just put a pin in your comment, cause I don’t think it’ll be aging well.

You said those things and then you said you’d hold me to those things that you inserted? heh. Indeed that is pinnacle internet tactics right there. No man. I too think about interest rates, tech sector, the stock market, general sentiment in the country, etc. But it is also a thing that the market has gone to sleep over the past couple months. It’s not binary. I think that the wild appreciation of the past year going back from May 22 to like mid summer 20 is well and truly done. But what will the appreciation cooling resemble in the end? Will any loss of value be subsumed within inflation itself? That remains to be seen. You also need to understand that building and all costs associated with every last thing that goes into creating housing has also gotten more expensive. Those costs will be getting passed on, or at least there will be an attempting to pass them on. Nobody goes into scenarios trying to lose money, you know.