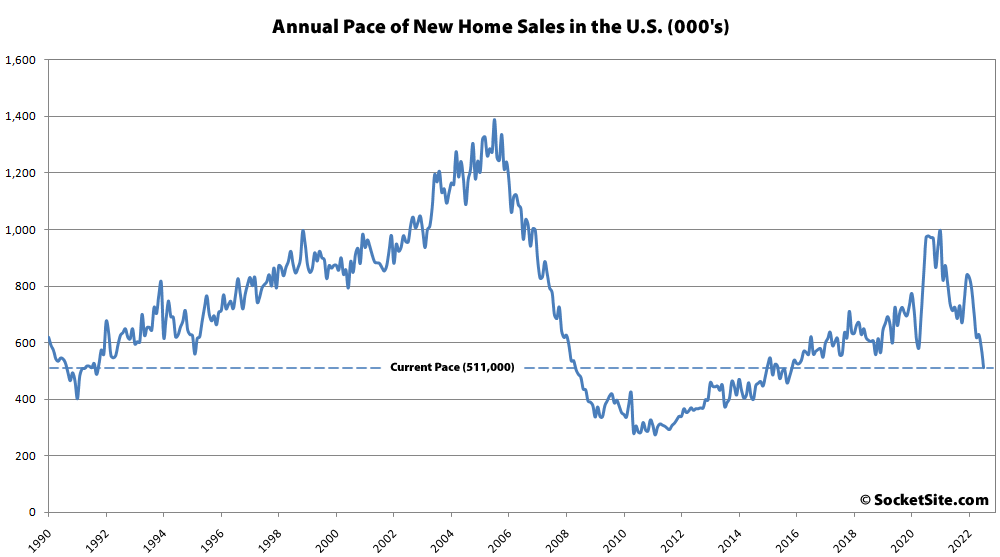

Having dropped a downwardly revised 7.3 percent in June, the seasonally adjusted pace of new single-family home sales in the U.S. fell another 12.6 percent in July to an annualized rate of 511,000 sales, which is 29.6 percent lower than at the same time last year and the slowest pace of sales since November of 2015, which shouldn’t catch any plugged-in readers by surprise.

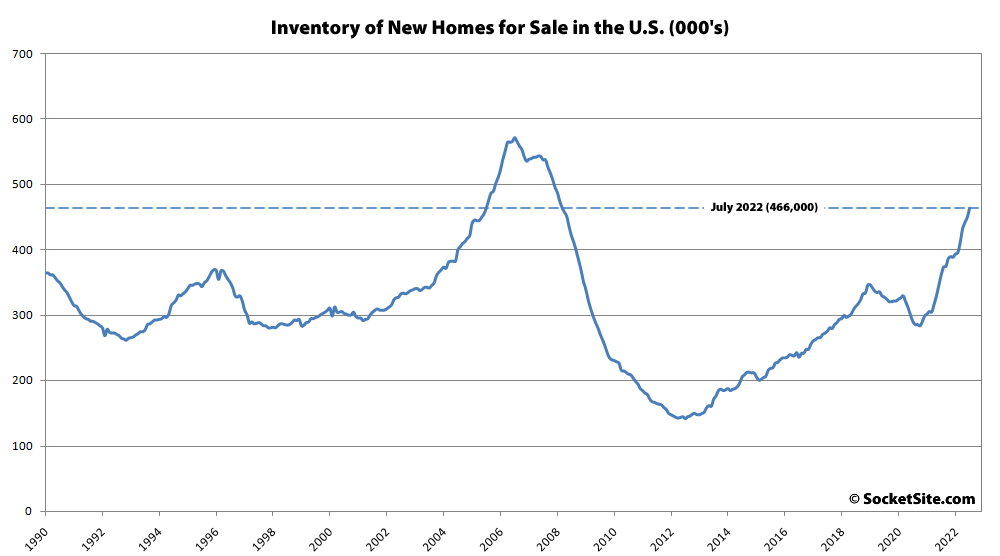

At the same time, the number of new homes on the market ticked up another 3.2 percent in July to 464,000 homes, which represents 28.2 percent more inventory than at the same time last year, the most new homes on the market since March of 2008, and 10.6 months of inventory, which is a 13-year high and technically represents a strong “buyer’s market,” for those who like that stat.

As a hopefully soon to be first time home buyer, my eyes light up whenever I see “2008” referenced in an article about real estate activity…

Looks like the Fed will get its recession – hurting all the blue collar workers who are already just trying to get by (in this case, construction workers among many others), while the wealthy will coast along OK (writing off RE losses to offset income, grabbing land on the cheap for future builds, etc.)… And none of it actually addressing the underlying causes of recent inflation – covid, supply-chain issues, and the Russian invasion of Ukraine.

Don’t forget climate change (though that could be tied into supply chain issues)

You mentioned currentinflation, but left out the past decade of inflation….in asset prices, which have very much to do with interest rates being artificially depressed for 15 years. And insofar as one of those assets is homes, the peonage didn’t fare so well with that either…as the

tedioustireless comments about “affordability” will attest.And you left out the fact that inflation, as measured by the annual change in the price index for personal consumption expenditures, was below The Fed’s target of 2% for seven years during the recession and economic recovery from the 2008 pop in the bubble for mortgage-backed securities and associated dodgy financial instruments. Which brings into question whether or not interest rates were “being artificially depressed” over that same time period.

Members of the precariat class didn’t fare so well then, either. At least this time, unemployment is relatively low and to Sierrajeff’s point about the plight of construction workers, in contrast with previous recessions, their job prospects are much greater.

From the U.S. Bureau of Labor Statistics earlier this month, The Employment Situation — July 2022, (scroll down to the subheading ‘Establishment Survey Data’):

We definitely aren’t talking about a leading indicator here, but given that GDP has been contracting for two consecutive quarters, so far it looks like construction workers may be able to navigate this downturn much better than the last one.

This is the power of a historically low mortgage interest rate chair being pulled out. Let’s all just hope that underwriting was a good as the lending industry claims it was (versus the 2000’s standards) so that when recent buyers go to sell they can withstand the loss. A $800k 30 year fixed rate at 5.3% (today’s rate) versus 3% (November’s rate) will now cost a borrower $1300 more per month. That’s a drastically fast change in borrowing cost, historically fast change in fact, that absolutely will slow all home buying activity.

A friend of mine provided loans back in the 80’s when the interest rate was around 20%….just to put things in perspective.

My first mortgage for a condo bought in 1982 had an 18% rate.

Kids these days don’t know how well they have it.

Now, get the hell off my lawn!

What was your monthly payment back then? And any thoughts on what would happen to home values if the average mortgage rate spiked to 18 percent today?

Yes life was so hard when you could buy a house with one spouse working full time at a grocery store, the other stayed home full time with the three kids, and student loan debt wasn’t even a thing.