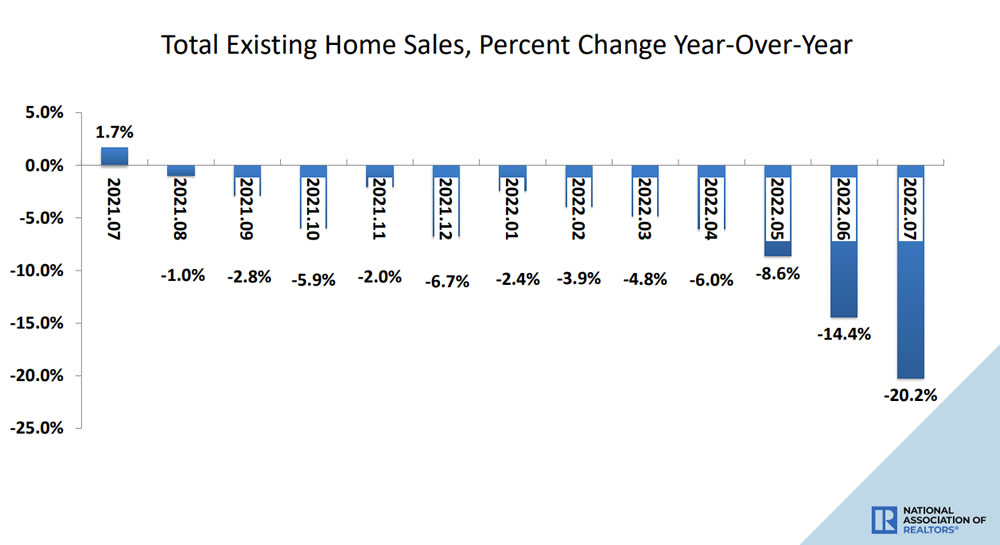

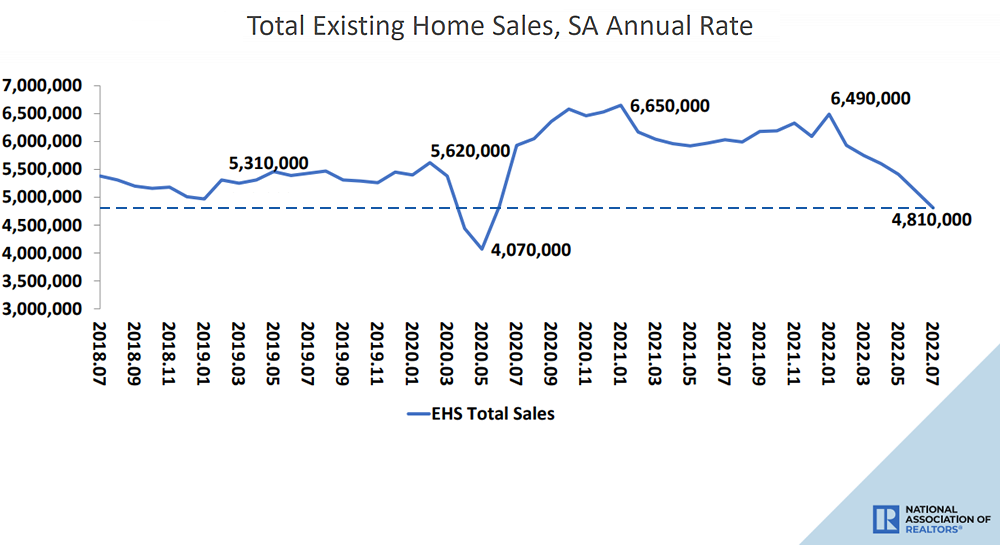

Having dropped 5.4 percent in June, the seasonally adjusted pace of existing-home sales across the U.S. dropped another 5.9 percent in July to an annual rate of 4.81 million sales, representing the twelfth straight month with a year-over-year decline in sales; the largest year-over-year decline in sales (20.2 percent) since the pandemic hit; the slowest seasonally adjusted pace of sales since June of 2020, when the markets were effective frozen; and well below the pre-pandemic pace of sales as well, according to data from the National Association of Realtors (NAR).

At the same time, the number of existing homes on the market at the end of last month, net of all sales, increased another 4.8 percent to 1.31 million homes on the market, with the inventory of unsold new homes on the market having climbed to a 14-year high.

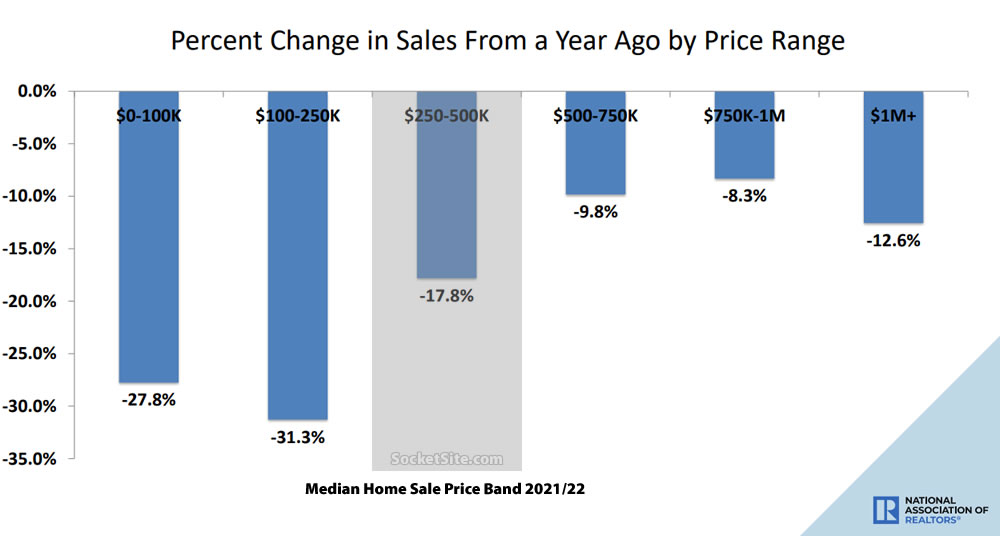

And having peaked at $413,800 in June, the median existing-home sale price dropped $10,000 to $403,800 in July, which was 10.8 percent higher than it was at the same time last year but with a dramatic shift in the mix of the homes that have sold, a key point that we still can’t overemphasize and none of which should catch any plugged-in readers by surprise, particularly as we outlined that there had been “a drop in the average mortgage loan size… which will result in a drop in the median sale price” last month, an ongoing trend that is poised to become even more evident.

Perhaps closer to home, pending home sales in San Francisco are down nearly 40 percent on a year-over-year basis, despite a sharp increase in inventory levels, as we forecasted earlier this year.

From 72% of recent homebuyers have regrets about their purchases, earlier today:

Emphasis mine. The survey was conducted in July among individuals who bought a home in 2021 or 2022.

With The Fed not close to the end of their tightening, the bottom is many, many months away. No reason to go out and try to catch a falling knife.

Tucked into these downward charts and 14-year look backs is that prices are up 10% YoY, and “tight competition led 36% to make an offer on a home without seeing it in person first”.

Truly we are many, many, many, many, many months away from the knife finally dropping.

Or as we rather clearly outlined in the third paragraph above, “having peaked at $413,800 in June, the median existing-home sale price dropped $10,000 to $403,800 in July, which was 10.8 percent higher than it was at the same time last year but with a dramatic shift in the mix of the homes that have sold, a key point that we still can’t overemphasize and none of which should catch any plugged-in readers by surprise, particularly as we outlined that there had been “a drop in the average mortgage loan size… which will result in a drop in the median sale price” last month, an ongoing trend that is poised to become even more evident.”

In directly related news, Purchase Activity at the High End of the Market Is Weakening.