With “supply and demand imbalances related to the pandemic and the reopening of the economy” having “continued to contribute to elevated levels of inflation,” which has been rattling the market, the Federal Reserve has decided to reduce the pace of its bond-buying program and economic support for the economy even faster than previously expected.

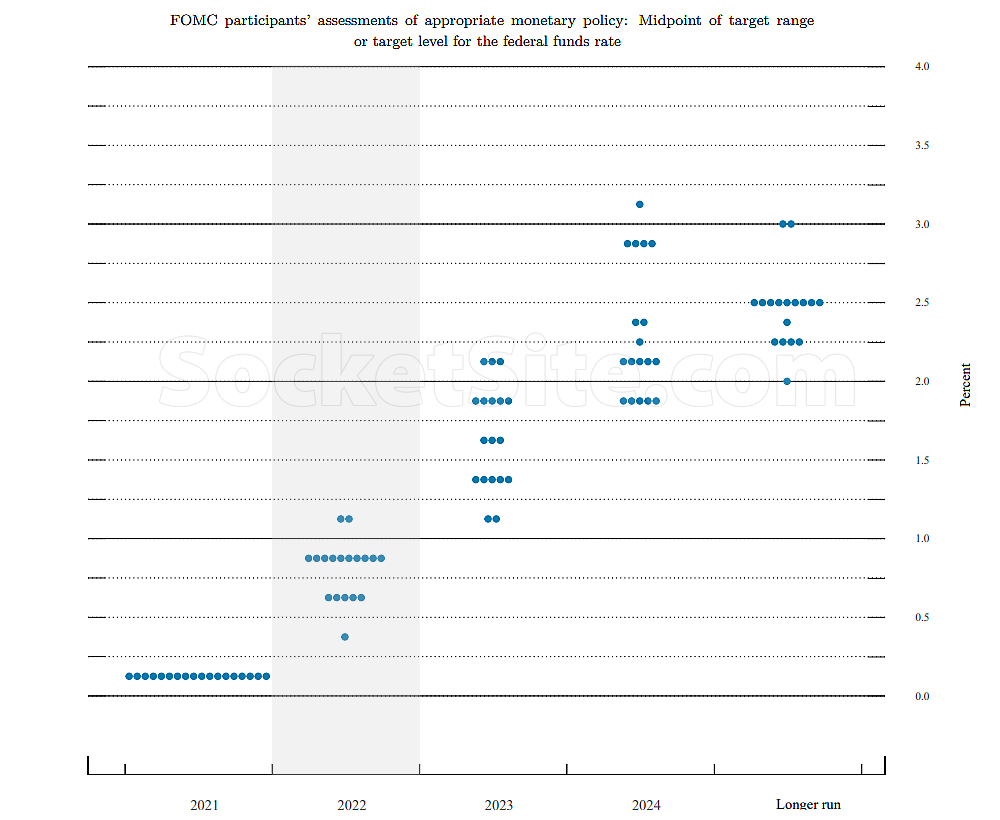

And based on the latest dot plot of Federal Open Market Committee (FOMC) members’ assessments of the appropriate target for the federal funds rate, which has been held at 0 to 1/4 percent, the majority of members are now positioning for up to three quarter point hikes in 2022, followed by an additional three hikes in 2023.

FOMC members had been evenly split on whether or not rates should be raised at all next year back in September, but with expectations for a rate hike having accelerated, as we outlined at the time.

UPDATE: As we outlined in December, the Fed was moving to reduce its support of the economy and positioning for up to three rate hikes this year. And based on the minutes of the Fed’s mid-December meeting, which were just released, the likely timing for the first hike had been moved up to June 2022.

UPDATE: As expected, the Fed has just affirmed its intention to start raising rates, and “soon.”

UPDATE: Benchmark Mortgage Rate Just Jumped to a 2-Year High