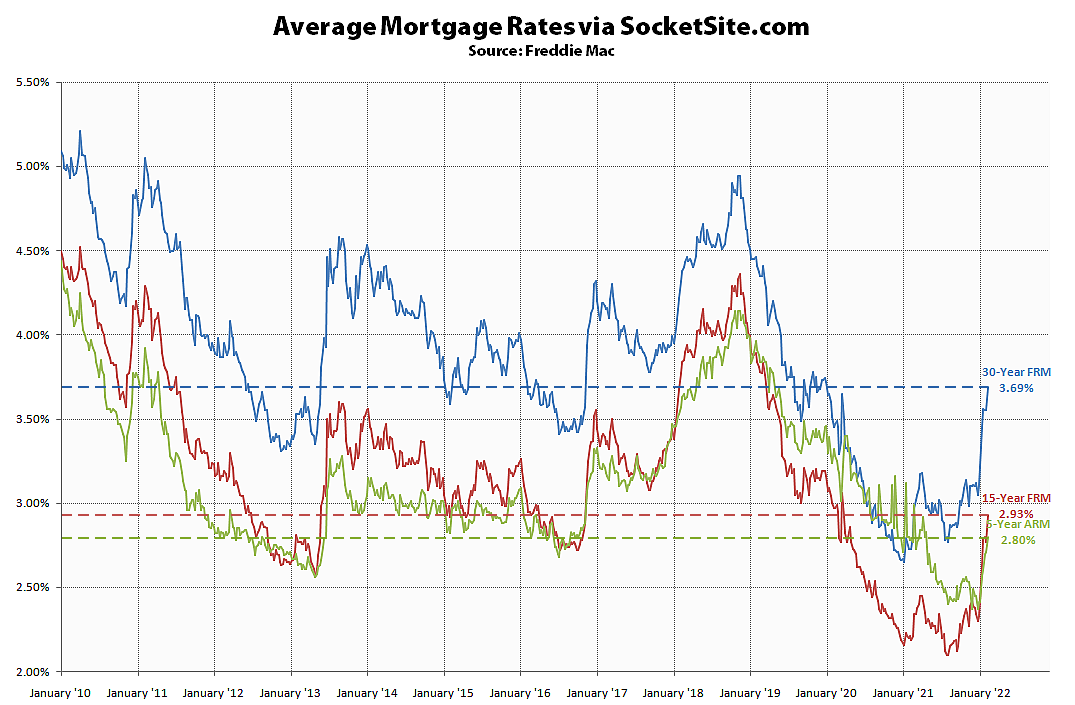

The average rate for a benchmark 30-year mortgage jumped 14 basis points (0.14 percentage points) over the past week to 3.69 percent, which is nearly a full percentage point (96 basis points) higher than at the same time last year and the highest average rate since January 2, 2020.

At the same time, the Fed has affirmed its intention to start raising rates and soon, with bond traders now expecting a half-point increase next month and a total of six, if not seven, quarter point increases by the end of the year, which should translate into even higher mortgage rates, less purchasing power for buyers, and downward pressure on home values, none of which should catch any plugged-in readers by surprise.

And yes, the aforementioned 3.69 percent average rate for a 30-year mortgage was measured prior to this morning’s consumer price index (CPI) reading and the yield on the 10-year treasury, which is the foundation for the 30-year mortgage rate, has since ticked up another 10 basis points to its highest mark since August of 2019.

How long does it take for the mortgage rates to “trickle down” to lenders once the Fed raises rates… that is, how long until the buyers actually see the affect of fed raising rates when they apply for mortgages? Is it instantaneous? And how long does this raising of rates by the fed historically take to affect home prices?

Buyers are already seeing the effect of the Fed raising rates as the movement in the 10-year yield and resultant mortgage rates are being driven by bond traders’ expectations of how the Fed is going to act and the future Fed funds rate.

The impact on home values isn’t as immediate which is why you’ll want to keep a close eye on true inventory levels which are a leading indicator for the market.

Just to answer the second question a bit more directly (SocketSite’s answer is correct): it’s faster than instantaneous, because the bond market prices in highly probable Fed rate hikes in advance.

By the time I looked at it this morning, CNBC Television was already reporting that the rate on 30 year fixed mortgages is now 4.02%, a 12 basis point move higher in a single day! And of course that is due to the change in the 10 year yield, which in turn was driven by the CPI report.

UPDATE: Based on an analysis of the futures market, bond traders are now expecting at least a half-point hike in March with a total of six, if not seven, quarter point hikes by the end of the year, effectively doubling the expected net increase in the Fed funds rate as of a month ago.

The Fed will hold back on rate increases, short of that in March and perhaps one other, until after the November elections. The Administration in power (Democrat or Republican) exerts pressure on the Fed to keep the economy humming through an election. The Democrats are hoping to gain Senate seats and take outright control and to hold onto the House. A recession would pretty much end their chances of so doing. Look for significant rate increases after the election and a recession in early 2023.

Time will soon tell. But with the growing specter of inflation, the bond market currently disagrees.

My money’s on the bond market, not Dave (Seattle dude).

Inflation could be a worse political problem for the democrats than rate hikes.

[Editor’s Note: We’re going to keep the focus on rates, rate hikes, the drivers and impacts (and away from political debates).]

If inflation is 7.5% and my mortgage rate is 3.5%, I have a -4% real interest rate on my debt and am getting paid in purchasing power terms to borrow money.

Yes but it also depends on the term of the debt and how long inflation persists at this rate. Seems unlikely to continue at 7.5% for 30 years.

I completely agree that it’s unlikely that inflation will continue at 7.5%.

The Fed will want to fight inflation and they blunt tool they have is to raise short term interest rates.

An increase will have some effect farther out on yield curve too.

It’s possible that long term rates go down lower from here if short term rates go higher.

So if 2-3 years short term rates are 4.5%, inflation has cooled to 3-4% and 30 year mortgage rates are ???? will I be glad I owe money at a 3.5%-ish rate? I think the answer is still yes.

If long term rates go lower, then I refinance.

The argument for borrowing money in an inflationary environment is reasonably strong IMHO.

More than reasonably strong! (for fixed rate borrowing)

7.5% inflation and 4% 30 yr. mortgages? Kids these days don’t know how good they’ve got it.

My first condo (1982) was financed with a 3 year balloon payment mortgage at 18%!

Maybe. 10-year expected inflation rate is 2.45% as predicted by prices on inflation-indexed bonds. 5-year expected rate is 2.81%. Those could be way off, and maybe we’ll see this higher inflation stick around. But I wouldn’t bet against the bond market.

The bargaining step in grief management is typically the most entertaining and illuminating.

UPDATE: Benchmark Mortgage Rate Jumps Again, 39 Percent Higher YOY