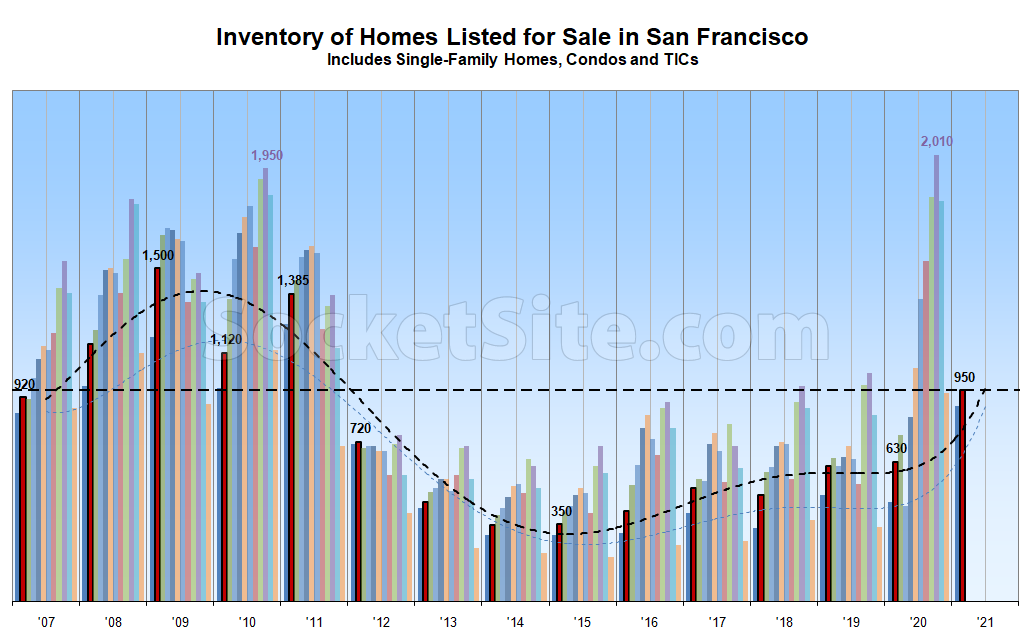

While the number of homes officially on the market in San Francisco (950) has only ticked up a few percent over the past few weeks, driven by new contract activity, overall inventory levels are still 50 percent higher than at the same time last year (versus down nationwide) and poised to jump following the long holiday weekend and traditional start of the spring season in San Francisco.

At a more granular level, there are currently 65 percent more condos on the market (710) than there were at the same time last year and 20 percent more single-family homes (250).

And following an end of year culling of unsold listings, the percentage of homes on the market in San Francisco with a reduced list price has inched up from 19 to 20 percent which is 6 percentage points higher than at the same time last year with an average “expectation gap” of around 5 percent between the average list price per square foot of the homes which are in contract and those which aren’t in escrow.

And if seasonal patterns hold, expect inventory levels to climb over the next quarter and through the middle of the year.

i’m curious what similar data looks like for surrounding, less-expensive cities? (oakland, berkeley, san leandro, daly city, richmond) are people leaving SF to get something bigger in the east bay? or are numbers similar all around?

“Days on market” is very flawed for reasons SocketSite frequently points out, but if we take it at face value the median days-on-market moved in opposite directions in SF and major East Bay markets in 2020. In SF, the measure increased, but in Oakland, Berkeley, Richmond, and Concord it fell.

Even more telling is the current disconnect between the indexed trend for Bay Area home values and what’s happening on an apples-to-apples basis in San Francisco.

I routinely track 3-4 dozen listings – those that I find attractively priced – and almost all of them went into contract in the past 2 weeks. Things definitely picking up. I heard NY is going thru the same now.

Also noticing a lot of houses that were on the market for 3+ months started to move which I thought was a bit surprising given the new inventory that came online over the past month. Anything that was attractive that came up in January has gone into contract in 3 weeks or less. Starting to see houses go into contract within a week again. Cautiously optimistic that this year we’ll start seeing people flock back to the city now as we’ll see COVID restrictions loosening and vaccination rates go up. If this happens, historically low interest rates will fuel prices for the next few years.

The key question is if buyers are coming back or are sellers giving up? Going to be keeping a close eye on the apples as they fall off the tree. There were a lot of hopes for the post-vaccine world and we’ll see if sellers are getting their hoped for prices or are they having to make deep concessions to move their properties.

In addition to being around 5 percent higher than for the homes which are currently in contract, the average asking price per square foot is currently down around 5 percent versus the same time last year.

So what gives seeing pending listings after around “1 day on the market”? I thought pocket listings were banned?

I think MLS realtors communally have access to coming soon listings on the MLS?

It also simply happens all the time that things go pending in a single day.

I am an amateur here with a sample size of one. The place next to us sold and we were curious to see the listing and price and looked everywhere for it. They showed it for about a week before it was listed. I don’t know if that is a pocket listing or not and I don’t think it’s a big deal but it does help the Days on the Market and I’d guess it helps with negotiations too.

There is a coming soon pre-market. So that’s a thing. But so too is something selling right away. It’s not one or the other.

I really would like it if general perception of days on the market would change. In other robust markets, things can take longer to sell and it’s not a big deal, but merely par for the course. Here if something doesn’t sell instantly all sides think something must be wrong with the property. It’d be great if everything was priced at the real price the seller wants to get and if it takes a while to get it, fine, and if not, then OK, reduce the price.

Does it really matter if pocket listings are banned if properties are listed and at the same time the listing goes up they are given the status “contingent” or “pending”? For all intents and purposes, that’s the same thing as a pocket listing.