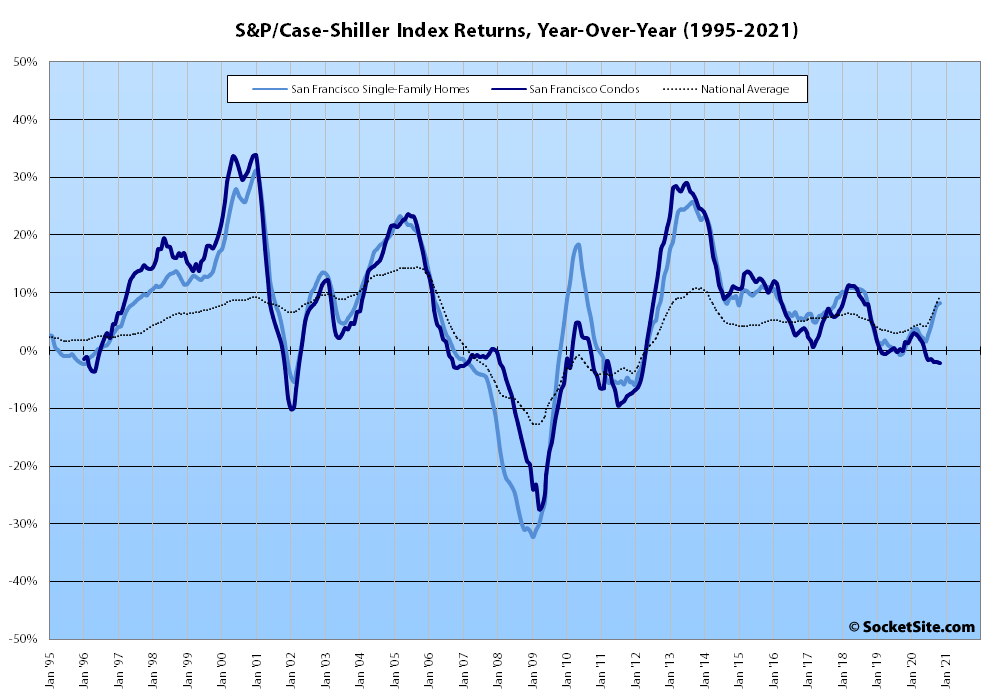

Having ticked up an upwardly revised 1.0 percent in October, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – inched up 0.6 percent in November for a year-over-year gain of 8.3 percent versus 9.5 percent nationally.

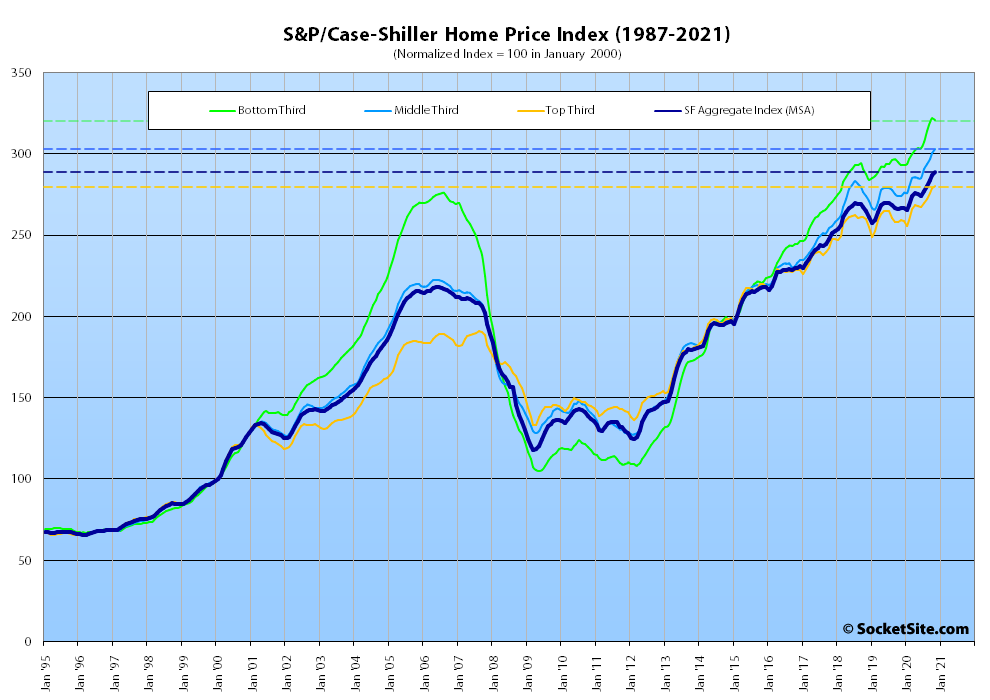

At a more granular level, the index for the least expensive third of the Bay Area market slipped 0.3 percent in November but was 9.5 percent higher than in November of 2019; the index for the middle third of the market inched up another 0.8 percent for a year-over-year gain of 10.3 percent; and the index for the top third of the market ticked inched up 0.5 percent and was 8.1 percent higher, year-over-year.

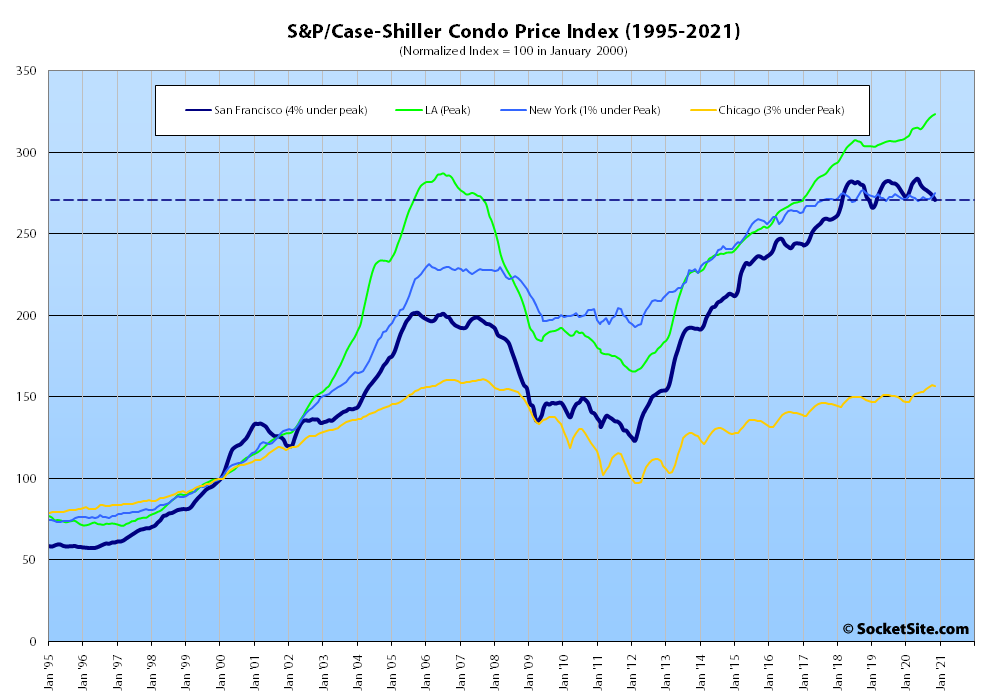

At the same time, the index for Bay Area condo values, which remains a leading indicator for the market at a whole, ticked down 1.1 percent in November for a year-over-year decline of 2.1 percent (versus year-over-year gains of over 5 percent in Los Angeles, Chicago and Boston and 1.1 percent in New York) and is now 4.1 percent below peak.

And nationally, Phoenix still leads the way in terms of indexed home price gains (up 13.8 percent on a year-over-year basis), followed by Seattle (up 12.7 percent) and San Diego (up 12.3 percent).

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

Over sixty one billion dollars of VC investment per year is going to leave a mark.

Well it looks like that mark will be less and less in the Bay Area and even CA. As one key data point, note that CA is the only state to have kept public schools closed for so long … and 25% drop in rents is also not ignorable, unprecedented drop in demand.

Is there any precedent for what happens when condo values and sfh values diverge like this? Seems to me that regional demand is temporarily skewed toward a particular type of property, but likely to correct since the two tend to correlate.