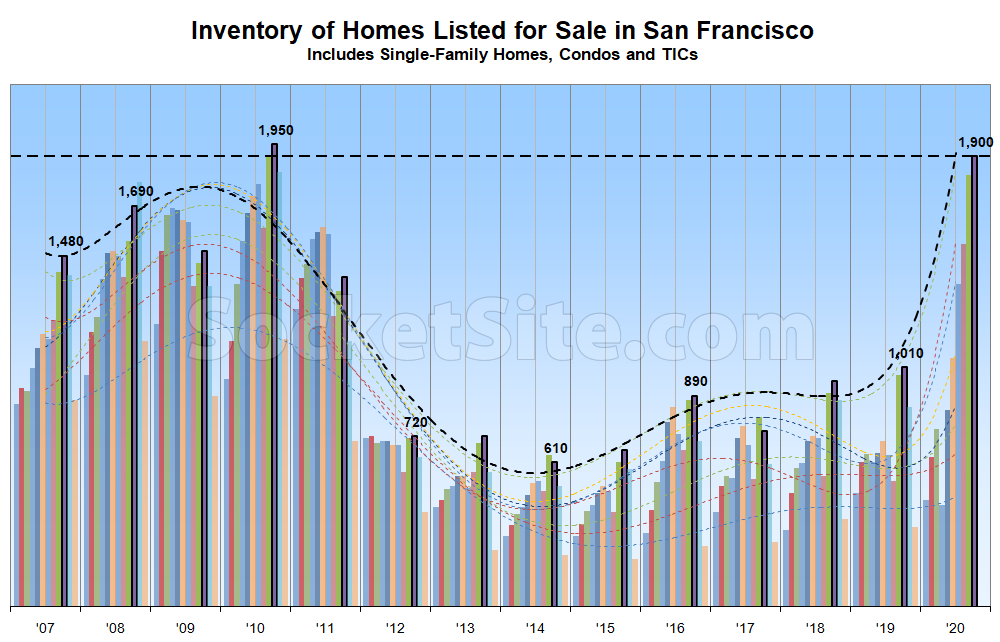

Having jumped over 20 percent in September, a move which shouldn’t have caught any plugged-in readers by surprise, the number of homes on the market in San Francisco, net of all sales, both pending and closed, has just ticked up to 1,900 for the first time in a decade and is within 5 percent of hitting a two-decade (plus) high.

In addition to running 90 percent higher on a year-over-year basis, versus nearly 20 percent lower nationwide, listed inventory levels in San Francisco are now over 200 percent higher than they were in October of 2015 and roughly 20 percent higher than during the Great Recession, with the number of condos on the market (1,460) now up 110 percent on a year-over-year basis and single-family home inventory (450) up a little over 40 percent, year-over-year.

At the same time, with 31 percent of the homes on the market in San Francisco having been reduced at least once, which is 14 percentage points higher than at the same time last year, the number of reduced listings has jumped 26 percent over the past month to a 10-year high in the absolute.

All that being said, while inventory levels will likely continue to tick up over the next couple of weeks, inventory levels typically peak in October. We’ll keep you posted and plugged-in.

I am part of a small 5 unit HOA. Soon after the pandemic started, there were 4 job losses out of the 5 units – finance, legal and business operations. 3 have since found a new job, with 1 still looking. So we might be closer to the end of the tunnel when we realize now.

That’s certainly great for those three. But in terms of an actual “end of the tunnel,” while the rate of new claims has slowed, and the unemployment rate San Francisco has declined with a contraction in the labor force, the total number of active unemployment claims actually ticked up 3.1 percent in July to 78,287 having peaked at 31,397 following the Great Recession. Which brings us back to the inventory levels at hand…

“So we might be closer to the end of the tunnel when we realize now.”

That’s very doubtful. You may have heard anecdotes about people who were making more in pandemic stimulus payments then they were while actually being employed. These weren’t just isolated anecdotes. The stimulus actually spiked personal income above it’s pre-pandemic trend. See the graph “Personal income vs. spending, through August“.

Post election I don’t think either party can or will be able to maintain this level of stimulus. Layoffs are mounting and we’ve been isolated from the full effect of the economic hit so far, but after the election it is going to be a very challenging time for the economy. That’s why it is quite surprising that rents in SF have already dropped as fast as they have and inventory has shot up as steeply as it has

There has been a historic hit to the economy and it is going to take quite some time to process and work through it.

SF is now less appealing and it will remain that way in a post-COVID world. Many great restaurants have moved on, there’s even more homeless people attracted to the city by hopes of benefits (hotel rooms!), SF just announced it is giving raises to city employees who are already dramatically well-paid (city will face more budget balancing challenges), many of the lower-to-middle income unemployed left because they were already paycheck-to-paycheck.

Not to mention that…

– people were already frustrated and on the brink of exodus

– rents had started declining slightly pre-COVID since 2015,

– people now often want more space at home due to COVID,

– there’s now a broader recognition of the value of being able to move on a whim.

– a move towards remote work dramatically accelerated

– the current for-sale inventory will take a long time to clear out, because more inventory will continue coming online.

– fires and smoke suck, and its going to keep getting worse

Rents have dropped 20% since March. Pre-COVID buying was already much more expensive in SF than renting after all costs and alternative investments considered. Today, prices could drop by more than 30% and homes still would not be undervalued.

City salaries are absurd. Breed is the highest paid mayor of any US city despite SF being a relatively small city. The work ethic of many city employees leaves something to be desired. DPW workers hanging (hiding) out at Lake Merced. Lake Merced maintenance/gardener workers keeping bankers hours.

Last year we went to Tahoe with a friend who is a city worker. It was Friday – his telecommute day – and he logged on early then played all day. Checking his e-mail twice during the day. I asked wasn’t he afraid he’d be caught – he wasn’t. Its apparently common practice for city workers on their telecommute days – those who are able to telecommute.

SF is among the most mismanaged and corrupt cities in the US and it’s hard to see city government reforming itself. However, without radical reform small business will not recover/return in SF. The fees and regulations were smothering before the pandemic and nothing short of a total overhaul of those regulations will do.

Entirely agree on the difficulties for small businesses. My wife operates a small business from our home, and the bureaucracy to deal with running a business while living in SF is a major headache. We’re planning to leave in the next 1-2 years. Or sooner. My wife was ready to jump ship 3 years ago.

I’m not at all surprised by your Tahoe story. To replace a small playground in the Panhandle, it cost $3,000,000. I checked on typical budgets in other cities for a small playground, and $30,000 to $100,000 was typical, or 3% or less than what it cost here in SF. Is it a nice playground? For sure it is, but at $500 per square foot it sure as heck better be. I don’t know how that contract could have been anything but corrupt dealing.

My dentist is just three years from retiring but says if he had 10 years left to practice he’d relocate to north San Mateo County. His patients come from SF and northern San Mateo. If you ever drive down Sloat which has a large median strip note every few years the city plants it with a few spindly tress and spreads bark. It takes days and there is a large crew. Milking it. The sad thing is they don’t maintain the newly planted trees and in a few years they die off. Now take a ride to Daly City or SSF (El Camino) and see how they handle landscaping medians. It’s a night and and day difference.

Dave, your friend’s behavior isn’t anything specific to city workers. A LOT of folks in Norcal/Bay Area take Fridays off even if they’re still on the clock. Unofficial 4 day work weeks seem to be the norm here, even at hard charging tech companies. It’s one of the West Coast’s defining characteristics in comparison to the East Coast.

Taking Fridays off is not the norm in tech unless your plan is to coast until fired. The behavior you are describing is why “hard charging” tech companies discourage remote work. One of the tech CEOs specifically called out Friday/Monday productivity drops as a reason why they need people in the office.

Job losses for professionals are not driving the real estate inventory. There’s many drivers of the increases in inventory, job losses aren’t one of them. So your light at the end of the tunnel is wishful thinking.

That would be like being a travel agent in the year 2000 and thinking you see a light at the end of the tunnel in 2002 when the economy started turning around. No, this is only going to get worse for you. There’s no light anywhere.

This is a redefinition of work, a redefinition of city businesses, and a redefinition of what families need for living/playing space. Professional job losses aren’t really an issue for real estate unless you are a new college grad, in which case you probably aren’t finding much, don’t need a rental here if you do, and that causes your potential landlord to want to sell.

This is certainly the most logical response to it all. No light yet, but it’s anyone’s guess how bad it can get. It doesn’t look good in the near future as a whole, but long term I’m not convinced the sky is falling yet. It doesn’t look terrible for SFH, but it does look grim for condos. Typically I would agree that condo is a leading indicator of the overall market, but demands of buyers are being redefined.

We don’t know what post-coronavirus life will be like. Demand is still there for now while we see people move on from apartments/condos to SFH, but only until we see well paid professionals laid off (if it happens). Even if demand sticks around, the big issue here is the glut of supply now and coming to market over the next year until we finally return to some form of “normal”. Basic supply and demand says there will still be room to go down since we’re not seeing any increased demand on the horizon to absorb the increased supply.

One positive we can get out of this is that we’ll probably have some affordability in a new lower end market created in the form of condos when we find a bottom.

Right now we are seeing mostly voluntary departures I think. A reader, Brhama, pointed out that this is revealing that many SF residents were very marginally attached to the city. When the stimulus fades there is going to be a large primary impact on certain industries. This is already starting with some furloughs turning to outright layoffs. Tech/Professional services isn’t going to be one of these industries taking a primary hit. But companies and workers in the industries that do get hit are consumers of tech products, software & services. And they are also buyers/targets of a certain amount of advertising sold by tech companies. This secondary impact will force a certain amount of belt tightening. We’re not going to get devastated like some of the industries taking a primary hit, but there will be a significant effect felt.

That is why I think there will be more job relocations vs layoffs. Airlines & theaters are getting hit so badly with no light at the end of the tunnel that they have no choice but to make large cuts. The companies feeling the secondary economic effects will need to contain costs while preserving their intellectual capital and maintaining readiness for the next growth cycle.

One funny thing about SF is that prices have risen so dramatically and Prop 13 freezes taxes so inventory can hit the market from people who wouldn’t be buyers at today’s prices. Tourism was a big part of the SF economy pre-COVID and prior to Tech’s arrival it wasn’t unrealistic for regular people to buy a house. So I think we will see some inventory come online from the primary economic effects on tourism. Some long hold time inventory from people/families that just want to cash out at a good enough time.

You may recognize this hockey stick-shaped curve from such housing bubbles as the Dotcom Bubble and the Global Financial Crash.

(Actually, this sucker looks steeper)

This is just a conjecture. Feel free to reply with any corrections or disagreements.

I think much of the gains in SF RE, in the last 1.5 decades are a speculative cycle fed by Tech startup boom. RE gains are the easiest and cheapest (taxwise) to extract payouts rather than wait for a successful exit. $1M dollars invested in 2010 could yield up to ~ $2.3M (approx and pre-tax) by 2020 (at 5x leverage with 15% rate of return compounded 3x).

With the prices so hot, i am not sure this shell game (aided by cheap money) can continue without interruption at least the in short term.

The entire west coast is moving out of the scummy unhealthy cities to Lake Tahoe. It is flipping nuts up there.

I’m one of those people who never thought in a million years I would move out of the city into suburb. Because all the homeless problems, restaurants and shops closed, and paying high rent, I’ve decided to move out to East Bay from SOMA. I live in a non rent controlled loft. I’ve asked my landlord for rent reduction couple months ago for around 9% and he countered to less than 5%. I just shake my head and decide to move on.

I predict going forward, people will go to all hands meeting on Mondays and perhaps do a socialize Fridays once a month. Rest of the time, people will work from home. I think this will be particularly true for tech jobs and other jobs that don’t necessarily need employees on hand.

SF will be rough for awhile. With depressed tax income due to various sectors closed down for extended period of time, many companies going out of business, and continue fluctuation of homeless people coming into the city for benefits, I suspect quality of life in the city will be down for several years. I’m glad I’m getting out before stuff hits the fan!

South San Francisco / San Mateo County are better options for tech. No homeless people, no bio-hazards to step in or on. Lower rents. Lower taxes. Better Transit. Relatively Cheaper housing.

I think that is where the remaining tech-action will move to, if it hasn’t already.

But what do I know, I am always mostly wrong.

Better transit? What?

There is BART up until Millbrae.

And Caltrain all the way to Gilroy.

And a transfer point between Caltrain and BART in Millbrae.

San Mateo County also has 101 and 280 corridors running parallel.

There is a ferry service from South San Francisco to San Francsico & Oakland.

Pretty easy to expand if more connections are required.

This is all obvious stuff .. why are you asking?

I learned long ago in the real estate business, don’t make assumptions about the future based purely on conditions today. That includes periods of real estate euphoria that we just came through or real estate depression that we are currently in.

I’ve heard it all, “San Francisco real estate only goes up.” (pre dot com implosion, housing bubble period and post great recession) and “San Francisco real estate is depressed because the world has changed” (during dot com collapse, post-Lehman until about 2012, and now). Neither of these are true.

What is true, is San Francisco is in the worst or 2nd worst real estate recession in 20 years. Working through inventory takes time, economic recovery takes time and I am willing to bet that this winter there will be a lot of newly minted Tahoe residents (recently transplanted from SOMA), stunned about how hard it is to dig out 4 feet of Sierra cement that blocks their driveway.

there are already a decent number of city dweller who have moved to tahoe. Almost everything coming online in Tahoe in the $700K to $1M range is going for $100K over asking and has multiple bidders. locals are pissed. I have a redfin search and get all the notifications when they go into contract, which is usually within a week or 2 of listing. its been that way for the last 3 months

I’d be curious to see how many of these places are 2nd homes while keeping their places in bay area.

not sure how one could find that out. Anecdotally, I know a couple of people who are in rent controlled apts in SF who recently bought in Tahoe.

If done by the book and financed, second home purchases would have a second-home rider attached to the public record deed.

Always nice to have a place in the country to flee the pandemic and a place in the city to flee the fires.

If I was a real estate investor, I’d be buying as much as possible in SF right now. The city has always gone through downturns and ALWAYS returned stronger than ever. Patterns repeat themselves. This work from home thing will not be permanent. Its driving people nuts.

I am a real estate investor, but I haven’t seen deals yet. That is part of reason the number of houses on the market is so high. I’m thinking post Election is going to be buying season.

UPDATE: Single-Family Home Inventory Just Hit a 9-Year High

UPDATE: Number of Homes for Sale in S.F. Hits A Two-Decade High