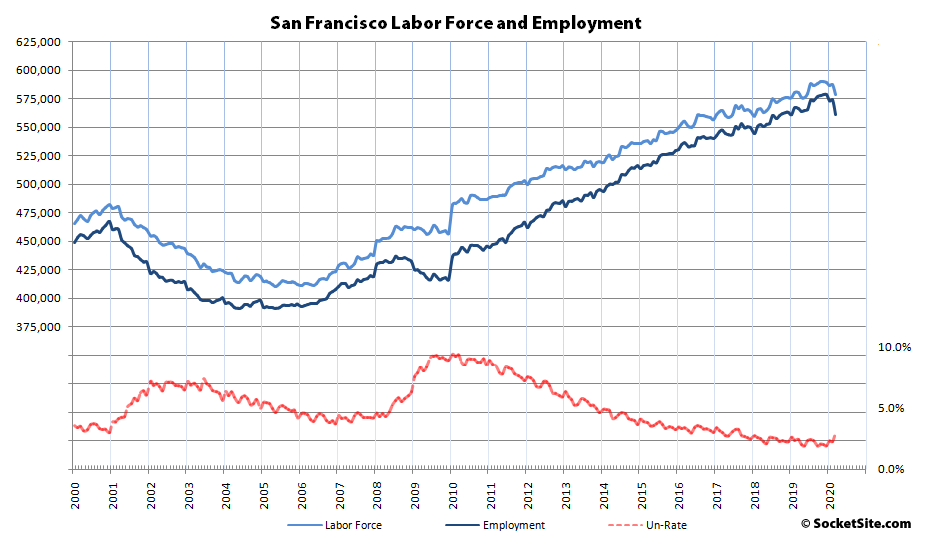

Based on employment data through the second week of March, which predates the bulk of the ongoing economic impact caused by COVID-19, the estimated number of people living in San Francisco with a paycheck has already dropped by at least 13,100 to 560,800, representing at least 5,400 fewer employed residents in the city than at the same time last year with an unemployment rate of at least 3.0 percent.

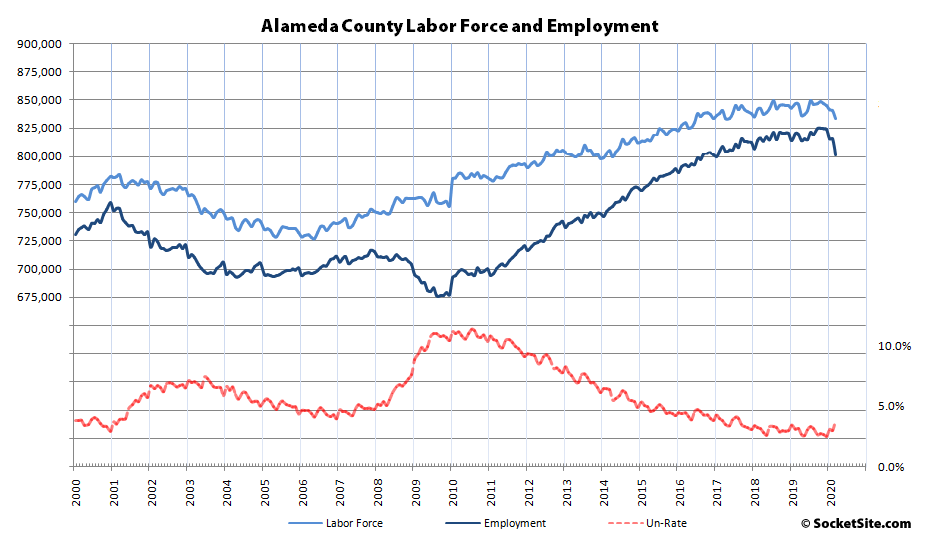

Over in Alameda County, which includes the City of Oakland, the estimated number of employed residents has dropped by (at least) 13,900 to 801,500, representing (at least) 18,000 fewer employed people in the county than at the same time last year with an unemployment rate of 3.8 percent.

And across the greater East Bay, including Solano County, total employment has dropped by (at least) 25,700 to 1,531,300, representing (at least) 33,100 fewer people employed across the East Bay versus the same time last year with a blended unemployment rate of 4.0 percent.

Up in Marin, the number of employed residents has dropped by (at least) 3,000 to 133,500, which is (at least) 2,500 fewer employed residents than at the same time last year, with an unemployment rate of 3.1 percent. Employment in Napa has slipped by (at least) 900 to 70,300, which is only 600 fewer than at the same time last year, but with an unemployment rate of 4.0 percent. And employment in Sonoma County has already dropped by (at least) 4,200 to 247,300, which is (at least) 3,000 fewer employed residents than at the same time last year with an unemployment rate of 3.6 percent.

Down in the valley, employment in San Mateo County dropped by (at least) 10,400 in March to 442,800, representing (at least) 4,600 fewer employed residents than at the same time last year, with an unemployment rate of 2.8 percent. And employment in Santa Clara County has already dropped by (at least) 19,900 to 1,008,200, representing (at least) 16,900 fewer employed residents than at the same time last year with an unemployment rate of 3.3 percent.

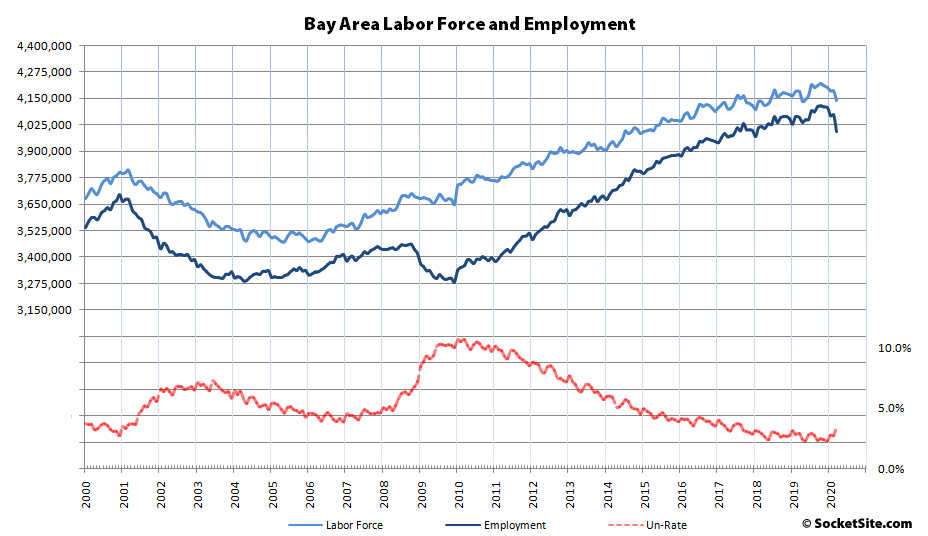

And as such, total employment across the Bay Area – which had already peaked at a downwardly revised 4,113,700 this past October, prior to the COVID-19 hit and which shouldn’t catch any plugged-in readers by surprise – dropped by at least 77,200 last month to 3,994,200, which represents at least 119,500 fewer employed residents across the Bay Area than at the same time last year with an unemployment rate of 3.5 percent.

But once again, the employment numbers above predate the bulk of the ongoing economic impact caused by COVID-19. And over the past four weeks, which post dates the data above, there were 2.7 million new unemployment claims filed in California. That’s at least 2.3 million, or over 600 percent, more than the highest number of new claims filed in a single month since January of 2010.

UPDATE (4/28): Make that 330,000 new unemployment claims in March alone.

“Buy the dip!”

or maybe it’s “Buy and you ARE a dip”

One or the other, I guess…

The first (of at least two) WOW! moment(s) we’ll see on this front.

Where is this data coming from?

The underlying data, which we compile, is by way of California’s Employment Development Department.

This is the content I came here for. Not the 30 comment thread about bikeshedding a SRO in Eureka Valley. The stuff in this post is what matters folks. Realtors are calling clients saying now is a great time to buy with low competition. They’ve got blinders on to the entire macro picture; prices in BA have not dropped enough to reflect the amount of uncertainty in the world. VIX at 50 and realtors trying to hawk 2BR condos at HIGHER than pre-covid19 pricing.

The realities of this world are going to hit the SF realtor community hard, and they’re going to end up in a soup line.

” “Everybody talks as if they know what’s going to happen, and nobody knows what’s going to happen.” Charlie Munger, vice-chairman of Berkshire Hathaway, quoted in the April 18, 2020 edition of The Wall Street Journal.

Boy, that “tipster” guy really has you realtors pegged. Last year you were Juul Fool hyping that IPO millionaires were going to eat SF alive with $5M average home prices and now “nobody knows what’s going to happen”.

Juul Busted! IPO’s Busted!

“And I happen to know it’s still garnering a great deal of attention at this price point.”

Noe Busted!

“Newsletter nonsense that sales would be up when they were actually down”

Busted!

““I think it gets asking or better rather quickly. The Noe market for things of this quality and in this range has been competitive this fall.”

Noe double-Busted!

But yeah, now with a global pandemic and employment dropping “nobody knows what’s going to happen”

The Juul employees got their money. I’m not sure why you chose not to understand that fact.

The Dolores Heights one? I already mentioned where I was coming from in another thread.

The 28th st one? I don’t remember that one but OK guess I was wrong. Other things in that range were trading briskly at that point in time.

I’m really not sure why you think “gotcha” culture is so swift, or why you’re so incessantly rude to me. But so be it.

Agree and I don’t understand why the reporters and bloggers are not covering the story.

“America’s Biggest Cities Were Already Losing Their Allure. What Happens Next? The urge among some residents to leave because of the coronavirus may be temporary. But it follows a deeper, more powerful demographic trend.”

They Are. From Could a remote-work revolution spread tech outside its clusters?:

Emphasis added. I think the impact on the commercial real estate market is going to be much more pronounced than residential, though, because so much of the local economy depends on low-paying, tight margin businesses like restaurants who are simply going to stop paying rent next month if they haven’t already done so.

Interesting links. And spot on. The macro picture has been changing for the Bay Area for a while and this pandemic will accelerate that. As it is, the Bay Area was in the process of declining (relatively) as a business/tech/population center to other metros. Mid-level tech jobs are increasingly being shifted to places like Boise, Colorado Springs, Pittsburg and others – from the Bay Area. But for births, last year SF’s population would have declined. The quality of life in the Bay Area is eroding. The streets of SF are filthy and crime ridden. Conventions are shifting from SF to Las Vegas and other venues. SF’s city government is bloated and inefficient – the streets in constant disrepair. All that and SF’s mayor is the highest paid of any in the US even though SF is far, far smaller than cities like LA, NY, Chicago, Houston, Dallas and San Diego.

The effects of the epidemic on tourism will be felt for a long time. Tourism is the main SF industry and it won’t come back for years. Net office absorption had been paltry even before the virus as companies exit the city. A perfect storm as telework will emerge as a major trend across many industries and especially tech. The service industry will not come back as it was. Many restaurants won’t reopen. Already vacant brick and mortar storefronts from Taraval Street to SOM will increase. Service industry workers are already leaving the Bay Area looking for more promising places. The TTC area will further be distanced from its once vaunted promise as street level storefronts lie vacant and planned hotel, office and condo projects are abandoned. The HUB is now effectively DOA.

No one can predict the future but an educated surmise can be made. A significant population drop across the Bay Area in tandem will a net loss of jobs and a major hit to commercial real estate as well as a significant, but smaller, hit to residential real estate. And SF’s bloated government – sorry Mayor Breed and those who pose as supervisors – the revenue stream is gone. Hotel taxes, small business taxes, real estate transfer taxes. That revenue stream will collapse and can’t be replaced. SF will be forced to trim its bloated and too high salaried workforce. And to force those who reman to actually put in an honest day’s work.

“Mid-level tech jobs are increasingly being shifted to places like Boise, Colorado Springs, Pittsburg and others – from the Bay Area”

How about some non-anecdotal citation here? Very few tech jobs are being created outside of major metros and even fewer are being moved from the Bay Area to small metros/micropolitan areas. We’ve consistently observed that when tech jobs are moved outside the Bay Area, they tend to go to cheaper and fast growing metros like Dallas, Austin, and Atlanta and are disproportionately sales positions.

And by the way, overall crime is at a multi-decade low.

But hey, let’s not let facts get in the way of your embarrassingly tired and counter-factual narrative…

Yes, Texas cities are getting some of these shifted jobs. For instance HP has stopped most hiring into the Bay Area in the last several years. Pushing new jobs to mini-hubs in Colorado Springs and Houston.

Dave has been predicting a big population drop in the Bay Area for many years.

The population has not dropped.

[Editor’s Note: Babies Kept San Francisco’s Population from Falling in 2019]

Agreed.

And even if the population of SF has basically been flat in 2019, the Bay Area’s overall population has continued to grow. There’s absolutely no evidence at this point that a substantial population decrease in progress or imminent. If that evidence changes, then we should reevaluate projections based on that. But the notion that “the Bay Area will see a precipitous drop in population, because I have a feeling” has no merit.

Or more accurately and factually, “while the total [Bay Area] population ticked up to a record high of 7,796,235 [last year], the growth rate dropped to a decade-low of 0.3 percent and net migration tuned negative for the first time in a decade as well.”

Yeah, so essentially flat, with small growth. Not in opposition to anything I said. And certainly not supportive of the baseless prognostication of large decline.

But in terms of the actual trend and evidence, versus prognostication and feelings, while the total population was essentially flat, thanks to births outpacing deaths, “net migration tuned negative for the first time in a decade.” And as such, the adult Bay Area population actually declined.

Dave of “Seattle is paradise on earth” ramblings … why doesn’t the editor ever chime in on that nonsense? So weird.

@Anonymous – The decline in net migraion has been an 8 year long trend. That’s plenty of evidence of a trend. This COVID thing might be blip, but it sure seems like if anything it will only accelerate the 8 year long trend. Hard to see why it would do anything to reverse it.

Technically population still did increase, but babies don’t buy homes. And from my social circle’s experience the arrival of a baby is very likely to motivate the whole family to move out of the city.

@SFrealist – I have not “predicted” a big drop in SF’s population. I have predicted a drop and did not quantify it. Historically in the latter half of the last century SF’s population hovered around 750k. Up and down. It is now, IMO, at an historic high (at least for our lifetimes) and will drop towards its more historic norm. Not all the way. Maybe settling at 800k, give or take, which would not be a “big” drop.

Smart man ! (always be vague…never a date AND an amount….etc.)

That having been said, it never really “hovered” : it fell from ~800+K at the end of WWII to 678K in 1980, and then moved up to what it is now. (Much of the population drop was simply due to reductions in household size, unlike cities such as Detroit, StLo, Chicago where there was actually a reduction in the number of households); the only really static period was during the Great Depression…the Great Depression of the 1930’s, that is, for those who might be confused.

Actually, my advice notwithstanding, I’ll give both

August 1945 827,400

The population was up and down in the late century period:

1970 715,674 −0.34%

1980 678,974 −0.53%

1990 723,959 +0.64%

It’s not about being vague, but about following trends (no matter what your broker says you can’t time the market) and extrapolating from them informed “predictions”. That lands one in the ballpark.

I appreciate everyone trying to quantify the jobs issue, which i think is a large driver and a proxy for what a huge driver in price appreciation – psychology. FOMO is a big driver imo of price appreciation. If people think they need to outbid the next person for a unit/sfh., etc. that drives prices up up and up. However, confidence in future stability will plummet for a lot of folks. IMO, that will also drive prices down. As prices drop, on the seller side, if you want/need to sell, why would you wait if you think your sell price will depreciate in the future. Also, the rent to buy calculation will shift as unemployment rises and rents fall. We’ve been at ~2% unemployment in sf for years, thats changed fast. IMO it will take months for sellers to realizes that those valuations they have in their mind are gone. Prices are sticky and it will take time for sellers to deal with that reality.

Finally, it’s PittsburgH. With an H.

I was in the market for a 1-bd condo way back in early 2009 here in SF at the height of the housing collapse and brought on a Realtor. I was that dummy thinking that since housing prices had collapsed ~30% by then I could simply buy a condo for 30% discount. I was wrong. Of the very few houses on the market available, all were asking pre-bubble prices from underwater or stubborn sellers. Equivalent condos were selling in foreclosure for a fraction of the ones Realtors had on MLS inventory but I didn’t have pure cash to buy at auction not to mention all of the other risks and uncertainties. Short sales were also nearly impossible due to needing bank approval and all of the extend-and-pretend tricks the Fed deployed to slow fire sales in the traditional market.

I ended up not buying one from a Realtor due to them all being overpriced. Very little sales volume happened at that time due to this problem. This next time around assuming another big crash I will not bother with a Realtor as I have the cash at hand to go straight to auction to get a condo. Realtors are not true mark to market regarding housing prices, only foreclosure auctions are.

You are right. I only bought a condo in SF in 2011, because I DID NOT use a realtor. The listing realtor only took my offer because he could double dip on the commission and not share it with another agent. Later after I had closed on the unit, I heard from neighbors that they had offered more with an agent and were rebuffed by the crooked listing agent. I paid less than 200K cash for my unit and now it’s worth 720K.

FYI, auctions are not always the cheapest place to buy. My condo’s auction min bid was nearly twice what I paid for it. No one bid at that price and Fanny Mae took it back and listed it with the crooked broker.

I’m an angel investors (about 50-80 companies a year) I’m seeing a lot of my portfolio companies give up on San Francisco AND embrace remote work. It’s BOTH thing occurring at the same time

The first is happening due to homelessness, crime and taxes, and the second is happening because the technology has gotten good, young people want to work from home and because of the pandemic we’re in.

We’re seeing Sacramento, Autin, Florida, Brooklyn and Los Angeles as the top destinations these days.

Office space is the next big shoe to drop. Folks were taking less and less space per employee, and with folks not wanting to be in San Francisco AND remote working showing folks who is actually doing the work at their companies, I predict office space will crash.

Homes will not crash, but I think will be sideways if not modestly down (say 10% lower rents). This is because the big companies are STILL hiring and growing, and there are still many founders who want to come here.

Jason, who’s to say that large tech will continue to hire? Google and FB are ad dependent, and we know how that’s playing out. Apple has faced their own problems with supply and consumer demand.

Until they get a better forecast on what lies ahead, why would they hire at rates greater than to replace attrition? I see them acquiring more depressed companies and hiring that way. But only after things go on sale and the acquisitions have cut lean through layoffs.

I’m just going by my experience in the last couple of downturns, where the companies that survived went supernova.

This time could certainly be much different, especially with work from home/remote work being forced on 100% of the digital work force (only 10-20% of people were working remote prior to this–now it’s literally 100%).

Post 9/11, Microsoft hired with wanton abandon to disasterous effect. It hit their bottom line and productivity for almost a decade. (remember mini-MSFT?) I was there; I saw it firsthand. I wasn’t there post 2008 crash, but I know they didn’t go as wild. Much different leadership in there now, too.

I think they’ll buy companies and hire through acquihire, but not hire tons of individuals directly. Just my hunch.

There is a lot of arm chair quarterbacking on this thread (always on this site) and I’m not one to say a lot of the arguments aren’t logical, especially w/ Covid reality here for the next year, but I also find it hard to believe that all of these commercial developers w/ hundreds of millions on the line don’t have a deeper appreciation for the near and long-term demand of commercial real estate in San Francisco.

I could definitely see a few start-ups moving some/all of their operations to virtual or tier 2 cities (or go out of business), but it sure seems like most of the blue bloods (Google, SFDC, Facebook, Amazon, etc.) are amassing a lot of office space in SF. I also have a hard time believing that in a market downturn they are going to shift this new office occupancy for these city workers back down to the valley.

Younger people want to live and work in the City (which is why those companies are moving up here) – not to mention those that have been doing a 1.5 hr commute each way to the valley would seem to the first ones promoting a work-from-home situation. Yes, I think there will be downward pressure on commercial (and residential) rents, but there will not be an overnight shift to tier 2 cities or WFH at massive scale right after Covid state. Just my opinion. It may happen but it will take years.

That said, we are in the middle of a grand experiment and able to capture a TON of data. It will be interesting to see just how productive workers are from home (especially those that have not been able to in the past) and promising indicators there could shift the acceleration. Just feels like with so many companies (particularly in tech) battling to win a culture war, executive leaders aren’t going to be gung ho to have everyone work from home.

Who’s to say that commercial real estate won’t be (at least somewhat) buoyed by the need of many companies to unwind the movement from cramped shared workspaces and unassigned seating back to more covid friendly cubicles and standard offices?

Ahh that would be so welcomed… back to the 90s cubicles instead of the crappy bench work spaces that we have now.

As someone who works at a company that offers traditional cubicles, but whose friends overwhelmingly work for companies who only offer elbow-to-elbow seating at Wework-style tables, I’d welcome this but I don’t think it will happen.

Companies implement shared workspaces and “hot desking” and all the rest because class A office space is expensive, so they are maximizing their use of over-priced office space and thus lowering the per-employeee cost. Commercial landlords would have to lower rents substantially, on a long-term basis, to reverse this. Here’s hoping.

UPDATE: Make that 330,000 new unemployment claims in March alone.