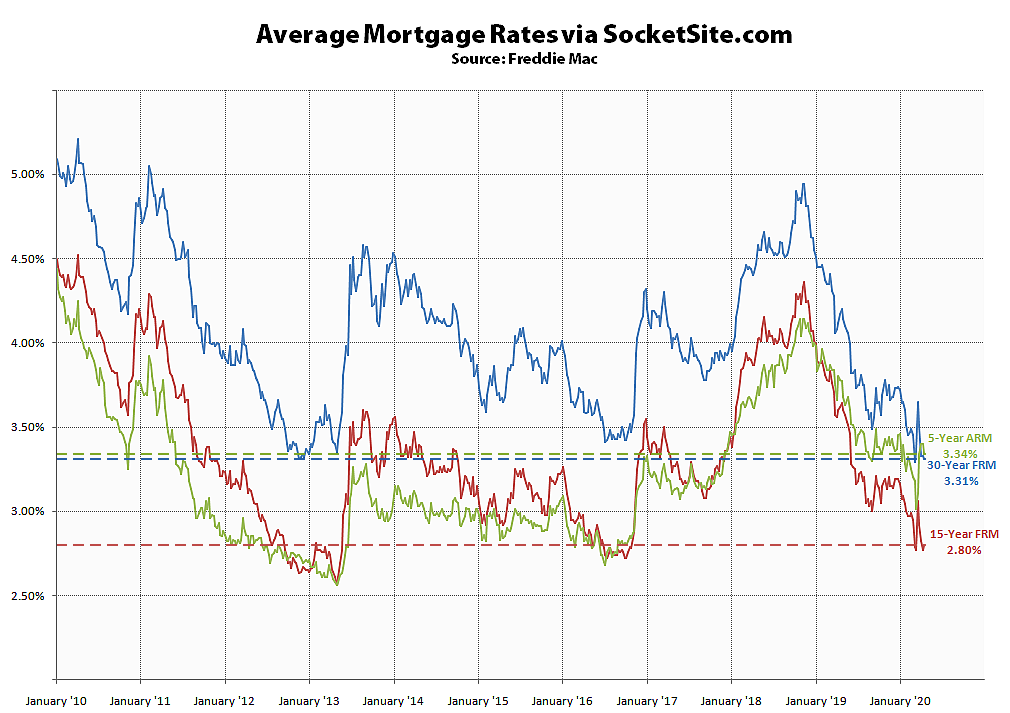

The average rate for a benchmark 30-year mortgage inched down another 2 basis points over the past week to 3.31 percent, which is 86 basis points (0.86 percentage points) below its mark at the same time last year and within 2 basis points of an all-time low, according to Freddie Mac’s latest Mortgage Market Survey data.

The average rate for a 15-year fixed mortgage inched up 3 basis points over the past week to an average rate of 2.80 percent (which is 82 points below its mark at the same time last year), while the average rate for a 5-year adjustable dropped 6 basis points to 3.34 percent (which is 44 basis points below its mark at the same time last year and an “inverted” 3 basis points higher than the average 30-year rate).

At the same time, pending home sales activity in San Francisco is currently down 40 percent on a year-over-year basis and “purchase demand is weak due to economic tightening,” nationwide.

Such a great time to refinance – but ironically most people are either out of work or have experienced income reduction (evidently 3/4 of the nation) so qualifying is another issue.

While purchase loan activity in the U.S. is currently down 35 percent on a year-over-year basis, refinancing activity is up 192 percent, at least in terms of applications.

From Mortgage Lenders Are Hiring Like Mad to Handle Demand as Rates Plunge:

That was back in March, Before The Federal Reserve made a surprise move and cut its benchmark borrowing rate to near zero. Huge opportunity for real estate agents not currently selling to make a career switch.

Wow, that sounds like the recruitment pitch from Boiler Room.

Not worth getting paid 1m a year and not being able to see your family. Plenty of jobs that pay 500k to 750k and you only need to work 30 hours a week. You still have plenty of time to take naps and watch you kids grow up.

>Plenty of jobs that pay 500k to 750k and you only need to work 30 hours a week. You still have plenty of time to take naps and watch you kids grow up.

you forgot /s

Only the creme de la creme are getting rock-bottom refi rates. You need $200k+ in liquid balances in said bank to qualify for any cash-out refi, and even then the cash-out amounts are being capped.

This is covered extensively on other sites. Rates are low, volume is razor thing. On a VWAP basis, this mortgage market is all fluff and no bang.

This is in regards to jumbo loans, which is an absurdly high amount of the Bay Area. Conforming loan figures do not apply here.