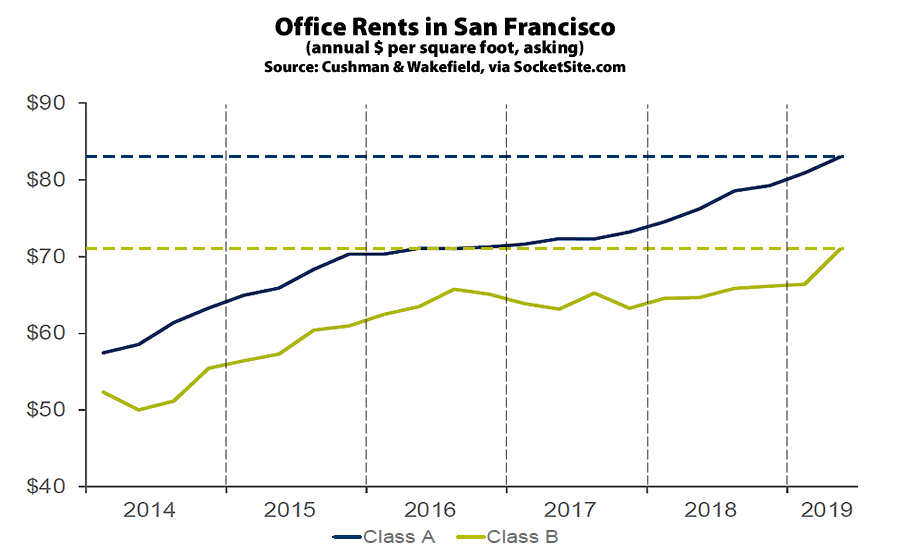

Having ended 2018 at a record high, driven in part by the delivery of a record 3.7 million square feet of high-end Class A space, all of which was delivered pre-leased, the average asking rent for office space in San Francisco has ticked up another 4.5 percent in the first half of 2019 to a record $79.07 per square foot per year, which is 9.4 percent above its mark at the same time last year, according to Cushman & Wakefield.

At the same time, the average asking rent for older Class B space in the city, which hadn’t really budged over the past couple of years, jumped 4.8 percent over the past quarter alone to a record $70.94 per square foot per year, which is up 9.7 percent since the second quarter of 2018.

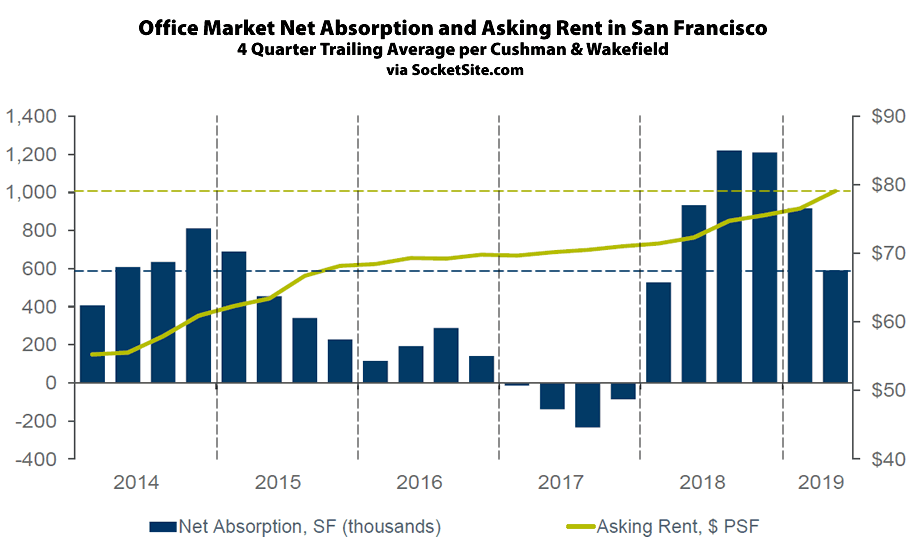

With a net 86,000 square feet of office space having been absorbed in the second quarter of the year, versus 1.4 million square feet of net absorption in second quarter of 2018, the overall vacancy rate in the city has inched down to 5.5 percent over the past quarter, which is 190 basis points below the 7.4 percent vacancy rate at the same time last year and 10 basis points below the previous 10-year low of 5.6 percent set in 2016, with 4.6 million square feet of currently unoccupied space in the city, including 870,000 square feet of space which is technically leased but available for sublet (which is down from 970,000 square feet of sublettable space at the same time last year but up from 790,000 square feet in the first quarter).

And while there remains another 2.5 million square feet of office space currently under construction in the city, roughly half of which will be delivered, pre-leased, over the next two years, the cumulative need of tenants looking for new office space in San Francisco has jumped to an estimated 9.9 million square feet, which is up 50 percent over the past quarter and 60 percent higher than at the same time last year, with all eyes still trained on the legal challenges of San Francisco’s Central SoMa Plan and recently approved developments.

Would love to see a similar analysis for retail space. The amount of empty store front in SF and greater Bay is staggering.

All over America. Retail is shrinking fast.

How much of the 4.6 million feet of vacant office space is Class A? I’d guess a good chunk as much of it is space vacated by SalesForce, DropBox and a big chunk at One Bush (IIRC) given up by a Federal Agency leaving the City. All in all, almost 6 million feet available (including not taken space under construction) and 9.9 million feet being south leaves a net “need” of 3.9 million feet. Some of that space being sought is by companies looking at other Bay Area cities as well as SF. A portion of that need will be filled outside of SF. Bottom line, not a huge supply/demand imbalance.

The Central SOMA Plan will likely be in court several years before being finally settled. So projects like that at the Tennis Courts and Flower Mart may not be ready for occupancy for 5, 6 or more years. Talk of an initative by housing activists, in case the court case fails, could effectively indefinitely delay the Central SOMA projects.

That said, why is no one seemingly looking at HP/CP? Exempted from M and originally planned for 3 million feet plus of office space, Lenanr moving forward now might put them in a sweet spot in the coming decade if Central SOMA is waylaid. They could become the only game in town for major new office buildings. Along with the Giants whose 1.4 million feet of office space has been approved.

2,791,378 (or 3,493,977 inclusive of sublease…which is your 4.6M number) A remarkably easy number to obtain.

Indeed, the large majority of space. One wonders why then it is hard to find 100K blocks.

I walked from 11th to 2nd along Folsom last week and could not believe how many vacant store fronts there were. It’s stunning. Yet demand for office space is on fire in the city. So what gives? Maybe some of the building are filled with start ups but are made to look vacant due to the PDR zoning.

Retail is dying and zoning can’t save it.