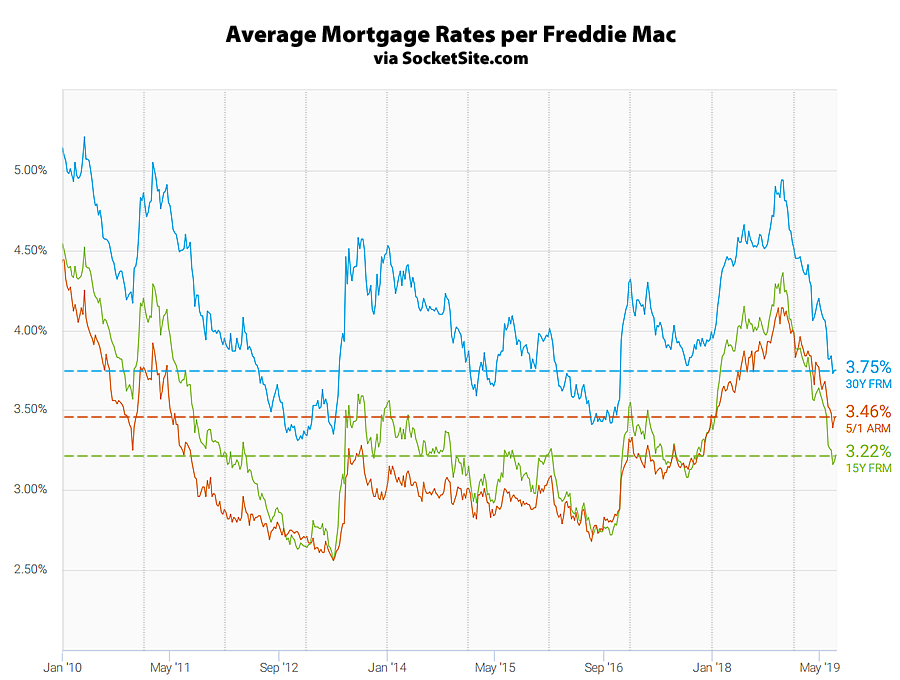

The average rate for a 30-year mortgage has been holding at around 3.75 percent over the past two weeks, which is down 119 basis points (1.19 percentage points) since the fourth quarter of last year, down 78 basis points on a year-over-year basis and is effectively the lowest 30-year rate since November of 2016.

At the same time, the average rate for a 15-year fixed mortgage has inched up 6 basis points over the past two weeks to 3.22 percent but remains 80 basis points below its mark at the same time last year and the average rate for a 5-year adjustable has inched up 7 basis points to an inverted 3.46 percent (which is 48 basis point below its mark at the same time last year).

And the probability of a Fed easing rates by the end of the year is holding at 100 percent according to an analysis of the futures market, which which shouldn’t catch any plugged-in readers by surprise.