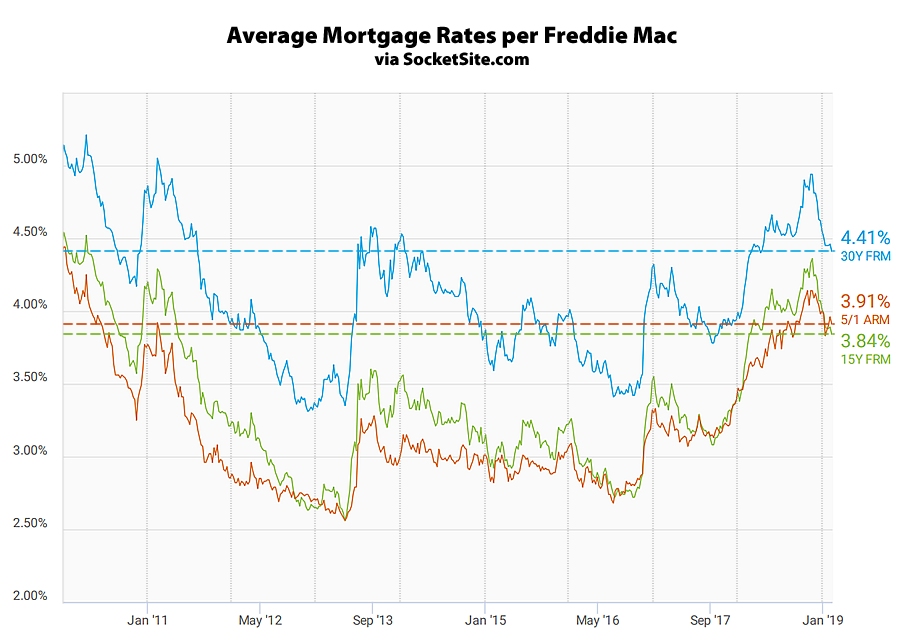

Having dropped to a 9-month low at the beginning of the year, the average rate for a benchmark 30-year mortgage, which hit a 7-year high of 4.94 percent this past November, has inched down another 4 basis points to a 10-month low of 4.41 percent, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has dropped to 3.84 percent, which is 7 basis points above its mark at the same time last year but down 52 basis points since mid-November, while the average rate for a 5-year adjustable has inched up to 3.91 percent, which is now 34 basis points above its mark at the same time last year and an inverted 7 basis points above the 15-year rate.

And with the Fed having formally signaled a more “patient” approach with respect to any future rate hikes, the probability of a hike this year has dropped to around 5 percent, with the possibility of an easing now approaching 20 percent, according to an analysis of the futures market.

The “Fed put” at work. Real estate bears should keep it in mind.

The Fed was not able to stop the last housing downturn. They would not be cutting back on rate hikes if they saw a strong economy ahead.