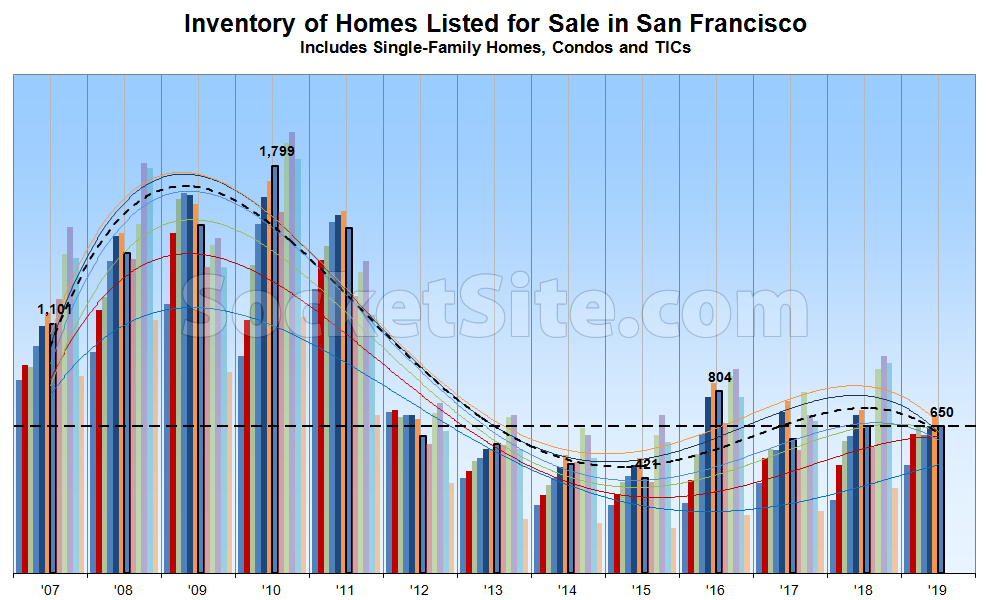

While the number of homes listed for sale in San Francisco hit a seasonal peak last month, inventory levels ticked up 12 percent over the past post-holiday week to 650, which is even with the same time last year.

At the same time, the percentage of active listings in San Francisco which have undergone at least one price reduction has ticked up to 20 percent, which is two (2) percentage points higher than at the same time last year, while the percentage of homes on the market with a price tag of a million dollars or less is holding at 29 percent (which is five (5) percent points lower).

And with contract activity over the past three weeks having dropped anew, the pace of sales in San Francisco is now running over 10 percent lower on a year-over-year basis, which shouldn’t catch any plugged-in readers by surprise.

This is data from MLS or tax record and to what time period?

We crunch MLS-based data for both listing and pending sale trends, which are then adjusted for unlisted activity to derive year-over-year comparisons and a point-in-time pace of sales which we track on a weekly basis.

I hope prices drop, I just don’t see it. I looked at 1 bedrooms in Dolores/ Castro for the past few weekend, open houses on Sunday, and then followed their sale….and each of the 3 (1) bedroom condos (1 with parking, 2 without) all went for 1 million PLUS!..Just Nuts.

No surprise here. Despite lower rates giving buyers 10% more purchasing power over last fall, and the much touted slew of IPOs creating hordes of newly minted millionaires, the real driving force driving SF real estate appreciation has left the building.

More on this. And we have only begun to see the full effects. Direct effect on RE and secondary effect via tech funding and reduced immigration of Chinese tech workers.

“Growing distrust between the United States and China has slowed the once steady flow of Chinese cash into America, with Chinese investment plummeting by nearly 90 percent since President Trump took office.

The falloff, which is being felt broadly across the economy, stems from tougher regulatory scrutiny in the United States and a less hospitable climate toward Chinese investment, as well Beijing’s tightened limits on foreign spending. It is affecting a range of industries including Silicon Valley start-ups, the Manhattan real estate market”

The real driving force, rental rates, have left the building? No, they’re in residence actually. Rent asking prices are at or near all time highs. When you speak about the Chinese buyers and link to an article like that, which displays 280K medians and whatnot, what is it that you’re doing? Seems to be quite a conflation. Then you insert the slew of IPO hordes as if that hasn’t been discussed ad nausea, lockups, tax periods, etc. Not to mention the mere fact that last fall was actually quite slower and lesser than this spring? What a scattered post that was.

In terms of actual market activity, keep in mind that recorded sales in the first half of the year will be lower on a year-over-year basis in San Francisco. And despite some reports to the contrary, sales in the second quarter of the year are actually on pace to be lower as well, as we pointed out last week.

Year over year higher end prices are up.

And yeah, I should have said “a driver” not “the driver.” But rents play a role across the board. Don’t mistake that fact. There are investor types for every class of property in this town.

As we pointed out last week, your Compass reports are based on transactions reported to the MLS, which doesn’t account for the majority of new construction activity or off-market sales.

In addition, the “higher end” market to which you’re referring, which was defined as sales of single-family homes for $3 million or more and condos with a sale price of at least $2 million, only represents around 10 percent of the total market in San Francisco. And based on Compass’ data, but not highlighted in their report, the difference in “luxury market” sales between the first half of 2018 (314) and the first half of this year (329) was a total of 15 sales.

At the same time, with more expensive homes on the market, more expensive homes tend to sell. And when the share of “luxury” home sales increases, it mixes the median sale price up.

Many off market sales will of course be included. Yes, higher end, luxury, 2M condos and 3M for sfrs. A total of 15 sales, yes. Not a huge number of course but still up yoy at all time high prices. I don’t see need to qualify things right out of meaning constantly.

Rental Rates? In San Francisco the rental stock is largely rent controlled and of vastly different type and quality than the for sale stock. And buying for rental income here doesn’t even come close to penciling out. Rental rates are not the driver of the for sale market here. Driving new apartment construction maybe.

UPDATE: Pace of Home Sales in San Francisco Continues to Drop