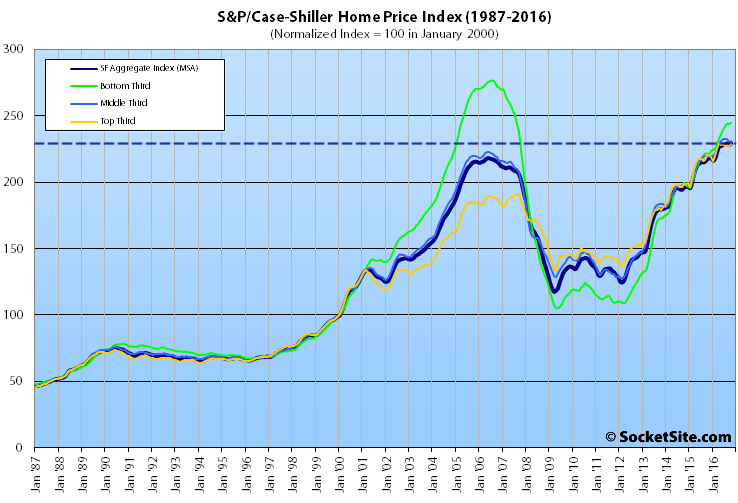

Having slipped in September, the Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – inched up 0.6 percent to a record high in October while the index for Bay Area condo values was unchanged.

On a year-over-year basis, the aggregate index for area single-family homes is running 5.4 percent higher, which is the smallest year-over-year gain since the third quarter of 2012 and has been trending down for a year.

Having gained 0.3 percent from September to October, the index for the bottom third of the market is running 10.5 percent higher versus the same time last year but remains 11.5 percent below it 2006-era peak; the middle third of the market inched up a nominal 0.1 percent in October and is running 5.3 percent higher versus the same time last year but remains 1 percent below its August peak; and while the index for the top end of the market gained 0.7 percent in October and is running 19.4 percent above a 2007-era peak, its year-over-year gain of 3.7 percent is the smallest since mid-2012 and has been trending down since October of last year.

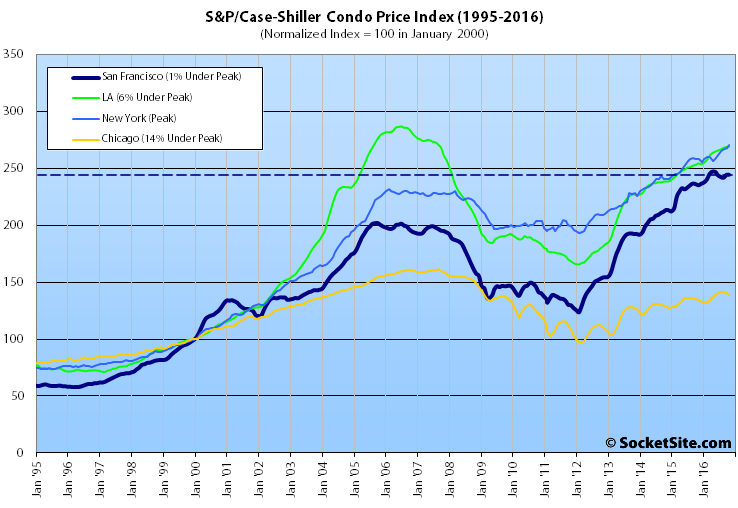

The index for San Francisco area condo values was unchanged in October, having ended a three-month slide the month before, but remains 3.5 percent higher versus the same time last year and 21.0 percent higher than its previous cycle peak in October 2005, down from 22.3 percent higher in May.

And for the eighth month in a row, Seattle, Portland and Denver have reported the highest year-over-year gains in the index for single-family homes, up 10.7 percent, 10.3 percent and 8.3 percent respectively.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

That talk several months back of how the downturn was upon us? Never mind.

While leading indicators for San Francisco proper have dropped significantly, both in terms of transaction volume and pricing, any thoughts as to what may be propping up the performance of the broader index above? If not, here’s a hint.

I think it’s probably down to SF’s sub-“luxury” single family home market remaining competitive. Most sales fall into that price range, so there’s the prop up. Just a hunch.

Agree, it’s the SFR in the outer neighborhoods that still represent a good deal for investors at current rents. Everything else is meh.

You forget, though, people have been predicting the next crash for a very long time. A very long time. Sadly for them, Apple, Google, and Facebook continue to be strong

Well, you should include the employment figures in your list of indicators. Strong employment growth should go with rising real estate prices.

[Editor’s Note: The rate of growth for local employment, which averaged 4.5 percent in 2012 versus 2.3 percent over the past year, has been trending down (while the inventory and asking price reductions for homes on the market in San Francisco have been trending up).]

RE Editors note, it is always tricky to alert on a decrease in the rate of growth; after all it is still growth and 2.3% employment growth isn’t bad. Did the total housing stock increase by 2.3% year over year?

That being said, there should be an (economic) limit to how much more you can demand for a home in SF vs surrounding counties, and we should see an overflow effect perhaps all the way to Sacramento as we did in 2005-2007 ish.

An often forgotten point is the following. I will use a generic example to illuatrate my point:

If SF gains net 10k new residents per year. It means that 90k moved out and 100k moved in. If you are interested in how this affects the real estate market, It would be useful to compare the median income of the ones moving in and the ones moving out. The same applies to employment. What are the salaries of the jobs being created and what are they for the ones being eliminated. If the jobs being created pay +100k and the ones being lost pay 45k, real estate prices should rise more than just the 2.7% net employment growth. Thoughts?

That’s an interesting point. I feel like it can perhaps be drawn into my earlier point about the sub-“luxury” market driving the SF price small gain / stability for single family homes. Why? Because two people with very good jobs or one person with a great job can afford these types of mortgages, 2 – 1 1/2 million dollars and under. So, yes, I feel like the net 10K coming in are probably well salaried, generally.

To clarify my point, It’s not just the well-salaried 10k that move the real estate market, but the well-salaried 100k that have replaced the less-well salaried 90k.

I fully support your point regarding the sub-‘luxury’ market. Assume the following: Most households moving in make somewhere between 100k-150k per year. With that salary, you can afford SFH or condos in the range of 750k-1M (20% down, 4% interest, spend 1/3 of income on housing). For SFH, the only options you have are in the Southern neighborhoods of SF or in the East Bay. This is what keeps the prices in these neighborhoods on the rise.

You folks have the right idea. For SF since 2010, the increase in households making over $200k is greater than the total increase in households. And the growth in households making over $100k is ~150% of the total growth. Most of the decline in SF households has been in households with incomes below $35k/yr.

If you are looking for a very simple ‘replacement’ model, then those earning $100-200k have replaced those earning under $100k, and about all the net growth has come from those earning over $200k. The growth component is 3 times the size of the replacement component.

Also, this data is about where people live, not where they work. Many people with low paying jobs in SF commute in from far away. I doubt there has been much of a decline in low paying jobs in SF. FWIW, the trend in SF for higher income new arrivals to displace lower income residents while there’s an increase in the number of long distance commuters (mostly from Sonoma, Solano, and San Joaquin counties), goes back at least 20 years in the Census data. Probably all due to NAFTA.

I’m going to see if I can coin a word to describe this phenomenon – “gentrification.”

Yes, this can explain increasing housing values even if the overall population were not rising. All boils down to supply and demand. And the wealthier populace moves the demand curve. It does not inevitably keep moving in the same direction as we saw during the GR. But the tailwinds are still with us today, even if they are no longer gale force as in 2014.

@Jake, what is your source for these detailed income figures? Census.gov? Thanks!

yup, the US Census ACS. Nosy wasters of your tax rubles.

pero, i do not think someone making $150K /yr can afford a $750K condo. thats just insane at 5x income. a big recipe for disaster

Wow. Chicago. It looks like it’s just barely beating the cpi inflation. Barely.

This somewhat confirms those of us who see a leveling out of prices in SF with the possibility of a modest decline (say 10% in terms of SFHs) over the next year or so.

The bigger thing is the fact that SF price gains are now not much above the national average. In some cases SF is being strongly outperformed by other markets – Portland’s numbers of late warm my heart as I’ve been purchasing SFR rental properties there for several years now in anticipation of this shift.

Going forward my feeling is there will be a prolonged period in which SF RE price gains, while outperforming many markets, will not be substantially greater than the national average price gain. Greater for sure, but not the crazy stuff we’ve witnessed in the past decade.

SS noted above that SF job growth has slowed to 2.3% this year..

Seattle’s job growth this year is 4.4% (CPS figures) while Portland’s is 4.8%. Job growth going into the future too will play a big role in price appreciation and places like Seattle and Portland have lots more room for job growth over the coming decade. A main reason, IMO, SF’s appreciation will fall more in line with, and perhaps lag a bit, that of other desirable major metro areas in the coming years.

Headline from Portland business journal: Portland real estate forecast: ‘Every party comes to an end’ (Dec 9, 2016, 7:00am PST)

It is subscriber content, and I don’t subscribe, but from the headline it looks like a different opinion.

What was the job growth in Santa Clara County in the same period as what you are showing for Seattle and Portland?

Will Portland slow from the 10.3% growth of 2016? Surely, that growth rate is not sustainable. Aside from that, some are predicting Portland could be the #2 city in terms of appreciation in 2017. I expect good appreciation in the Northwest over the next decade and that it will outperform SF.

Its the relative numbers that count.