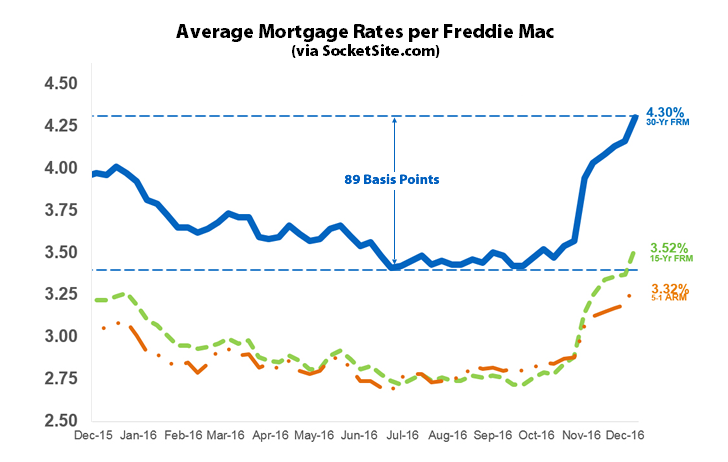

As we foreshadowed within a basis point, the average rate for a benchmark 30-year mortgage jumped another 14 basis points over the past week to 4.30 percent, the highest average rate since April 2014 and 34 basis points above the 3.96 percent rate in place at the same time last year.

The average 30-year rate has now jumped a total of 73 basis points over the past five weeks, and 89 basis points since early July, according to data from Freddie Mac’s Primary Mortgage Market Survey, a move which shouldn’t have caught any plugged-in readers by surprise.

And while the Fed’s three predicted rate hikes next year won’t directly translate into quarter-point hikes in mortgage rates, we’ll keep you posted and plugged-in.

Thanks Obama!

Yep, I did 13 loans under obama and I’m all set now. Thankfully.

ditto, but only 3 loans, all at historical rock-bottom rates.

Though I don’t thank obama, I have to thank bush and greenspan and the republicans for allowing the finance and real estate sectors to drive themselves into the ground, taking the entire economy with it, requiring ultra-low rates and fed QE for years to try to recover because republicans were dead-set against obama-proposed stimulus programs (i.e. government spending at those rock-bottom rates).

“because republicans were dead-set against obama-proposed stimulus programs”

It’ll be interesting to see how dead set they are on stimulus spending when trump proposes it.

I also did 3 loans at rock bottom rates. Definitely a big thank you to Obama.

Obama? Sorry but it’s this type of thinking (that presidents are the only branch of gov’t and therefore are more like kings) that leads us to Trump being president. People believe that a president can wave a magic wand and save their jobs or wholly make their life better. For the most part, Presidents are very limited in what they can accomplish and the federal reserve and congress blocking any fiscal spending are what led to ultralow interest rates, not president Obama. You may have been being sarcastic but this thinking gets under my skin. You could argue he appointed yellen who kept the rates low but bernanke started it and i would argue any fed president would have kept rates near zero for quite some time.

it’s a joke, a catchall for any bad thing that happens. Semi-related, executive orders and cabinet appointments (all made by potus) do have a pretty dramatic effect.

Janet Yellin’s first of several rises coming to screw over Trump.

So Yellen would shirk her responsibilities, potentially screwing over the entire nation, just because she doesn’t like trump?

too little too late, the damage has already been done by Grandma Yellen