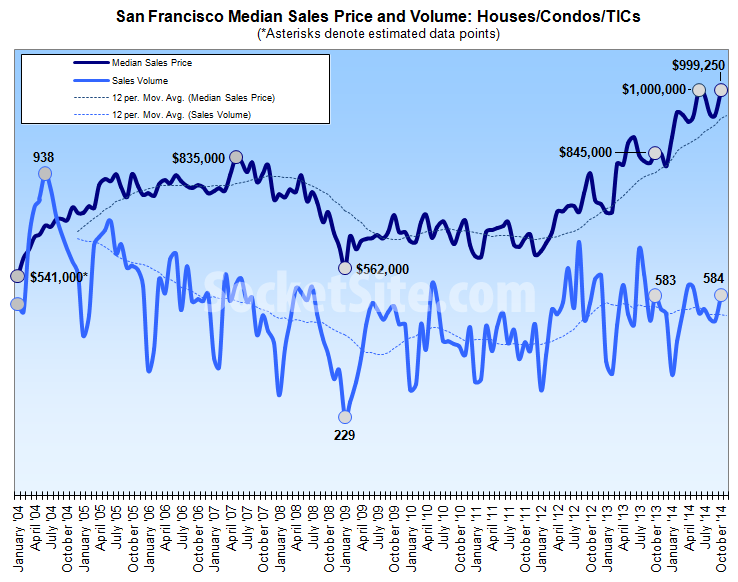

The number of San Francisco homes sold and the median price paid both rebounded in October, with the sales volume up 14.5 percent from September and even with the October before. The sales volume in San Francisco typically rises from September to October but has increased has averaged 3.6 percent over the past ten years.

Having hit a record $1,000,000 in June, the median price paid for a property in San Francisco dropped for three months in a row but rebounded to $999,250 in October, up 6.5 percent from the month before. A mix-driven increase in the median from September to October is typical in San Francisco and has averaged 4 percent over the past ten years. In addition, the share of luxury home sales in San Francisco jumped a few points in October.

The median sale price for a home in San Francisco is currently 18.3 percent higher on a year-over-year basis, 78 percent higher than the recent low-water mark of $562,000 recorded in January of 2009.

Across the greater Bay Area, homes sales increased 3.4 percent from September to October, 1.3 percent higher versus the October before while the median price paid slipped to $601,000, down 0.5 percent from September but 11.3 percent higher, year-over-year and 107 percent higher than the low-water mark of $290,000 recorded in March of 2009. The Bay Area median home price peaked at $665,000 in July of 2007,

At the extremes around the Bay Area last month, Napa County recorded the greatest drop in sales volume for the second month in a row, down 7.4 percent versus the October before but with a median price which was 13.8 percent higher. Contra Costa recorded the greatest year-over-year increase in home sales volume, up 6.8 percent and with a median sales price of $455,000, up 15.2 percent year-over-year, the second greatest gain behind San Francisco.

Keep in mind that DataQuick reports recorded sales which not only includes activity in new developments, but contracts that were signed (“sold”) months prior but are just now closing escrow (or being recorded) and any properties that were sold “off market.” And as always, while movements in the median sale price are a great measure of what’s in demand and selling, they’re not necessarily a great measure of appreciation.

should have bought two spots in 2011

Yeah, we bought our place at the end of 2011 and considered a 2-flat nearby for income property. Decided we did not want to be landlords. Would have been a good buy. But the stock fund we have as an alternative has nearly doubled since then, with no property taxes, maintenance or rent control do deal with. So I can’t say I’m kicking myself.

Agreed, stock market for us is far outpacing additional housing investments so we are selling our 2nd property now in order to put more of our money back in the stock market.

I dunno ’bout that. With leverage and cheap loans I have made way more money investing in SF RE than the stock market. Way more.

If you own the house free and clear, you can simply refinance to cash out fund to invest in stocks. There is no need to sell your 2nd property unless you think there is no additional appreciation expected.

It feels like I will be waiting forever, for property prices to come down to my affordability level, and I make $165,000 a year.

When?

There are plenty of places in the SF and the Bay Area that you can afford, you just won’t be able to buy in the most expensive and desirable areas. And that’s not going to change, unless you find some more money.

Yup bayview is up and coming. Presents a real opportunity in a cool neighborhood.

WaitingForever, I was in your position when we bought a small-ish flat in the Lower Haight 15 years ago during dot-com 1.0. Thought we couldn’t afford anything, but then made the leap and bought in a “bad” but improving neighborhood. Heard gunshots quite often. No kids in sight. But then that neighborhood gentrified a ton and is actually an awesome, rather pricey area filled with families and strollers now. Things change pretty rapidly here.

If I were you, I’d consider the Bayview, the Western Addition/Anza Vista, the Excelsior or a similar not-yet-gentrified neighborhood. Great, affordable places there. And they will all get better in the coming years.

WaitingForever’s income is enough to buy a million dollar house. Many buyers make less than 165k. I do not understand why WaitingForever is not buying a condo or house. There are plenty of options between 500k and 1mil.

$1M is over 6x his annual income. Seems extremely unwise and not actually affordable to me. And I seriously doubt “most buyers make less than 165k,” unless you’re including all of the Bay Area. Most owners, no doubt; but most buyers in the past few years and in the current market — no way.

Unwise, yes, impossible, no. With 20% down and a 5/1 at 3% you’re under $5000/month PITI. Somewhat manageable at $165K/y.

Of course at these levels you are a debt slave and the only upside is potential appreciation. But with the current price levels, this is highly hypothetical in the short term.

$5000 per month is comparable or lower with the rent you will pay for the same unit. So you’ll be building equity while paying the same amount as your rent.

I would never advise anyone to do that nor do it myself. And $200k down plus closing costs plus immediate necessary work (call it, charitably, $250k all in) is no joke to save for someone earning only $165k — hardly something to gloss over or assume.

I’m obviously more risk-averse than many, but we waited until we had 20% plus another $200k in the bank to buy something with a total purchase price of under 3x HHI, on a 30-year fixed.

But hey, in retrospect we would have been better off to buy a cheaper “starter home” any time from 2009-2012, sell it, and then buy our current home. I don’t think we’re in a 2009-12-ish place right now though, as much as it would serve me to not be at or near the top of the bubble.

Also I said that “plenty of options between 500k and 1mil”. WaitingForever does not have to buy a million home, he can buy a 700k condo or house in many decent locations in SF. At least for WaitingForever, affordability is not an issue.

AnalyzeVotes,

True, WaitingForever could shoot for a more “starter” home instead of the home he will need/want longer term.

There’s one issue with this in hindsight: say you bought a house smaller than you could afford in 2010 with the goal of trading up in 2014. With prices almost doubling he would be SOL today. Even with a great equity, his income would not be enough to “double up”.

One example: say he purchases a place in 2010 for 700K with 20% down, then sells it today for 1.2M. He’d have roughly 500K cash after closing costs, taxes, fees. But with a 165K income, he would not even be able to afford more than the house he just sold! I am certain a mortgage broker will be creative enough to have a slight upgrade, but without a sizable push in income or more ready cash, the only solution would be more debt.

FronziScheme, I understand your point. However, it is always better to buy a starter home early in an appreciating market. It can not hurt, right?

If you bet on your income increase to buy your dream house, you take the risk of being priced out of both your dream home and the starter home. WaitingForever can afford a starter home at 700k in year X, however, his income increase many not be enough to afford the same starter home at 1.2M in year X+4.

Of course, if people expect marriage to double the income, they can wait a little bit to buy their dream home. However, plans change. What if the expected marriage takes longer than expected?

Anza Vista and Western Addition are expensive

Anza Vista was built and always has been at least middle class. The streets were laid out to be separate from the surrounding neighborhood. Then there is the nearby Ewing Terrace which was developed to be a lesser version of Presidio Terrace, and has long attracted people who might otherwise have lived north of California.

There are no bargains in these neighborhoods, but if something slips through (as even happens in PacHts as socketsiters know) there is plenty of money to be made.

A few homes and condos sold in these hoods over the past few months. All went for well below what I would have thought. Great little micro-hood that hardly no one knows about. Great deals all over that area and super central / good weather. Mansions, no. But some great urban housing stock.

Why did you feel the need to expound about the neighborhood of Anza Vista, when I said it was expensive, indicating my own familiarity?

Yeah, friends bought a great 3-BR TIC in Anza Vista last year at a price that one could easily afford on $165k/year income. Needed only a few thousand of work to make it awesome. These “up-and-coming” neighborhoods still have (relatively) affordable buys, far less expensive than the already gentrified neighborhoods.

I waited until I got married until I bought my first house because having two people earning $200k/year each definitely moves the needle on the affordability equation. That was back in 2010. Then I went wild and bought 6 more houses down on the Peninsula but that’s another story.

Don’t wish for it; work for fit 🙂 At your salary you can afford to buy in SF! It’s about your strategy.

(This is like that moment when you hear the screech of brakes right before a collision.)

if that is the total family income, you can buy a 1bdr condo in core areas of SF for around $750K. With a 20% downpayment, you should be able to afford a $600K mortgage.

Otherwise theres a lot you can buy (SFHs) in Oakland, San Bruno, South SF, Daly City, Fremont, Hayward, Novato, etc. for $750K

Does anyone actually think that San Francisco are worth these prices any more?

I guess you could argue that anyone currently buying here does, partly perhaps driven by expectations of future growth, but taking even a small step back the prices seem increasingly hard to justify.

Maybe it’s me slightly jaded after 8 years here – there was maybe a time when I would (and did) throw money at the situation to be in SF and guess the newcomers feel the same way.

I almost bought a place in SF, warts and all, but was outbid by a lower bidder. Go figure. There are deals to be had here and there in forgotten little corners. I pick up about 1 a year … some to hold, some to flip. If you just want to own real estate, the lesser Peninsula suburbs like Millbrae, San Mateo and Redwood City (west of El Camino only) have great values. Always buy location (ie top ranked schools) and you will have no shortage of tenants.

Millbrae and San Mateo, west of El Camino, are no longer lesser if they ever were. They were always middle class. Even east of El Camino in San Mateo has some very nice areas.

Oh I am just thinking in comparison to Burlingame, Hillsborough, Menlo Park and Palo Alto (all on the west side of course except that little pocket of Burlingame by the park). Millbrae, San Mateo and west RWC are all a notch below. And nothing compares to SF, of course!!

What about San Mateo Park? As good as anything in Burlingame, and for some old timers, better than Hillsborough.

Jimmy, SF price is probably lower than some Peninsula cities. Probably more than half of SF houses are selling for less than Millbrae, San Mateo and west RWC. Most of SF is lower than Palo Alto.

San Mateo Park feeds to the wrong elementary and middle schools. But they have some beautiful classic houses there no doubt about it. It’s just out of my price range is all. I just scratch around in the sub-$1M fixer market looking for deals …

I think that things are overpriced in SF these days. I have been accused of being a pollyannish cheerleader during the gloomy times, but I knew that things would eventually turn around.

I think San Francisco deserves a huge premium for being such a great place to live with so many high paying jobs nearby. But even I think that prices have lost all mooring with reality. I can’t imagine moving here as a bright ambitious 22 year old and thinking that I could set down roots, at least not without a huge amount of family money to help me out.

NVJ, right as usual. Prices certainly appear to be in the “only make sense if one anticipates huge appreciation” range. I would not buy here today unless you had so much money you really didn’t care about the finances.

I too feel for the 22 year olds moving to SF. That is about how old I was when I moved here (with several periods elsewhere since then). Rented a great 1BR in cole valley for $600/mo (about $1000 inflation-adjusted). Can’t do that anymore. On the other hand, there are now way, way more good neighborhoods than there were then. 20+ years ago I would have never lived in the Western Addition, Tenderloin and civic center, Bayview, much of the Mission, much of Bernal, Dogpatch. But now these and more would all be great options for a 22 year old. Yeah, it is far more expensive to find an apartment in the Castro or Noe. But the whole city has opened up.

Holy cow, when did socketsite become the home to realtor cheerleaders? The correction is way over due and in some ways has already started with numerous high end condos languishing at the Infinity and multiple units pulled at the Brannan over the last 6 weeks. Sit tight. As a 20 year resident, I’ve seen this show before. Interest rate movement, NASDAQ correction, whatever the catalyst, 20% yoy appreciation never ends well.

Housing market correction is not as deep as stock market. Usually correction is mostly a price stagnation and sales slowdown. A 5% fluctuation is possible, but that fluctuation could be simply a seasonal slowdown.

True, price has gone up a lot in the last 2-3 years. However, with the robust job market, I think the price will be significantly higher 3 years from today.

I think it is an exaggeration to credit the price appreciation to realtors. If realtors are so powerful, they would stopped market crash in 2009-2011 by persuading people to buy or hold instead of sale or not buy. Market is controlled by buyers and sellers. Millions of people make decisions based on their own individual situations. Most people do not buy or sell based on realtor promotions.

Agreed.

I said this site had realtor cheerleaders urging some poor poster to buy right now, made no reference them as market makers. Cost of funds and income determine what buyers can afford, and once one of those variables changes, prices drop. Meaning interest rate movement or tech job growth stagnation or cuts will be the trigger. The party can’t go on forever.

Once the Chicken Little’s of the world start calling it a bubble, history shows there’s still 18-24 months worth of appreciation to go as the smart money sucks in the dumb money from Main Street while the smart guys are themselves exiting the market. This bubble has some legs left in it yet, just watch. I’m not calling it until 2016 … credit standards are still loosening and interest rates will remain relatively low for at least the next decade.

Real Estate moves in 6-8 year cycles so if 2010 was roughly the bottom, the market’s natural cyclical upswing will carry on until 2016-2018. And unlike some posters I at least put my money where my mouth is.

Do you realize that by your own definition and esitimates you’re calling today’s buyers the “dumb money” and those who are exiting “smart”?

Well not necessarily. I’m buying a place for a 6-month remodel/flip. The guy who buys it from me isn’t gonna make anywhere near the appreciation I’m going to. But the people who buy now for a long-term hold are going to likely see pretty tepid appreciation for the next few years. So what? You still have to live someplace, might as well own it. Renting is such a drag.

Why did you read that realtors told someone to buy right now? I just reread the whole thread and nobody said that. Thanks for wasting my time. Sounds like you have an idea or two you carry with you always which you like to talk about, is all.

I understand waiting forever’s pain. We make $250 K collectively, have $500 K in the bank, and still can’t find a property that’s both affordable and attractive for us.

C’mon. I think you should temper your expectations. $250k is not really that much money into this neighborhood. Or any other neighborhood around here.

with $250K salaries, you should be able to afford up to $1.1M. A very nice 2-3BdR condo in a nice area, or a SFH in an outlying area. There are a whole lot of people making more than $250K that you’re competing with.

You’ll be ok. I think you can get a $1-1.2 mill mortgage with your income, and given that you also have $500 K cash, you can put 20% down easily and then you can afford a $1.5 property (very nice condo or house in not insanely hot area). Good luck!

you cant afford a $1.2M mortgage on $250K income. thats a poor financial decision.

Well, you can purchase it, but can you keep it without losing sleep or giving your pound of flesh anytime you have to pay your property taxes, do a paint job or try a kitchen remodel.

A mortgage slave friend of mine has started his kitchen remodel and his family is in the 200K income range. He 1) did a refi to pay for 1/3 or it and 2) knows he will not take any vacations for one or 2 years.

Everything is MUCH more expensive in SF. Then of course if you overpay by buying an expensive place from the get-go, you’re in for a world of hurt if you don’t have the proper income.

If people can not buy a house or condo with 250k income, what’s the income that can afford to buy?

In San Francisco, how many households have an income of 250k and above?

i would guess more than 80,000 people

here’s some socketsite threads on SF incomes and home buying

Few people recognize this, but in California, debt IS wealth! Meaning people who use leverage to buy Prime real estate always prosper in the end. (“in the end” is sometimes 10+ years away if you time it wrong but have faith and you will get there). More debt equals more house, and more house equals greater appreciation, and your wealth goes up and up. With the miracle of cash-out refinancing and ever-lower interest rates, you can tap into that expanded equity for only marginally greater payments.

Just one tiny example of how this works in practice: I pulled out $350k recently from a building and my payment only increased $120/mo! To cover that I raised the rent $550/mo and pocketed the difference.

Cash out refis! Yeah, we’re approaching the bubble top . . .

Jimmy is somewhat right, but the timing issue is not so minor. Take someone who bought rental property in, say, late 2006, shortly before the crash. Would have been bleeding cash each month, could not refi, and market value did not return to even until about 2013. Sure, if you had the cash cushion to hang on, that is okay. But if not, you were really, really screwed, and the higher the leverage the bigger the loss. Have to be particularly careful when things get frothy (like now).