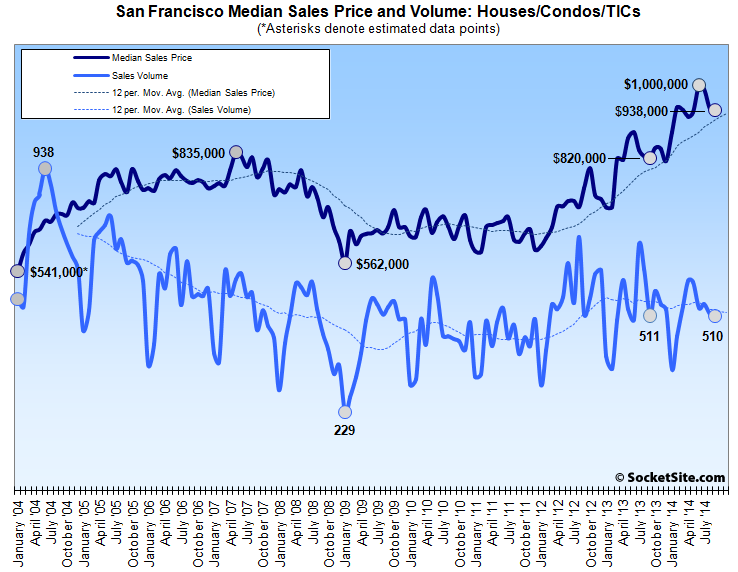

The number of homes sold in San Francisco and the median price paid both held steady in September, with the sales volume down a nominal 1.0 percent from August and only one transaction lower versus the September before. Keep in mind that the sales volume typically drops from August to September and has dropped an average of 13 percent in San Francisco over the past ten years.

Having hit a record $1,000,000 in June, the median price paid for a property in San Francisco dropped for the third month in a row to $938,000 in September, down a nominal 0.2 percent from the month before. The median remains 14.4 percent higher on a year-over-year basis, however, and 67 percent higher than the recent low-water mark of $562,000 recorded in January of 2009. A slight mix-driven drop in the median price from August to September is typical and has averaged a little over 1 percent over the past ten years.

Across the greater Bay Area, homes sales in September were the strongest in five years, down 1.8 percent from August to September but 4.2 percent higher versus the September before. And the median price paid for a Bay Area home was $604,000 in September, down 0.5 percent from August but 14.0 percent higher on a year-over-year basis and 112 percent higher than the low-water mark of $290,000 recorded in March of 2009. The Bay Area median home price peaked at $665,000 in July of 2007,

At the extremes around the Bay Area lat month, Napa County recorded the greatest drop in sales volume, down 17.6 percent versus the September before, but with a median price which was 15.9 percent higher, year-over-year. San Mateo recorded the greatest year-over-year increase in home sales volume, up 16.9 percent with a median sales price of $790,000, down slightly from August but up 16.2 percent year-over-year.

The median price paid for a home increased the most in Marin, up 17.3 percent versus the September before but with a 10 percent decline in sales volume.

Keep in mind that DataQuick reports recorded sales which not only includes activity in new developments, but contracts that were signed (“sold”) months prior but are just now closing escrow (or being recorded) and any properties that were sold “off market.” And as always, while movements in the median sale price are a great measure of what’s in demand and selling, they’re not necessarily a great measure of appreciation.