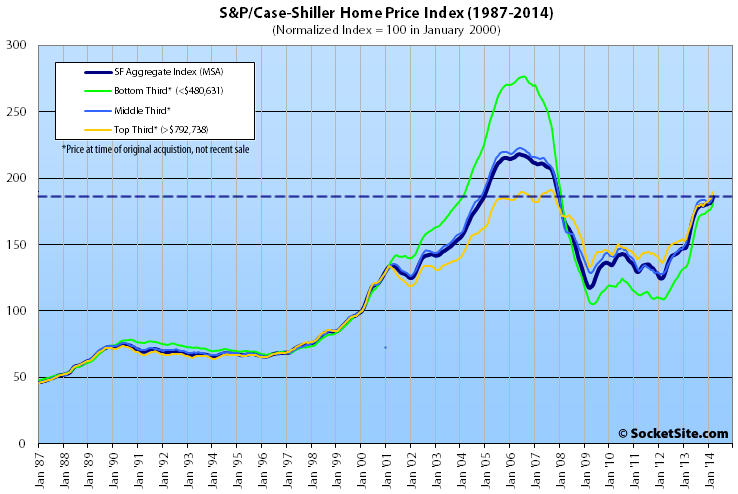

According to the S&P/Case-Shiller Home Price Index, single-family home values in the San Francisco MSA jumped 2.4% from February to March of this year.

Up 21.0% on a year-over-year basis, the overall San Francisco Index remains 14.7% below a May 2006 peak. That being said, home values ticked up across all three price tiers for the second time in six months and the index for top tier homes is within 1 percent of its 2007 peak.

The bottom third (an original cost basis of under $480,631) gained 2.1% from February to March (up 32.4% YOY); the middle third gained 2.2% from February to March (up 17.8% YOY); and the top third (an original cost basis of over $782,738) gained 2.4% from February to March and is up 19.1% year-over-year.

According to the Index, single-family home values for the bottom third of the market in the San Francisco MSA are back above November 2003 levels (35% below an August 2006 peak); the middle third is back above October 2004 levels (16% below a May 2006 peak); and the top third is just below July 2007 levels and within 1% of an August 2007 peak.

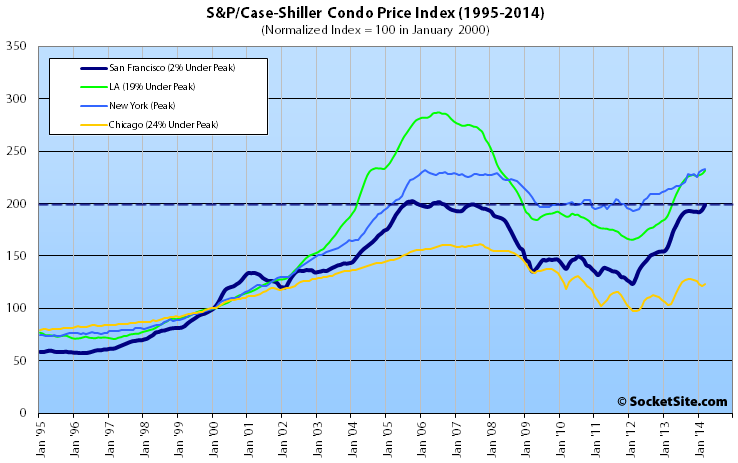

Condo values in the San Francisco MSA gained 2.4% from February to March and are up 20.2% year-over-year and within 1.6% of their December 2005 peak.

For the broader 10-City U.S. composite index, home values ticked up 0.8% from February to March and are 12.6% higher year-over-year but remain 19.8% below a June 2006 peak.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

The tiers have once again converged. How interesting.

Interesting piece in today’s Business Insider, hints there might be a problem with CSI. The ‘issue’ appears to be around foreclosures and how they might be skewing the CSI numbers.

Not sure how much of an issue this would be for the SF MSA.

Ha ha brilliant. why is it when prices are rising the methodology is always questioned, but never when it is falling?

I don’t recall, for example, too much talk on how a huge number of foreclosures were skewing price data downwards…

if you’re gonna question the index the question to ask how could it possibly say that prices are still below the peak? Someone needs to check this thing make sure it’s working right.

The CSI for the SF MSA is for Metropolitan SF, including many cities outside SF county.

On SS, a somewhat accepted rule of thumb is that SF overall is represented by the top Tier. But this is the whole of SF including prime central as well as other areas.

Looking at some areas of SF, it is obvious we have surpassed the 2007 top, but overall, and taking mix into account, I am not too surprised we would be at the top.

Agree with Steophl’s sentiment (I’m sure the answer has to do with mix). Anecdotally, and based on apples reported here, it seems that prices are discernibly above 2006 levels. And I say this as someone whose self-interest would be in prices not being so high.

Just look at 1967 29th ave featured on SS. Sold for 35% above purchase price in 2007 to $1.8 million.

We are way above previous peaks in SF!

40% over purchase price you mean in 2007 with no improvements or additions. I went there and was a bidder at $1.5 mil.

Golden Gate Heights, Inner Sunset, Sunset, and Parkside has the most opportunity IMO.

SF proper is most certainly above the peak! I think D9 is even over peak at this point based on some of the stuff selling in Bayview. I’m personally thinking about selling my condo. I would fetch 30% over what I paid in ’07 based on strong (basically identical) comps, but the problem comes in when I’m ready to buy a new place. Hard to justify spending so much on a SFH when I have a condo that should be paid off in 10 years, and renting kind of sucks (no offense to anyone). Decisions, decisions.

@Lance, join the club with the other owners wondering the same thing. Condo owners thinking to upgrade to SFHs and SFHs looking to move up or into a different area. No one I know wants to sell and/or cash out. At least those that are staying in the city longer term. I’m no longer predicting sustained growth but I’m not sure we’re going to see a bubble pop like last time either. I’m beginning to be convinced that what we are seeing is sustainable in the long run as tech moves into SF; and the Bay Area becomes “the” tech epicenter. The converged lines on the chart are a good thing, IMO. It shows the market tiers all moving in balance which is the way it should be. The larger issue not shown in the chart is that these tiers are making less & less sense for Prime SF. The upper strata of homes is probably separating from long term norms if one were to chart such things. And there are more than a few off market deals happening at the high high end. The competition for Gold Coast and Super Prime homes is pretty intense.

eddy, I am starting to doubt the old rule of thumb (top tier is a proxy to SF) that we’ve been using for years now. Top tier includes most of SF of course, but also prime property from cheaper counties. These are subject to their own local market forces, which could greatly differ from SF.

On a personal note, I decided against doubling up myself in 2013. My rule #1 has always been to step away from hysteria, and this market is packed solid with irrational behavior. The new-old bear skin starts to fit, 4 years after I mothballed it.

There are two top tiers in my mind. The “top top” tier is the over $5M market. And then there is the more normal top tier in the $1-5M range. Volume in these tiers is unprecedented. The bottom tier is all but useless for all intents and purposes other than to gauge if there is a massive over-valuation of the lowest tier of homes. The bear suit may come in handy at some point but I’m not sure you’re going to need it for a few years. And even then it may be a short winter. I’m taking the long view at this point. There was an article in sf gate over the weekend about people in the sunset getting massively outbid. I’ve been predicting a rise in Sunset and Richmond districts as these areas are close-in with a SF Zipcode and will be snatched up with increasing pace. I’m waiting for the Ocean Beach areas to catch on as people realize that they are 30min from downtown and 2 minute from the beach. Granted we’re not talking Malibu weather but the beach has a nice draw. The city could be doing a lot more to make this a more desirable area. My point is that the demand for traditional d1-d9 isn’t going anywhere but up up up and you know what they say about a rising tide.

The beach was there 4 years ago, and it fetched close to 1/2 of today’s prices. What makes it more desirable than 4 years ago today? Nothing. It’s pure market psychology. Some of it catch-up after a pretty nasty crisis. Much of it today is “it’s going up: 1) we’ll be priced out 2) something s going on, better hurry”.

This is exactly the same scenario that is being played in all run-ups of bubbles. A core is shooting up. The surroundings are stuck in disbelief until frustrated buyers decide to go there for the value. Prices there go up and make the next city very cheap. Soon enough the wave moves outward and fast, even in areas that have very little to do with the original “core” increase.

In particular, What’s happening on Ocean Beach will lead people to reconsider Daly, then Pacifica or SSF. With increasing prices, many people formerly under water will feel giddy, then will be in positive equity. When this happens expect a massive wave in the subprime sector. The rationale will be “the idiots that gave up in 2007-2009 could have waited it out. It always passes.”

The belief that you can never lose is what fuels bubbles. Soon enough we’ll be in this phase. It will be maybe 2 years before Everywhere, USA goes back to believing you can use your house as an easy way to riches.

I agree with you about the never lose attitude fueling bubbles. People always forget how fast market psychology can whipsaw.

But it’s good to remember that not all bubbles are national and in fact most RE bubbles haven’t been. There are large national factors at work in the RE market, but I’m not as convinced that the overall national economy is as healthy as SF’s. Generals tend to be fighting the last battle and I do think that many in power will be loathe to repeat the mistakes of the last subprime bubble. So I’m not as sure as you that we’re heading into a repeat of subprime. But national remedies lead to their own problem in that low rates and other stimulus which keeps flyover country on economic life support can prove to be over stimulative to less troubled economies such as the coastal markets.

Even in tech, there’s less evidence of a broad based bubble than some concentrated froth in social/biotech.

Well, right [now] the current situation nationally is the following:

– Rates still very low by historical standards

– Recovery showing signs of weakness, proven by the latest Q1 GDP data

– National Housing market still marred by underwater owners

Short of a Marshall Plan / Helicopter Ben scenario, the only thing where the US Govt has power is relaxing lending standards. There have been talks about this for a few weeks now. Once you open the door, it amounts to extract a potential (and limited) resource. The next growth will be easy to get just by going back to relatively safe standards. Then we’ll need the next growth to come from somewhere. If the rest of the economy doesn’t step up as much as it should, they’ll have to relax standards again to get to the next vein of growth. It can very easily snowbowl from there. It could turn out to be another scenario, with a very different timeline, but the current situation looks pretty much like 2002-2003 I think.

And that’s why I’m looking to see if the RE industry responds to weaker home sales by driving to a lower price point. Unlike the national remedies that are contributing to the froth of the coastal markets, weaker markets could be selectively targeted with lower priced homes allowing for a pullback of nationwide intervention. And lower priced new homes need not necessarily represent a loss for landowners or builders. A lot that was expected to house a $500k SFR instead being turned into three $200k units, for example.

Banks have been kept sated with refi activity until now, but with that tapering down I’d guess there will be increased urgency on their part to increase the dollar volume of home buying activity.

I wouldn’t buy now. Cheaper to rent and the rapid appreciation days are now behind us, although I don’t know if we are at the precise “top” just yet. SF has seen exactly what many other cities have seen, like San Diego, Seattle, Portland, etc. Super low rates plus a recovering economy have caused a big bounceback off the recession lows. The nice buy window was open from 2009-2012, a good four year period of opportunity. If you’ve been in your place a long time and plan to move out of SF in the next several years, might be a good move to cash out and then rent.

Agree with Bob. 09-12 was ‘the’ window. Buying now has risks. Buying always has risks, even in 09-12, it’s just in hindsight do we now see how ‘cheap’ things seemed. I still contend that if you have a 10 year horizon you probably will not get burned to the ground by buying in San Francisco. Recommending long term owners to sell if they plan to move in a few years is not great advice IMO. Homes don’t work like that. I know a couple that sold in 2012 thinking the sfre market would tank. Now they are paying rent through the nose, prices have risen and they were hurt twice as bad here by losing out on appreciation of their (sold) condo as well as the appreciation of whatever home they might have purchased. Now they are stuck renting. Couldn’t afford their old place if they wanted to; and are quite miserable and depressed. True story. Housing is one of those things where you are best advised to make an informed decision based on your current situation and needs. Trying to time the market will have disastrous results. I have several friends that bought condos at the peak and were massively underwater. Most wanted to upgrade into a larger place but were stuck, so they waited out the market dip and sold during the recovery and moved on. Ironically, it was the long time condo owners who sold and “locked in their gains” in 2012 only to get burned by the rising tide. Maybe they get lucky and the market tanks. But this is their life and well being and they are paying a dear price for taking such a gamble. People throw advice around pretty loosely like real estate is a stock market investment. Most people could deal with their stock portfolio taking a financial hit to some degree. Housing is a different animal. Buy what you can afford and make your payments. Evaluate where things stand when you need to sell and make a smart decision. Good luck out there folks.

Yeah, we considered selling when we decided to move around. But the idea that the cash we’d get today might not allow us to get back to SF when we want pushed us to rent out. Plus rents are so ridiculous today that it’s all turning out pretty well.

Agree that buying still can make sense in SF if you have firm plans to stay in your place longer than the average 7-10 years.

My suggestion to sell was aimed at a very select group – those who plan to leave SF in the not too distant future. Probably also applies to long term landlords wanting to cash out to diversify. Locking in gains is not really a novel idea. My own anecdote – neighbors had owned their home for about 20 years and just sold with about a $1 million gain. That is about 80% of their retirement assets. Planning to retire and move to Florida next year (not that cliche as one grew up there). $500,000 of the sale was tax free and the remainder was at capital gain rates. They are renting a place in one of the new towers downtown with a pool – loving it as it is kind of like a hotel compared to their simple home in a residential neighborhood. And they’ve already paid cash for their Florida condo (about $300,000 for a really nice place), and are renting that out for now, which covers about half their SF rent. Agree that real estate is a terrible investment to move in and out of as the selling costs are ridiculous compared to any other investment. But “timing” the market is not impossible if you are just looking to time a single transaction on the buy or sell side. Pretty obvious in 2011 that SF prices were a decent deal, for example (we bought at the end of 2011 by the way, but more through happenstance as a nice bonus at work permitted us to buy before we sold our old place).

It’s worth pointing out again that sellers being hesitant to sell and hence low existing home inventory is a national phenomenon not limited to SF.

SF and other high cost markets do present an opportunity for people with significant equity to trade down to lower cost areas which can be very attractive.

The eddy scenario isn’t realistically a worry for those with SF sized equity and the desire/ability to live elsewhere as Bob points out.

In general, this drive to cash in/out drives inventory to follow higher prices. What’s unusual now is that this correlation has broken down nationally as inventory has declined in the face of rising prices. As illustrated in this paper linked by another poster a few weeks ago: http://www.frbsf.org/economic-research/publications/economic-letter/2013/october/low-housing-inventory-factors/

As an aside, the SS search function seems like quite a downgrade from its previous incarnation.

10 yrs is generally a good hold time but there are lost decades. For instance, SF in General did not appreciate at all between 2002 and 2012. There are neighborhood exceptions where gentrification took place like mission and bernal, but overrall no appreciation. I think we still have 2-3 more years in this run before we level off

Nice thread. It is timely for me at least, and I like your advice Eddy. BTW, my hunch is that we haven’t yet reached bubble territory, but there is likely a plateau and/or correction coming in the next 2-3 years…or possibly sooner.

Frankly, I’m shocked at the market. I thought for sure were at a plateau in 2011 / 11 where the market seemed to be balanced and that SF would move sideways with some slight appreceiation. Density in SF is the name of the game and its driving everything up. And there is simply not enough housing in the pipeline to support the demand. Offices are crammed, rental units are jammed, not enough SFHs to meet the wealth/demand. It’s crazy. I fully admit that I’ve lost the feel for the market and where its headed. I refuse to believe that we’re at a point where ‘common’ housing stock in prime areas will trade at $1k/psf but I’m seeing it regularly. I’m also struggling to figure what could cause a long term ‘crash’ in either the stock market and / or the employment market in SF. Interest rates could go up, I suppose, but it would take quite a few quarters to get anywhere near a 7% rate that would start to impact prices in any meaningful way. All signals point to up uP UP but it just doesn’t seem possible unless you make direct comparison to NYC or London; and I’m not sure we’re there yet. But it does seem that we’re quickly moving to that level of parity.

^ I think we are like manhattan and London wrt real estate prices. Although they are much larger cities, we have the preponderance of the tech industry, as well as nutty rental and building entitlement policies, which contribute significantly. That, and we are small in land size with almost zero room to grow (the hunters point shipyard is probably the last significant expansion we will see in our lifetime here.) so basically once outer Richmond/sunset and D10 become prime, that’s it, SF is done wrt any “up and coming” neighborhoods.

Agreed. The demographics of those moving to SF seems very different now from 7-8 years ago.

Either those who are already rich, or have a strong desire to be very rich very soon. There always was that element of course here but seems much more the norm now.

SF is still being chosen for “lifestyle” reasons but the elements of that lifestyle choice are very different now, more high end, luxury, service.

Lot’s of “global” people coming much more from NYC or after stints in Asia – Singapore etc.

Many more people who are successful and strongly identify themselves as such and with the finances to back it up.

This is purely anecdotal of course, but is what I have noticed.

This is having a huge effect in such a small market, with trickle down etc..

@pam and REp, II think you both are hitting the nail on the head. The increase of luxury options (restaurants, retail, amenities) and the pace of gentrification are both really astonishing. The increased level of wealth has set, or is in the process of being set, at a new minimum standard on par with NYC. It’s really just surprising how quickly its all happening. You could make a strong argument for going on a buying spree out in the Richmond and Sunset and it seems like many are already doing it. Some are just bypassing these areas all together and headed right to D10.

Square loses around $100k per employee. Wonder if any of that finds its way into the housing market? Go big (900+ employees) or go home.

this might be a go home situation this case.

Whoa. 555 Bartlett #207, one of the 3/2s in the building above Walgreens at corner of Cesar Chavez and Mission, bought for 650K in late 2010, just closed for $1.1m. That building is not supposed to do that.

This used to be the location where day laborers would wait for their next job. Fast forward 6 years later with Million Dollar boring condos. Now THAT’s gentrification.

yeah, add a yahoo/google bus stop to complete the metromorphosis

There are tech shuttles right across the street and around the corner from this building. Also check out 199 Tiffany Avenue for several recent sales way above peak prices from 2005-2007 (including one at $995K).

Tiffany is a great street, especially since it has been pacified when the connection with Valencia was redesigned. Ever since it has become a quiet street right in the middle of a vibrant neighborhood. The issue was that housing quality wasn’t up to snuff with potential. This is being corrected very quickly.