As we first reported in March:

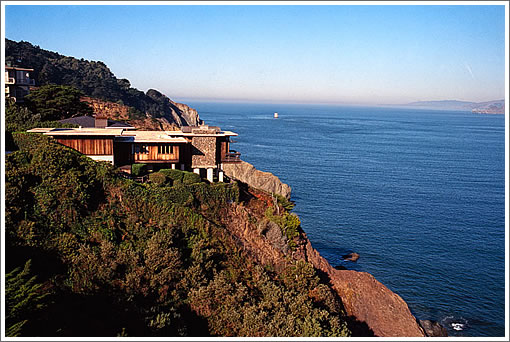

It would appear as though 830 El Camino Del Mar quietly sold for $9,990,000 last month with a listing that was “withdrawn” a week its before closing and unreported on the MLS.

As plugged-in people know, the Sea Cliff home had been listed and withdrawn seventeen times without selling since 1998 and had been listed for as much as $18,000,000 in 2008.

Feel free to suggest a final stanza for a reader’s original poem. Then again, the buyer was the rather anonymous “830 CDM LLC,” so perhaps there’s a new poem waiting to be penned.

While the registered agent for 830 CDM wouldn’t comment, if Business Insider is correct, Jack Dorsey of Twitter and Square fame was the buyer behind the LLC. No word on whether or not the seller was Square enabled or Jack was able to swipe for the home.

“Lord let there be one more boom”

Too bad SF’s most stunning properties are being lost on computer dorks. I’m only slightly bitter.

Right on.

Just curious sf: who do you feel would be more deserving and why?

—————-

And hey, did no-one complete the poem? I nominate Kathleen.

A rock star. A poet. An astrophysicist. A philosopher. Matt Cain. A Kennedy.

Milkshake: In general, I would say that old money–i.e. those who inherit their wealth–are more desirable stewards of that wealth than some johnny-come-lately punk who makes his wealth himself and inevitably then has to flash it around in the most tasteless manner.

sf – so by simply buying this house, he’s “flashing it around in a most tasteless manner”????

He’s worked hard and earned his money – which is more than you can say for some trust-fund douche who’s inherited his money from mommy and daddy and would hardly be considered a “desirable steward of that wealth”.

Or are you just trolling?

sf at 8:30am is not the same as sf 8:29am and 7:59PM

wow, sf. so a wealthy lolly gagger is more deserving of such a beautiful and desirable homes because he/she didn’t have to work for it. this is such arcane and unenlightened thinking…

When was the twitter IPO? When was the Square IPO?

Apparently, IPOs have far less of an impact on the real estate market than they used to. Who’d have thunk?

Anyone know when Sequoia is going public? The partners there must really need the liquidity.

How do you know he didn’t privately sell shares in either of these companies, or the other high-profile ventures in which he invested?

Wow. It is pretty shocking that someone might think that inherited wealth is preferable to earned wealth. And the idea that money needs to be “stewarded”?! It isn’t like finite resources such as air, water or land; money doesn’t give a shit. If dude wants to spend every last penny, why do you care?

… Re: “when was the Twitter, Square IPO”

Why don’t you lay off the crazy for like one whole week, Tipster?

You’re the one going around downplaying the significant amount of tech money in the SFRE market. You and your accomplices, that is. Nobody said it was all down to IPOs on here. Not once [Removed by Editor].

point is that realtors have been frothing here and elsewhere that some wave of IPOs will re-blow the dot-com 1.0 bubble. Can’t wait!

But . . . not gonna happen. Even if dot-com 2.0 ends up creating more wealth and has more staying power than 1.0, which is doubtful. In 1999 a web site was born, IPO’ed six months later, then quickly rose 500%. This created many dozens of millionaires or nearly so. Repeat 2 or 3 times every WEEK. Lots of house buyers there.

Now, VCs and a handful of founders rake in big coin but the masses receive very little. The VCs won’t, and know they don’t have to, hand over shares or options to the plebes. I have a good friend at Twitter who is a senior developer, 12 years out of Stanford with an engineering degree. Heads a good-sized team. He makes $130,000 and got a small number of RSUs. These vest over 5 years, bringing him about 30k a year more if he sells in the secondary markets, which he hasn’t yet. A good job but nothing close to a 1999 jackpot. New legislation ups the number of permitted stockholders to 2000, from 500, before you need to “go public.” This will slow the IPO pipe even more. Jack Dorsey might buy a couple houses, but a lot fewer than 10,000 new stock-option millionaires!

In this case, history will not repeat itself. Too bad for the realtors. But very good for homebuyers and muppet investors as they avoid buying into another bubble.

Tech money is currently the dominant force in the local marketplace. Why you repetitive types choose to read “newish social media companies,” when the word tech is used is nothing short of bizarre. You gave your anecdote. Mine is the five or six Apple employee would-be buyers I’ve spoken to at open houses over the past several months. Put that “too bad for realtors” nonsense to bed. The only thing realtors are unhappy about right now is the dearth of good inventory. Otherwise realtors are quite pleased right now, other than an annoyance with the sheer competition bidding for properties.

the realtors I know are more unhappy about the low sales volume than the “dearth of good inventory.” fewer buyers means less commission. Duh.

” “newish social media companies,” when the word tech is used is nothing short of bizarre. You gave your anecdote. Mine is the five or six Apple”

https://socketsite.com/archives/2012/01/its_bazynga_as_the_pincus_pad_in_cole_valley_closes.html

Show me the post were You And Eddy Go On about Apple for A Week

Anon1, all I do is carefully analyze the hype and I follow up and it drives you realtors nuts.

So the boosters tell us JCP as an anchor is going to “save” midmarket but I know retailing so I say it’s not going to do well as an anchor in an affluent area. I post information about some other malls anchored only by a JCP in affluent areas, and it drives the realtors and boosters nuts. They just want to spout, with no analysis. I do the analysis. It’s frequently less rosy than the spouting.

So boosters tell us the Zynga IPO will generate hundreds of millionaires all buying houses at any price, again, with NO analysis. Just spouting. They crank up their PR machines and they convince some newspapers to run with it. Hmmm, that hasn’t been my experience. So I dig. Doesn’t look to be the case – the options are mostly going to be underwater. NVJ brings up that RSUs are better than options because they always have value. So I look into it. I analyze it. No, taxes are high. No millionaires off the RSUs. Sorry.

You’ll note the papers don’t follow up. That’s because many many articles you read are actually written by publicists of interested parties and submitted. The papers make some minor edits and publish. The realtors aren’t going to hire publicists to push an article that the Zynga millionaires did not materialize. So I follow up.

You’ll also note the papers didn’t look at the taxes on the RSUs. No one did. No one. No one but me. Can any of you say you understood the issue as clearly as after I posted about it. Did you think anon1 was going to tell you any of this. No wonder he wants me to stop.

It’s mostly hard numbers, but sometimes you do have to make some reasonable assumptions and I post my assumptions, and examples for anyone to question and reanalyze if they want to.

I just can’t see how that gets your panties in such a bunch. Except for the fact that you can’t just spout any more. I think it irritates you. Sorry if the truth hurts. I’ve been saying that the tech wealth is already baked in to prices well before the IPO, not that it doesn’t matter.

That’s what I just reposted above. Can you go up, reread my post about no twitter and square IPOs and identify where I said anything different? If not, you probably want to quit while you are ahead.

No wonder you change your identity every year or so. I would too.

struggling how you think you countered my dearth of inventory statement, there. (And you can stop with the childish “duh” type stuff at any time you want to be treated more politely.)

@tipster

“When was the twitter IPO? When was the Square IPO?

Apparently, IPOs have far less of an impact on the real estate market than they used to.”

Where’s the analysis in that statement? You imply by the fact that a rich guy bought an expensive house without a prior IPO that it somehow invalidates the idea that tech IPOs will have an impact on real estate, but that is flawed logic.

By the way, I did an analysis on a recent thread on Facebook and showed that it’s IPO was going to result in hundreds of new millionaires, possibly around a thousand, and that was when FB was lower than it was today.

On top of that, it doesn’t really matter if it’s millinoinaires, 900,000-aires, or 300,000-aires. Any significant number of people getting a large windfall at the same time will have an impact on the real estate market. This effect is already obviously happening right now in SF and many peninsula cities where tech folks tend to live.

Lastly, most of us who think an IPO can have an impact don’t think that the impact can only exist post IPO, it can happen before as well, but the IPO releases a lot of wealth, and will have a greater impact post IPO.

“This effect is already obviously happening right now in SF and many peninsula cities where tech folks tend to live.”

This is the part that I just don’t see. It’s pure argument, and not fact. Look at the facts. SF sales volume continues to be far below 2000-2006 levels. Yes, median prices have ticked up slightly (but they were down just a couple months ago), and yes sales volume is a bit higher than a year ago, but the same is true throughout California and the U.S. CSI shows prices continuing to fall YOY in SF, and throughout California and the U.S. And a huge foreclosure hiatus caused by litigation reduced inventory, in SF just like the rest of the U.S. If you have something to show that the “tech effect” in SF and surrounding areas is “obvious” then let’s see it. Let’s see something showing that SF is experiencing anything different from the rest of the country. What we have is outrageously low interest rates that are upping the buying power of people a bit and that is supporting prices a little bit. But there is nothing unique to SF or the peninsula there as the exact same effect is felt nationwide. Unlike SF, prices are up in Phoenix and Detroit. A tech boom there?

The fact that a bunch of realtors are saying “Wow, so much tech money, better buy now!” doesn’t mean there is any truth to it.

Tipster failed to address being called-out on his statement about a lack of a Twitter IPO.

To make my point again, do you think people are not getting liquid?

“Twitter found one such buyer recently: Saudi Prince Alwaleed bin Talal, who announced in December that he had acquired a $300 million stake in Twitter. The deal was done entirely through private share purchases from existing stockholders, Fortune reported.”

http://money.cnn.com/2012/02/14/technology/twitter_stock_sales/index.htm

And guess what, it’s not only social media companies that are doing/have done this.

D’oh, edited again when questioning Tipster’s “it’s mostly hard numbers” statement which we all know is a lie.

Guess it’s verboten to quote old Tipster to question new Tipster. Oh well.

[Editor’s Note: Tipster’s quote: “It’s mostly hard numbers, but sometimes you do have to make some reasonable assumptions and I post my assumptions, and examples for anyone to question and reanalyze if they want to.”

You responded by pointing out that tipster has made assumptions, not a single one of which you actually questioned, a total waste of time for all involved.]

I saw that list of tipster’s use of approximate terms that you had posted, R. I didn’t really understand how that pertained to the discussion though. Just because a person has used approximations doesn’t mean that they don’t also use hard numbers.

MOD, not sure whether you think they are relevant is not is reason for deletion by the editor?

And my point is this: If you take some ‘hard numbers’ and then make up others, the final calculation is not based on ‘hard numbers’. It’s made up.

R, sorry

Ithe “editor” deleted that post. I do speculate, but I state when I do.I don’t recall any qualifiers in the article about all the hundreds of Zynga millionaires, nor do I recall NVJ qualifying his statement that RSUs are guaranteed to have value. I think it’s better to use qualifiers where appropriate.

Joshua, I will try to respond but I need more info. First, when is the timeframe you are talking about. Was that investment right around the time HP announced twenty six thousand layoffs? Did it say whether the Prince’s investment was to employees or could it have been VC firms with investors outside of the area? If it didn’t, why did you not use a qualifier?

Hopefully, my points are clear. I DO understand your and lyqwyd’s points. Of course there is wealth being created. But my point is that by the time of the IPO, that tech wealth is already largely baked into prices. Yes, some of it is locked up via RSUs that have limited liquidity until after the IPO (banks will loan, but you do have to pay interest), but that isn’t where the big money usually is.

The big money is from options, the vested ones are not that illiquid, and if you look at Zynga, the pre-IPO sharespost price was $14 and now it’s bouncing between $5 and $6. Someone with vested options at $4 has lost a huge amount of money.

So wealth is declining for a lot of people too. I didn’t see where that was factored into your analysis.

@anon

When I said

“This effect is already obviously happening right now in SF and many peninsula cities where tech folks tend to live.”

I mean the parts of those areas where tech folks live, so in SF it would be SOMA and Noe Valley, etc, but not Excelsior and Visitation Valley for example. In the peninsula an example would be PA vs. EPA.

If it’s the term “obvious” that you have a problem, then fine, I have no problem saying it’s not obvious.

To me it can be seen pretty clearly by anybody who is following the market, and the same trend can be found in rent prices, which have probably been hotter than home prices.

The data source you site, CSI, while useful for many purposes, is both too broad (the SF category covers much more than just the city), and too delayed (The S&P/Case-Shiller Home Price Indices are calculated monthly using a three-month moving average and published with a two month lag) to be useful in this determination.

You can see it in the fact that last year there was low to decent inventory, but few houses had multiple offers, and I believe average list to pending time was over a month, while today anything decent is getting multiple offers. The moths of inventory is very low, 2 months of inventory right now, vs just a few years ago it was in the 6-8 months.

Sure, on the long term SF is no different from the rest of the country, but on short and medium term there can, and have been, disconnects. And I’d agree there is some seasonality to it, but I don’t think that’s all there is.

You said:

The fact that a bunch of realtors are saying “Wow, so much tech money, better buy now!” doesn’t mean there is any truth to it.

Sure, but it also doesn’t mean it’s false. And just because somebody says something similar doesn’t mean they are saying it because they heard a realtor say it.

I say similar things because I see the effect and it makes sense: I’ve shown in another thread that there are hundreds, if not thousands of people who will have made enough money off the Facebook IPO to have enough money to buy a property. Not all will choose to buy, but many will, and that many people will have an affect on prices. Will it be long term? Not unless a bunch more IPOs happen. Will prices double? Of course not, but they will go up.

Lastly, it’s not even just about IPOs or stocks, there’s Apple, Google and other bay area tech firms that are doing quite well. I was recently contacted by a Google hiring person and they informed me they are doing their biggest hiring year ever. While the rest of the country is doing pretty poorly tech in the bay area is strong right now, and that’s going to put an upward pressure on prices.

Personally long term I’m bearish, but I see a short term bull market right now, at least in certain portions of the bay area.

Tipster, stay on topic. You wrote, “When was the twitter IPO? When was the Square IPO? Apparently, IPOs have far less of an impact on the real estate market than they used to. Who’d have thunk?”

Point being founders, employees and investors now sell a whole bunch of stock before the IPO. It happened with FB, ZNGA, P and a bunch of other companies. There’s a lot of liquidity sloshing around regardless of IPOs.

You were wrong in your post above, just own up to it and move on.

p.s. though your HP reference is way off topic, do note that those layoffs are scheduled to be completed in 2014, and there is no indication as to what geographical areas will be affected.

Ed: Can you explain why you delete posts? What’s the policy?

[Editor’s Note: We don’t care if you’re bearish or bullish, or whether or not we agree with your point of view, but take a look around, it’s amazing how easily others can successfully challenge another reader’s assumptions or argument rather than simply whining that assumptions are being made as they are every day on the street.

And of course, staying on topic always helps.]

“Point being founders, employees and investors now sell a whole bunch of stock before the IPO.”

Yes, that WAS my point. Do you not understand this? That was my exact point. It’s been my point for months.

And if they do that, home prices will be affected before the IPO. And so the impact of the IPO will not be as great as it was, because prices have already been affected. If 35 people sell in the months before the IPO and 35 people sell in the months after the IPO, assuming the share prices stay the same, the IPO should not be making any difference in house prices.

And that was what I was saying in my original post above: this is proof that A)people sell lots of stock before the IPO and B) they can then buy houses with that cash. But when the IPO comes around, prices already reflect the ongoing cash out, which occurs over time.

With two exceptions:

1. Share prices have been generally lower after the IPO than they were before it. So the IPO should generally represent the peak.

2. Some people are locked up and may be reluctant to take a loan, so the IPO unlocks them. But these people generally have not been the heavy hitters.

Now there is lots to home prices, not everyone in the bay area works for 5 companies. But with respect to the handful of companies that IPOd, the difference of the IPO was much less than in years past *because* the employees can get out before the IPO, unlike in earlier times.

Capiche?

Doesn’t seem to be your point here:

“Joshua, I will try to respond but I need more info. First, when is the timeframe you are talking about. Was that investment right around the time HP announced twenty six thousand layoffs? Did it say whether the Prince’s investment was to employees or could it have been VC firms with investors outside of the area? If it didn’t, why did you not use a qualifier?”

For what it’s worth, SharesPost currently lists stock in about 150 private companies for sale. Clearly this is nothing like Bubble 1.0 with millionaires continuously being minted left and right.

Your post actually makes the most sense you’ve made in years.

Except for this: “1. Share prices have been generally lower after the IPO than they were before it. So the IPO should generally represent the peak.”

I mean, if you take out ZNGA, LNKD, YELP and really all recent IPOs except FB, then your statement might be true. But if you include all recent local IPOs, most have gone up (and yes, some back down) since IPO.

“simply whining that assumptions are being made as they are every day on the street”

What are you talking about? You deleted my post that quoted historic financial data.

lyqwyd, it’s interesting that you mentioned rents as some evidence of your point. As soon as I clicked “post” above, I realized I should have included rising rents in my discussion! Look around. That too is a state-wide and nationwide phenomenon. Again, SF is no different and there is zero evidence that “tech” is driving anything. Rents always rise after a recession as people who doubled up or moved back with mom and dad set out on their own again. Because people still cannot, and do not want to, buy houses (as seen with continuing low prices), rents have seen bigger than normal leaps this time around as far more “move-outers” are renting rather than buying (again, see low sales volume in SF and everywhere). None if this is any different in SF and provides no support to an theory of a tech/housing boom.

While SF can diverge from the bigger picture short-term (we saw that in 1997-2000), that is not happening now and there is just no evidence of it. People in Riverside who look no further than Riverside would also conclude that “Riverside is uniquely seeing improvement.” SF is following right along with the broader trend. Crawling slowly out of a massive hole, indeed bigger than the country generally, but still not even close to anything resembling fast-rising prices. Probably just keeping up with inflation.

“You deleted my post that quoted historic financial data.”

Finally We Agree on Something

Trying Again

If all this Tech Money is Flooding BA housing

Why are Guys paying less in Morgage

“The typical monthly mortgage payment that Bay Area buyers committed themselves to paying last month was $1,491, up from $1,473 in April, and down from $1,533 a year ago. Adjusted for inflation, last month’s payment was 47.0 percent below the typical payment in spring 1989, the peak of the prior real estate cycle. It was 60.8 percent below the current cycle’s peak in July 2007.”

And here’s my deleted response:

“The typical monthly mortgage payment that Bay Area buyers committed themselves to paying last month was $1,491, up from $1,473 in April, and down from $1,533 a year ago. Adjusted for inflation, last month’s payment was 47.0 percent below the typical payment in spring 1989, the peak of the prior real estate cycle. It was 60.8 percent below the current cycle’s peak in July 2007.”

And in factual news:

30 year fixed rate from April 1989: 11.05%

30 year fixed rate from July 2007: 5.71%

30 year fixed rate from June 2012: 3.69%

I’ll give you one guess as to why the monthly payment is down.. Any guesses? Come on RfR, you can figure it out!

“The big money is from options, the vested ones are not that illiquid, and if you look at Zynga, the pre-IPO sharespost price was $14 and now it’s bouncing between $5 and $6. Someone with vested options at $4 has lost a huge amount of money.”

I believe you are mistaken here, but I could be wrong as I am far from a tax expert, but I do not believe vesting has any implications. It is only exercising options that brings consequences, so only those who exercised at more than $4 dollars in the above example would have lost money.

tipster knows little about tech and even less about facebooks RSUs. as NVJ pointed out, taxes are not due until 6 months after the IPO for most fb’ers. however, this is not because of the lockup per se but rather their vesting schedule. see this forbes article for an explanation:

http://finance.fortune.cnn.com/2012/05/18/facebook-stock-spooked-taxes/

or go back to fb’s S-1 for the final word:

http://www.sec.gov/Archives/edgar/data/1326801/000119312512034517/d287954ds1.htm

RSUs granted prior to January 1, 2011 (Pre-2011 RSUs) under our 2005 Stock Plan vest upon the satisfaction of both a service condition and a liquidity condition. The service condition for the majority of these awards is satisfied over four years. The liquidity condition is satisfied upon the occurrence of a qualifying event, defined as a change of control transaction or six months following the effective date of our initial public offering. (p 48)

note the last line.

the mystery is why tipster bothers, especially since he is so wealthy that even in a year like 2009 when his income was cut in half, he spent less than 5% of it on housing, transportation, clothing, food, entertainment and vacations. seems like he should have better things to do with his time.

“I’ll give you one guess as to why the monthly payment is down.. Any guesses? Come on RfR, you can figure it out!”

Exactly

What do Rates have to do with Tech

Or SF being Different

Less Money for housign but a bigger Sticker Price

^anon at 4:36. While rents have gone up around the country for the reasons you cite, rents in SF have gone up more (both on a percentage basis, and even more on an absolute basis). According to trulia, SF had the third highest annual percentage increase of major markets nationwide. The (relative) strength of our economy, and in particular the health of tech, is clearly driving that diversion from the mean. Oh, and rent increases of 11% per year are not “just keeping up with inflation”. You need to do a little more research before making your assertions.

http://money.cnn.com/2012/04/05/real_estate/buy-rent-home-prices/index.htm

Curmudgeon, I said housing prices are keeping up with inflation, not rents. The headline of your link supports my points precisely: “Rents keep rising as home prices stagnate.” From the article: Indianapolis – rents went up 9.7%, Columbus, Ohio – they jumped 9.3%, Sarasota – up 12.9%. Nothing particularly special about SF.

Also:

“Meanwhile, asking prices for homes nationwide crept lower over the past 12 months, according to Trulia.”

“With fewer consumers able to make the leap into homeownership, rents could continue to climb higher”

As I said . . .

@anon

From SF Chronicle (original data & quotes are from WSJ) article on April 25, 2012:

“While rents in other parts of the country are rising around the pace of inflation, at 2.7%, the average rental price in San Francisco shot up by 15.8% from a year ago.”

and

“San Francisco rental-home owners and brokers say they are being deluged with applicants for apartments that would have barely gotten a nibble a year or two ago. Some property managers say they are boosting rental prices by 30% to 40% when units turn over.”

do you think that is the same as what’s happening nationwide?

Another article, this time from business week, on May 11, 2012:

“Twitter’s relocation next month to Mid-Market, an area better known until now for drug deals, graffiti and vagrants, has sent rents up as much as 60 percent in a business district that didn’t exist a year ago.”

and

“That type of growth is making San Francisco the best U.S. office market as demand from Internet and social-media companies surges”

another thing that’s happening nationwide and nothing to do with tech right?

I Do think Rents are Up

But beware Asking V. Paid

“During the first three months of this year, the average asking price for San Francisco rentals was $2,663 a month, a 15.8% jump from $2,299 in the first quarter of 2011, according to RealFacts, a Novato market-data firm. Nationwide, the average monthly rent paid rose 2.7% in the first quarter from a year ago, to $1,018 from $991, according to real-estate research firm Reis Inc.”

More Guys not Richer Guys

“Mr. McKendrick and other landlords also say more people are crowding together to stretch their money. Recently, groups of three people have been vying for a two-bedroom apartment in Haight-Ashbury going for at least $3,800, with the living room serving as a third bedroom. Just eight months ago, the same apartment was rented to two people at a monthly rent of $3,200.”

3800 / 3 V. 3200 / 2

c’mon lyqwyd, some random articles citing nothing?

Take a look at http://www.google.com/url?sa=t&rct=j&q=detroit%20rent%20increase&source=web&cd=1&ved=0CFoQFjAA&url=http%3A%2F%2Fwww.coseoproperties.com%2Fstorage%2FApt%2520Michigan%2520Survey%2520Mid%2520Year%25202011.pdf&ei=3WziT-XIJMGU2AWNxKjgCw&usg=AFQjCNF-UuZOcCxmoFkr1iHcGJ8re5tgFg&cad=rja

“The largest increase in rent growth from the 4th

quarter of 2010 occurred in the Detroit market,

where rent increased from $623 to $1,148

or 84.3%.”

84.3% increase in 6 months?!?! Wow, Detroit must have hordes of tech workers!

Seriously, I don’t even dispute that tech workers are a decent chunk of the local economy and affecting rents. I’m just saying that elsewhere it is some other segment of the economy (mining, farming, drilling, finance – all booming and non-existent in SF – we’re missing out!), and the ultimate impacts on home prices are just about the same as in SF. Still slow.

steve, one cannot argue one company’s S-1 when talking about another company’s. We’ve been discussing Zynga.

I did see that interpretation of the fb RSU agreement in the S-1, but, even with respect to fb, that interpretation has been questioned by one observer already and it may be incorrect. I haven’t yet looked into it. However, I did not rely on an interpretation for the Zynga taxes, the actual RSU agreement was posted on line in a later filing. Vesting of accrued RSUs was at the IPO. Taxes are due for 2012.

lyqwyd, refer to earlier discussions regarding the Zynga IPO. For the Zynga RSUs, taxes are due in the year of the IPO, though it would not be until April 15 of next year. The rules are different for RSUs, and you are mixing up RSUs and options.

Price is not decreasing YOY in San Francisco this spring and now summer. Per MLS SFRs, D1-D9 4/1/12 – 6/20/12: 461 sales $586 psqft. SFRs, D1-D9 4/1/11 – 6/20/11: 453 sales $545 psqft.

Even D10 shows an increase YOY over same. Last year was 115 sales @ $342 psqft. This year it’s 117 sales @ $363 psqft.

And Rates YOY?

Google it yourself. My point is addressed at anon, who two or three times mentioned “continuing low prices,” and pointed to CSI. I don’t think where you’re going with this is anywhere worthwhile, though. Rates could vary greatly in the last bull market too.

@RfR

“Trying Again

If all this Tech Money is Flooding BA housing

Why are Guys paying less in Morgage”

The money is going into down-payments.

Also, last year rates were at about 4.5%, now they are about 3.75%, meaning that although the payments are down, interest rates are down more, so while payments are down, the corresponding mortgages are slightly higher.

Are we done talking about 830 El Camino Del Mar? Can I see a show of hands? If this thread is going to devolve into another pissing match about IPO’s and RSU’s I’d like to know now so I can stop clicking on this story.

@tipster

Note that I quoted you directly and you said options. If you want to chastise somebody, make sure the error wasn’t yours.

And why the focus on Zynga, it’s irrelevant. What matters is the IPOs in aggregate. Facebook is paying the the taxes for it’s employees, others are still using options. Zynga is a nice example for your purposes, but it’s only one of a number of IPOs.

Mr. Editor, can you please take all of this off-topic information and move it to the “What’s the point” story where it belongs.

Here is a link in the event other people would like to continue this civil discussion elsewhere:

https://socketsite.com/archives/2011/11/making_a_point_that_leads_to_a_trend.html

Let’s please stay on the very interesting topic of 830 El Camino Del Mar and its very noteworthy buyer.

hey guys — the purchase made the national rag sheets and confirmed that Jack Dorsey is the buyer: http://www.radaronline.com/exclusives/2012/06/twitter-tycoon-jack-dorsey-new-home-photos

I wouldn’t call that quite confirmed. Maybe Tom Cruise bought it? Oh, wait. 😉

super hideous house btw. i hope he tears it down.

(laughing) “Swiped”??? This property has been a laughing stock for years; the original list price merely a figment of the owners’ fevered imagination… and the recent sale price many millions beyond any sort of reality-based value for this gem… but of course it will be worth 20MM plus after the Master Of The Universe buyer gets finished realizing his dreams… 😉

Like most 2012 purchases, getting this home for $10mm looks pretty good in the context of recently $6mm listed, $11mm traded 178 Sea Cliff.