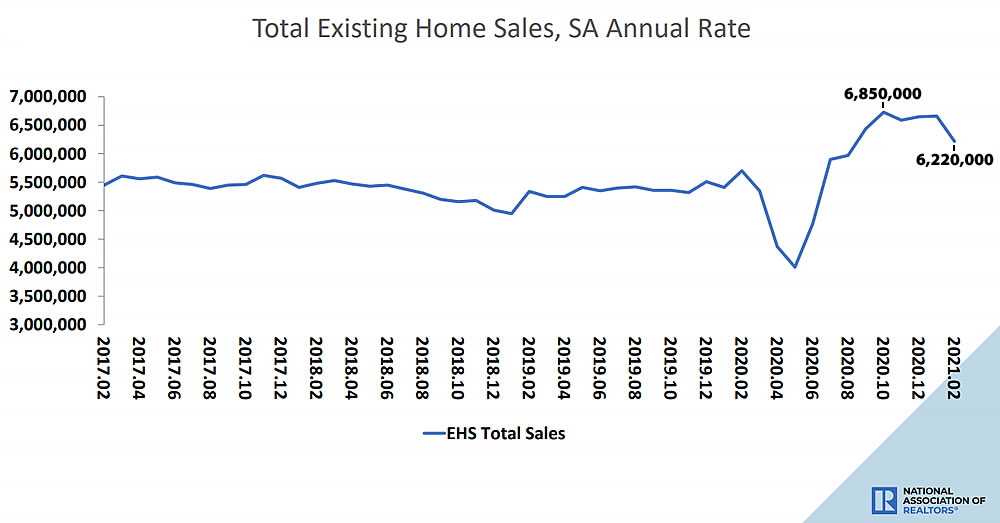

Having inched up in January, the seasonally adjusted pace of existing-home sales across the U.S. dropped 6.6 percent last month to an annual rate of 6.22 million sales, which is still 9.1 percent higher than at the same time last year but a significant drop, on a year-over-year basis, versus the month before, according to the National Association of Realtors.

At the same time, listed inventory levels across the U.S. held at just over a million (1.03) homes on the market, which is 29.5 percent fewer than at the same time last year (versus over 100 percent higher in San Francisco*).

And while the median existing-home sale price ticked up 2.9 percent from January ($303,900) to February ($313,000) and was 15.8 percent higher than at the same time last year, the increase was once again driven by a dramatic change in the mix of what sold versus underlying “appreciation.”

So the short term story seems pretty clear: nice suburban homes will do well since there’s low inventory and people (especially families) are looking for space. Likely exaggerated in the Bay Area since there’s greater potential for long-term hybrid/remote work. The question is – how long will this last? A huge determining factor will be public school openings. The Board of Education mess is definitely a factor in families leaving SF and the trend will continue if they can’t figure it out for the fall.

Last I heard K-2 are opening 5 days a week after next weeks Spring Break. With the new CDC guidelines of 3′ distance (instead of 4 or 6) there won’t be a single school district not 100% open in the fall. Then again, if there is one closed, it will surely be San Francisco.

From the chart it looks like current sales are still running almost a million over the avg from the three years prior to the pandemic. Doesn’t look like a real hit to me. What am I missing?

The trend.

In related news/trends: Pace of New Home Sales in the U.S. Drops Over 18 Percent

That doesn’t appear to be the trend at all in SF per the MLS. In San Francisco February sales for single family homes, condos, TICs, and are way, way up in ’21 (415 sales) over any preceding years. It looks like ’20 (307 sales), ’19 (284 sales), ’18 (319), ’17 (270), ’16 (281), ’15 (295). If you go back to ’14, with 389 sales, it gets comparable, and ’13 had 328, and ’12 had 382.

There has been a distinct increase in existing-home turnover in San Francisco, along with a rise in inventory levels and vacancy rates).

Good observation Ohlone.

So for SF inventory is up 100% YoY and sales are up only 35% ( 415/307 ). For the whole country inventory is down 30% but sales are still up 9% YoY.

San Francisco real estate has been impacted by the pandemic differently than the rest of the country. That much is clear.

The SF rental market seems to have been hit much harder than the for sale market, however.

The rental market is far more liquid and tends to be a leading indicator for the market as a whole.

The kids left town when ‘rona set in, but rents gonna rise when they’re back again.

DeBlasio is bringing municipal workers back in.

Newson faces rage from stifling the economy.

Plenty of young employees haven’t been fired but will be if they don’t show up and start getting some productive work done

.02,

Your mom

“So for SF inventory is up 100% YoY and sales are up only 35%”

Yeah, well, I cited February data which was not pandemic distorted. SF inventory fell off a cliff 3/18/20.

Inventory levels in San Francisco were up an average of 49 percent, on a year-over-year basis, in February.

So, cobbling mine and hmmm’s posts together, would you go along with the take that inventory was up ~49% but also sales are up ~35 % ?

That’s generally correct, with listing activity outpacing sales (versus the opposite nationally), driven by an increase in turnover.

What is meant by “turnover”? Locals moving locally?

I must say as the time goes on as these various times change and the editorial voice attempts at constancy, the simple lack of response, versus those responded to, is everything. Millennials are smarter along these lines.

UPDATE: Pace of Home Sales in the U.S. Drops to a 6-Month Low