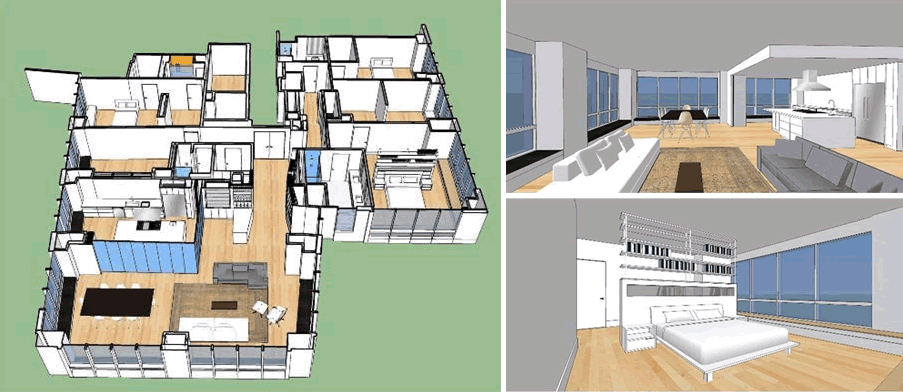

Asking $5.95 million at the end of 2014, the 2,757-square-foot unit #22A on the twenty-second floor of the Four Seasons Residences was reduced to a shell following its approval to be merged with the adjacent unit #22B to create a 3,600-square-foot “super unit,” and its price was subsequently reduced to $4.85 million as well.

This afternoon, the price for 765 Market Street #22A, which was purchased for $3.42 million in 2006, was reduced to $3.9 million.

And the price for the adjacent 765 Market Street #22B, which was purchased for $1.75 million in 2008 and was briefly in contract last year when listed for $1.55 million, has just been reduced to $1.45 million.

Its hard to read this.

2006 was the last peak. The end of it. Did the buyer pay too much in the RE frenzy at the time? 3.42 million? The half million gain over 10 years is maybe misleading?.

While the lower end of the San Francisco market peaked in 2006 as the credit bubble popped, the upper end of the market didn’t peak until 2008 (when the broader economy and stock market followed suit).

“Pop” goes the bubble!

Costs

3.9 for the big unit

1.45 for the small unit

——

5.35 for the space

1.0 for the build out

——

6.35 all-in costs

3600sf * $2K psf (?) = $7.2mm sales price for finished product

+$850K for this big of a project, with fat carrying costs, building for chinacorns who may disappear like a receding early 90’s Japanese tide of debt overhang?

Still doesn’t seem like a good trade.

You couldn’t pay me to live on that stretch of Market Street.

UPDATE: The listings for 765 Market Street #22A and B, which together form the “super unit shell,” have been withdrawn from the MLS without a reported sale despite a combined $2.15 million in cuts.

UPDATE: Another Big Cut for that Gutted Four Seasons Super Unit Shell