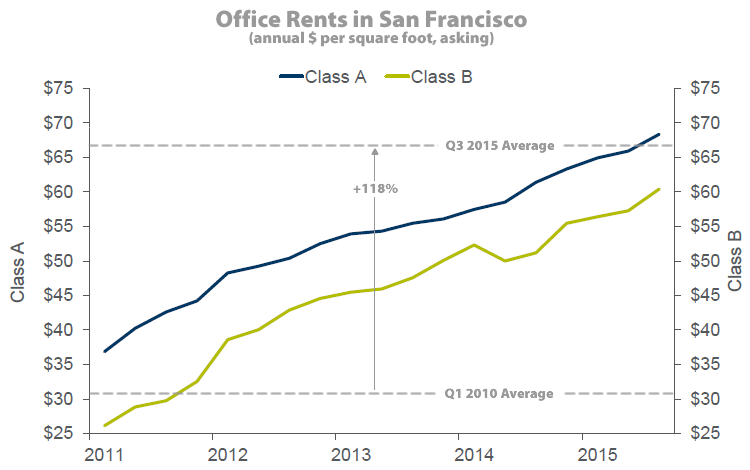

The average asking rent for San Francisco office space hit a record high of $66.71 per square foot at the end of the third quarter, surpassing the previous record of $66.00 per square foot set in the fourth quarter of 2000. And at 6.0 percent, the current office vacancy rate is the lowest since the 3.6 percent rate recorded at the height of the dot-com boom, according to Cushman & Wakefield.

The average asking rent for office space in the city has jumped 5.2 percent over the past three months, is up 15.3 percent over the past year, and has more than doubled since a post-recession low of around $31 per square foot in the first quarter of 2010.

That being said, the amount of leased but vacant space that’s available for sublease has ticked up for four quarters in a row and now measures just under a million square feet, the highest since the fourth quarter of 2010. And 1.4 million square feet of new office space will be ready for occupancy by the end of the year, 96 percent of which has been pre-leased but a portion of which could be subleased as well.

In addition to the buildings slated to open by the end of the year, another 7.1 million square feet of office space is under construction or entitled for development in San Francisco, 22 percent of which has been pre-leased.

Two observation.

Two red flags.

This rental rate is ridiculous given the gridlock in the office area of the City.

Second, the vacant sub-leased space. That is a red flag.

Companies are not locating to SF at all. Yes, exiting SF companies are expanding w/in the City but that is it.

The move to Oakland has started. It will be more obvious a year or two from now but it is there already.

The entitled space has a worrisome prelease rate which fits with Lennar having trouble leasing any of their upcoming HP space to “real” companies. its going to educational institutions.

Red flags abound!!

Existing companies are expanding so fast in SF that rent prices are hitting an all time high…but…but…that’s a red flag?

yeah right.

Exactly. Existing companies can just do so much and some, Uber, are doing all their expansion outside of SF.

Key is Google and Apple looking for a “secondary” Bay Area headquarters. They ain’t looking to SF. Rumors are it will be Oakland and, if that happens, the game is over for SF tech-company wise.

There is no need for such companies to be in SF and their employees, with more than an 8 hour a day demand, need to live closer to home.

The future of business in the Bay Area, go East young man/woman. it is Oakland/the East Bay.

I remain by my prediction that the first 100 story building in the Bay Area will be built in Oakland. Easy prediction, like SF would never allow it and San Jose has problems with its too close international airport.

Now you’re claiming that the Bay Area outside of SF will land more jobs than SF – no argument here, the Bay Area outside of SF has 90%+ of the population and 98%+ of the land. That’s very different from “red flags” in SF though, it’s just a matter of where land and population already exists. Booming outside of SF doesn’t mean that SF stops booming, in other words. I hope that we see both and Oakland begins to boom too, though that really hasn’t happened yet.

Spreading tech growth out to Oakland is a very good thing. Crowding everything into SF is a poor regional land use planning. The only way that would work is if local government could deliver on transportation improvements. And as we have seen with the Bay Bridge – $6 billion over budget – opened 25 years after the Loma Prieta Earthquake – that just isn’t going to happen.

Oh Dave, you do entertain. Uber signs a deal in Oaktown and you think it is the start of the great migration from The City. Good one. There will not be any 100 story buildings in Oaktown for the simple reason the SQ foot price is sitting at below $32. You need $50 sq ft prices for any company to build.

You keep on stating Lenar with HP? Can you link something here because it sounds like your making this up. I know for a fact Lenar is talking with Google about taking space out in the Shipyards for their YouTube division.

Some day things will slow down and Oaktown will be hurting because prices in The City will be affordable again. Remember 1999, 2007/8. What happens in SF so goes the rest of the Bay.

Dave, I hate to bother you with facts, but Apple is building another huge building a couple of miles from their spaceship. They’re not moving to Oakland. I would love to hear the rumors where they and Google are building a secondary headquarters in Oakland. Come to think of it, I would love to hear about any company building a secondary HQ in Oakland.

And if you were correct, and Apple and Google did build big HQs in Oakland, it would be *fantastic* for SF. But they’re not. Ever. Going. To. Do. That.

Constructing a tower in Oakland would not be much cheaper than building one in SF, but the space would fetch a much lower price than SF would. Hence, it doesn’t make sense for developers.

There was an article today about how a housing developer only plans to build about half of the zoned height of an Oakland property because it simply doesn’t pencil out to build it all the way up if it won’t fetch prime rent. Don’t think we’ll be seeing any 100 story towers in Oakland any time soon, and it certainly won’t be the first place where it eventually happens.

As for any sort of “migration,” Oakland simply doesn’t have enough existing office space/office space in the pipeline to ever draw the majority of business away from SF. Physically impossible. Uber may have taken the Sears building, but outside of that there isn’t much else room to accommodate large floorplates and substantial personnel sizes that large tech companies need.

Boston Properties just proposed a 1.1 million sf office complex in a single development site in SF. On the other hand, Oakland’s plans for the the entire Lake Merritt/Chinatown neighborhoods calls for just 1.2 million sf of office development, over the next 25 years. We’re talking totally different scales of growth here.

@Dave, I’ll applaud your Oakland/East Bay boosterism, but you need to do some fact checking. In regards to Apple, a simple scan of the SF Business Times shows that outside of the under construction Campus 2 and Infinite Loop (which they’re keeping) in Cupertino, Apple’s expansion plans are purely south bay.

Specifically the activity is in San Jose, where they purchased 40 acres between 101, North 1st, and Guadalupe Parkway to build out to TBD SF and Sunnyvale, where they just leased 770K SF in a to be built campus on Central and Wolfe.

Their only presence that I can see in the bay area outside of the south bay is a lease for 76K SF of space in the CNet building on 2nd, between Folsom and Howard – in San Francisco.

dave, please pass some of that Oakland bud that you’re smoking

You must be using Campos Math.

No. Why is Lennar struggling to pre-lease their 3 million square feet or so at HP? Why are the only ones interested, that we know, are government/educational institutions? All SF needs – more crony governemtn stuff and less “real” business.

That my friend is a red flag.

Would not you think Google or Apple, looking for a Bay Area satellite headquarters would be all over this?!

Yup, red flag.

Apple signed a lease in SF for 100k and Google is talking with Lenar about space in the Shipyard. What does Oakland have… Oh yeah, nothing.

IBM just signed up for 85,000 feet of space in SF. Does that count as an old technology company moving some folks into SF? Or do you only count Apple and Google?

Prices doubling in 5 years. Definitely the sign of a weak market.

Oh FTLOG, boosterism and civic pride is nice, but give it up. “The move to Oakland has started”?!

To quote an old Jewish joke,”Nobody goes there. It’s too crowded!”

Obviously prices wouldn’t be ever increasing if there weren’t strong demand.

Lennar’s office space has not been built yet. The first space will open in 3 years at the earliest, and the offices won’t be completed until 6 years from now, at the earliest. That space is not competing with currently available downtown office space.

Sorry– it was Yogi Berra who said, ” Nobody goes there. It’s too crowded!

Asking rents at a record high (indicating demand is very high).

Rents up 15.3% in the last year (ditto).

Office vacancy rate at the lowest level since the dot-com mania (ditto again).

96% of new office space coming on line has been leased (ditto again).

Just under 1 million sf of office space available for sublease — i.e. around 1% of total office space (ditto again).

Sorry, if you read that to demonstrate red flags abounding, you’re going to have to explain it to me. Perhaps you meant there are red flags for anyone who is looking for SF office space to lease?

I hope that the higher office rents price out some of the more useless “non-profit” organizations that do more harm than good – while paying their heads a mighty hefty salary.

No doubt, instead, they’ll come a-begging, hat in hand, to City Hall, saying they need “Moare! Moare!” so they can stay in SF and fight to enable more and more vagabonds to find their way to SF, where they’ll be knighted as “the homeless” and be given free housing, food, medical care, and cookies for their pitbulls.

Spot on…so sad.

These “non-profit” organizations can move to Oakland and Richmond.

Where they will actually be able to better accomplish their goals! – Finding housing for the homeless in Oakland will be MUCH easier and less expensive than trying to do so in SF.

I hope that the truly needed are well-served by legitimate non-profit groups, in the most efficient way possible – getting a greater bang for their bucks in the East Bay.

They are already moving out of Oakland; they are going to San Leandro and Hayward.

Sierra Club is moving to Oakland. They didn’t bother begging at City Hall.

This is about where SF office rents were in 1998, inflation adjusted. Vacancy rates too. The dotcom peak inflation adjusted would be about $90 for Class A now. Suspect landlords are weighing credit risk more heavily vs price this time around.

One difference is that we’ve had (and continue to have) more construction this time around. Thank god for that.

Then don’t you mean they’re about the same UNadjusted(?): it looks like the “real” rate is still about 30% lower.

anon, agreed. The downtown developers were too late to the dotcom party. Really, all of SF was caught flatfooted by the quickness and rate of the 1996 on runup. Guess that’s what happens when you haven’t been kissed in a while. By the time the new downtown buildings were ready it was too late. For example, JP Morgan had pre-leased 560 Mission and didn’t need it when it opened in 2002 (not so many IPOs to underwrite) and Sun bought out their Foundry Sq lease.

I think about 560 Mission every time I walk past the new Linkedin building at 2nd/Howard, cause that lot was primed for the next builds and then just sat there for ten years until this boom built up enough.

Let’s see how the Pure Storage IPO goes tomorrow and for a couple quarters, first unicorn out of the VC/privateinvestor stable in a while. SF has several that need to enter the financial free range and prove themselves. There’s buzz Uber loses 50 cents on every dollar, but makes it up in volume. Well PS is losing money but is a leader in a product category of the future. Sell the story if you can’t sell the P/E ratio.

Notcom, the dotcom peak was in 2000. In 1998, SF Class A was $45+/sqft, though increasing, which inflation adjusted to 2015 would be around where we are now. The vacancy rate is also eerily similar to 1998. As the vacancy rate continued to decline in 1999 while the VCs doubled their investment rates things went completely nuts and pushed RE commercial to the peak in 2000, which would be ~$90 in 2015 dollars. Very hard to have reasonable supply/demand behavior when it is so onesided. I had landlords of crappy class C buildings asking for warrants. Hey, why not a board seat.

Then Nasdaq crashed, but I could walk to a ballgame.