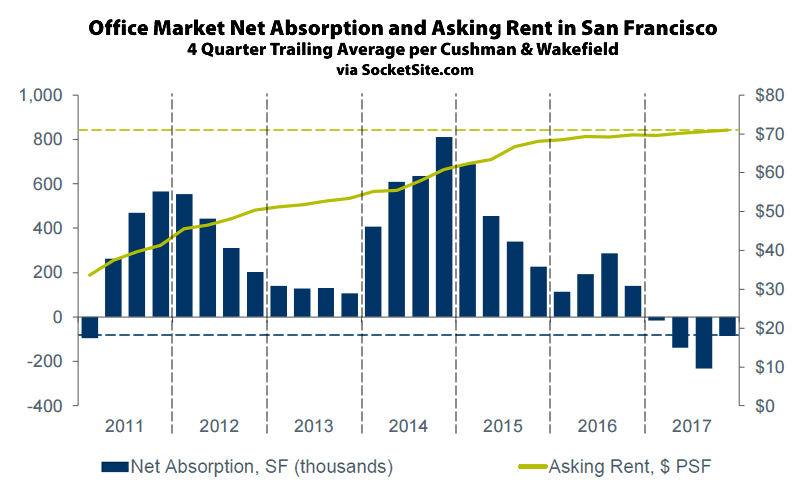

The average asking rent for office space in San Francisco inched up 0.7 percent in the fourth quarter of 2017 to end the year at an all-time high of $71.02 per square foot per year.

That being said, the year-over-year gain in asking rent dropped to 1.8 percent, down from a 2.4 percent gain in 2016, a 15 percent gain in 2015 and an average annual increase of nearly 20 percent over the previous six years.

And the gain in terms of rental rates, as well as leasing activity (which totaled 8.7 million square feet last year, the fourth highest total on record), was largely driven by the pre-leasing of new office space under development in the city. Absorption, the net change in occupied space, was actually negative for the year, according to data from Cushman & Wakefield.

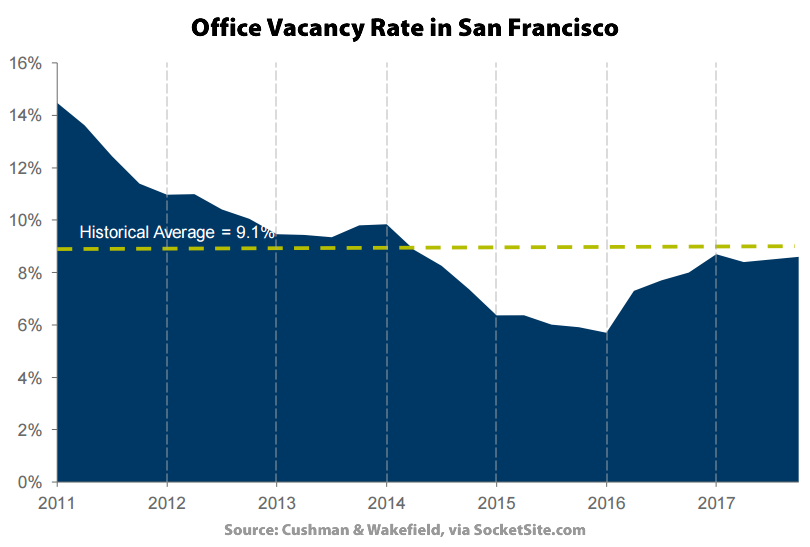

In fact, the overall office vacancy rate in San Francisco actually ticked up 10 basis points to 8.6 percent (5.6 million square feet) in the fourth quarter of 2017, which is still 0.5 percentage points below the historical average of 9.1 percent but the second highest vacancy rate in San Francisco since the third quarter of 2014 and 0.8 percentage points higher than at the same time last year, not counting 1.2 million square feet of leased space which is actively on the market for sublet.

At the same time, the average asking rent for older Class B space actually dropped 2.8 percent over the past year to $63.25 per square foot while its vacancy rate jumped from 6.3 to 8.6 percent.

And with the spurt of leasing activity last year, the overall need of all tenants actively seeking office space in San Francisco has dropped 25 percent to 4.5 million square feet with 6.5 million square feet of new office space currently under construction (2.2 million square feet of which is slated to be ready for occupancy in the first quarter of 2018, 90 percent of which has been pre-leased).

It’s also expected that San Francisco will see an increase in coworking spaces. Not sure what a coworking space entails? Follow the link to the JustCo website (共同工作空間) to discover how a shared office space could reduce your overhead costs and present new networking opportunities.

The numbers combine to show weakness in the office market as vacancy inches up, a full 4 quarters of negative absorption plays out and more space is being built than is being sought.

Despite the lease at 181 Freemont and the Dropbox lease (what is the status of the Park Tower?) overall more space is available and that likely means a net outflow of jobs. Some companies are simply shifting from older office space to newer space which explains in part the negative absorption. This reinforces those who believe the office projects proposed are not needed – at least not all of them. This hopefully spurs a significant reduction in the office/hosing balance in the Central SOMA plan. Large numbers of workers are not being shifted to SF and won’t be given cost and quality of life issues.

Now is the time to repurpose many of the office proposals to housing – no commercial offices at the Power Plant site should be a given. In the case of HP/CP the low end of proposed office development should be all the city allows – if that.

SF’s unemployment rate is now 2.3%, the lowest in modern history. This is not a ‘net outflow of jobs’.

1) don’t forget, prices are at record highs. Why is this ‘weakness’ giving the clients an upper hand in price negotiations?

2) SF office space supply is capped. In fact, very little new office buildings are scheduled to hit the market over the next couple of years. This is why the Dropboxed and Facebooks of this world are locking in more office space than they currently need in order to be prepared for the foreseeable future.

With SFRealist on no net outflow of jobs.

I can understand from the numbers that less space might be developed/or built versus what is being proposed considering recent lease data in addition to what is all already under construction & leased for the fact but how does that equate to net outflow of jobs? Especially when new space coming on line is pre leased and the vacancy on Class A is still below historical average.

The inflow of jobs might flatten out a bit but nothing shows big net outflow of jobs & will take a significant regional infrastructure investment beyond new BART cars and Caltrains electrification to make a dent in congestion in & out of the city or Silicon Valley for foreseeable future.

Note the big uptick in Class B vacancy. This mitigates new leasing in Class A space to a bit and explains partly the negative absorption in the 4th quarter. These offices (Class B) are being vacated to go to Class A space or, more commonly, as companies leave SF as they need more space but can’t afford Class A space. Hence a steady outflow of workers with no significant inflow leads to a net outflow of jobs overtime. New companies are not locating large chunks of workers in SF and older companies are leaving or will over time.

The worsening transportation situation with no relief in sight could lead to a point were it is near impossible for workers to get into the CBD. There is no need for millions of feet of office space in the Central SOMA and along the southern waterfront down to HP/CP.

Seattle is the hottest office market in the country now with its vacancy rate at a 15 or so year low and cranes everywhere. Amazon alone needs so much space that some there worry it’s gobbling up too much space and thereby taking space from companies that want to move to Seattle from places like SF. Unlike SF, Seattle’s transportation system is undergoing a massive expansion with new rail line extensions starting in 2021 and coming on line every few years through 2035 or so. That balanced approach to development – transportation and new offices and somewhat affordable housing – is what companies and their employees want and it is something SF can’t offer and won’t be able to offer in the medium or even long term future.

I think you nailed it when you say there is a limited supply of class A space – that explains the ever increasing rents. And it is true that if rents keep raising some companies will be forced to look elsewhere like Oakland or Pleasanton – nothing new there. However, there have been no reports of a net outflow of jobs – on the contrary.

Is Seattle growing? – yes, all the reports I have seen has said that rents are increasing faster there than anywhere on the West Coast – perhaps one of the reasons that Amazon is looking for a location for HQ2.

Except that, as SS noted earlier, “the number of people living in the city of San Francisco with a job increased by 4,600 in November to a record 557,400“. That is not an outflow of jobs. That is exactly the opposite.

Don’t overlook densification. When tenants move within San Francisco, in order to keep the cost of space in line, more and more employers are putting workers on benches, not even cubicles anymore, in order to have less square footage per worker.

Contrary to what has been written by many in the press, this is not to make their workspaces hip and modern and attractive to millenials. Maybe that was the case at first, but companies soon figured out that COST SAVINGS is the primary driver of densification. These open, high-density plans are not designed with the workers in mind. Not every work environment benefits from collaboration (i.e., noise), in fact it detracts from productivity in many cases.

Bottom line, when a company makes a move within a market, keeping their employee count constant, they will take roughly 80% of the space they previously occupied.

In my experience, when employers adopt open floor plans like this, a lot more workers start working from home, or from other offices, leaving the open floor plan less intensively used than a more traditional cubicle layout. I’ve been in some of these floor plans where there are often less than 10 people working per floor (city block). That was very depressing, and ultimately you have no reason to show up to the office apart from all hands meetings.

When you knock down barriers between people you fit fewer, rather than more, into the same unit of space, which at the end of the day is much more costly to the employer than if they had built the floor to maximize the employees’ comfort and productivity.